Coinbase Launches Crypto Remittance Pilot for Mexico

Coinbase is piloting a remittance program aimed at recipients living in Mexico as the exchange seeks new sources of revenue

Source: Nasdaq

- The service allows users to cash out at 37,000 physical retail outlets and convenience stores located across the country

- Coinbase claims its offering will be 25% to 30% cheaper than traditional methods following its fee-free trial period

US cryptocurrency exchange Coinbase has begun trialing a remittance pilot program for recipients based in Mexico as it seeks to capitalize on a multi-billion dollar market dominated by the likes of MoneyGram and Wise.

In a blog post on Tuesday, the exchange — led by CEO Brian Armstrong — said it was introducing an “instant” means of cashing out crypto sent to friends and family south of the US border.

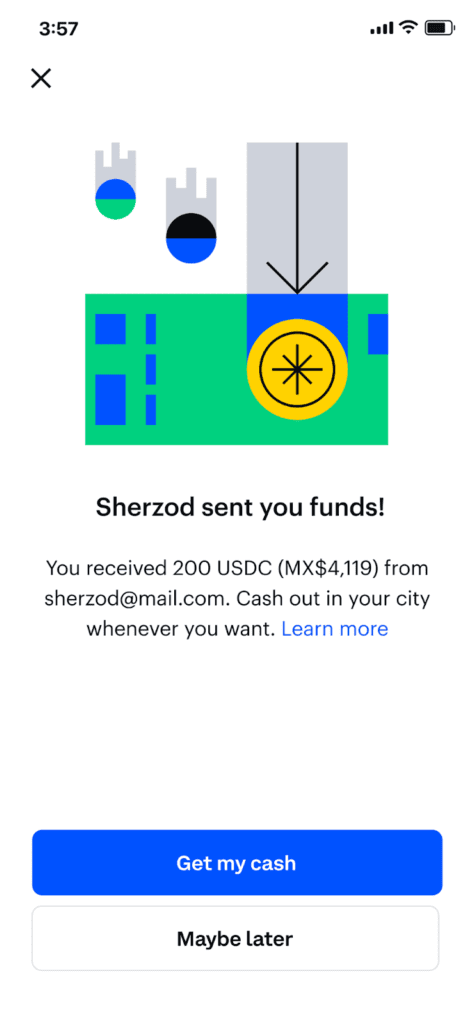

Once the crypto has been sent, recipients will receive a message via their Coinbase app asking them to choose between cashing out or saving the funds in their Coinbase account, the exchange said.

Coinbase’s Mexico crypto remittance pilot

Coinbase’s Mexico crypto remittance pilotShould the recipient choose to cash out, they can generate a code from their Coinbase app which is redeemable for cash at 37,000 physical retail outlets and convenience stores located across Mexico, the post reads.

Should they choose to keep the crypto on the app, recipients will be able to either hold their assets or convert and invest them.

“That includes USDC, a stablecoin pegged to the US Dollar, which will help the recipient hedge against any devaluation of their local currency,” Coinbase said.

The service won’t incur any charges until March 31, 2022, at which time the exchange said its option would still be 25% to 30% cheaper than traditional cross-border payment methods.

Coinbase’s concerted push into the remittance market can be viewed as an attempt to buoy headwinds incurred from recent volatility in the crypto markets. The publicly-listed exchange saw a decline in net revenue from $2 billion in Q2, 2021 to $1.2 billion in Q3, according to quarterly earnings.

The global remittance market size was valued at over $700 billion in 2020. That value is projected to balloon to around $1.22 trillion by 2030, according to data by Allied Market Research.

Coinbase also said Tuesday it was looking to expand globally and that part of its mission was to advance “economic freedom” by providing crypto services to the world’s 1.7 billion underserved or underbanked.

“We recognize this is a global issue. And while we’re starting in Mexico, over time we’ll consider other regions where customers face similar challenges,” Coinbase said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.