CertiK Closes $80M Round Led by Sequoia, Nearing $1B Valuation

This capital raise is the third round of funding for CertiK within the past four months, bringing its total amount raised to over $140 million.

Blockworks exclusive art by Axel Rangel

- Investors that participated in the round include Tiger Global, Coatue Management, and GL Ventures’ Hillhouse Capital’s VC arm

- This capital raise is the third round of funding for CertiK within the past four months, bringing its total amount raised to over $140 million

Blockchain security firm CertiK has closed an $80 million raise led by Sequoia, bringing its valuation near $1 billion. The funding will be used for the development and operation of more innovative products.

Investors that participated in the round include Tiger Global, Coatue Management, and GL Ventures’ Hillhouse Capital’s VC arm. This capital raise is the third round of funding for CertiK within the past four months, bringing its total amount raised to over $140 million.

“The reason we raised this round was majorly due to rapid growth that we have made in the past year,” Ronghui Gu, CEO and co-founder of CertiK said in an interview with Blockworks. “We have had revenue growth of about 20 times and our team has grown four times, so we are moving really fast,” Gu said.

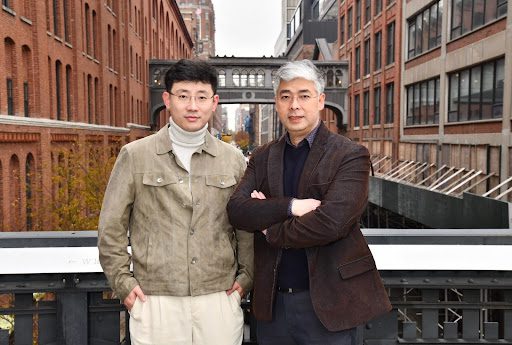

CertiK co-founders Ronghui Gu (left) and Zhong Shao.

CertiK co-founders Ronghui Gu (left) and Zhong Shao.The New York-based firm provides security products and services to over 1,800 clients, and its monitoring system Skynet has checked more than $4 billion asset transfers, $3 billion transactions and 4 million accounts in the past year, Gu said.

“Last year, the total assets lost due to software error was about $50 million. This year, so far, we have lost about $130 million, so that number almost tripled in less than a year,” Gu said.

CertiK hopes to develop products such as scammer alerts and token protection — currently, things that are missing from the blockchain security ecosystem, Gu said.

“The entire blockchain is about trust but the current system is not trustworthy,” he said. “That’s the challenge we aim to address. How can we bring trust back to the community beyond smart contracts, auditing and how can we provide more security products and one-stop products to help bring the trust back to the community?” he added.

In 2022, CertiK will focus on non-fungible tokens (NFTs) and the metaverse as demand for those two divisions in the crypto industry has increased in the past year, Gu said.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.