A deeper look at the industry’s crypto market structure demands

Developers need “additional robust, nationwide protections from misclassification under securities and commodities laws,” DeFi Education Fund policy lead says

US Senator Tim Scott | Maxim Elramsisy/Shutterstock modified by Blockworks

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

Seeing 112 organizations sign their name in support of the same issue is pretty rare. Chances are it’s probably pretty important.

A Wednesday letter drafted by the DeFi Education Fund called on policymakers to “provide robust, nationwide protections for software developers and non-custodial service providers in market structure legislation.”

It was addressed to Sens. Tim Scott and Elizabeth Warren (of the Senate Banking Committee) and Sens. John Boozman and Amy Klobuchar (of the Senate Agriculture Committee). Members of those bodies, which oversee the SEC and CFTC, will have a big role in shaping a final market structure bill.

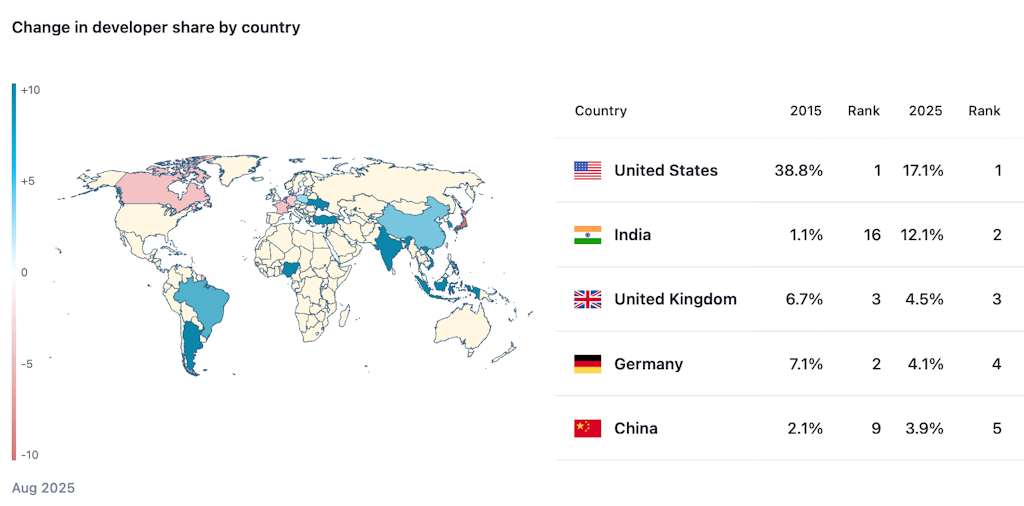

The latest letter cites Electric Capital data showing the plummeting share of open-source software developers in the US — a decline the President’s Working Group on Digital Asset Markets vowed to reverse.

Many attribute this trend to a lack of regulatory certainty. A quote that stood out to me from Solana Policy Institute CEO Miller Whitehouse-Levine:

“Public blockchains are neutral infrastructure just like the internet, roads or bridges. The US doesn’t criminalize the engineers who build our highways when someone uses them to commit a crime.”

The thought goes that Congress must apply that same principle to digital infrastructure builders.

Gavin Zavatone, policy lead at the DeFi Education Fund, told me the Keep Your Coins Act and the Blockchain Regulatory Certainty Act are a solid start. Those were included in the CLARITY Act passed by the House last month, as well as the Senate Banking Committee’s more recent market structure discussion draft.

Those provisions recognize the differences between intermediated finance and decentralized networks, and protect the right to self custody and engage in peer-to-peer transactions. They must remain in the draft legislation, Zavatone explained.

“However, developers need additional robust, nationwide protections from misclassification under securities and commodities laws,” he added.

This is non-negotiable, these organizations are making clear. This is the segment, remember, that put big money toward getting Donald Trump and other pro-crypto policymakers elected.

Some of what Chervinsky called Biden-era hostility has been addressed.

You might recall the end of what became known as the “DeFi broker rule” saga in April. I’m referring to the resolution that nixed an IRS rule requiring “certain decentralized finance industry participants to file and furnish information returns as brokers.”

Not all has been rosy for crypto sector advocates, though. The partial verdict against Tornado Cash developer Roman Storm, in my colleague Macauley Peterson’s words, “dampens hopes of giving DeFi protocols greater access to the US market by sending chills through the entire open‑source community.”

The called-for protections must make explicit that no individual/entity is subject to regulation for simply engaging in activities core to creating and maintaining blockchains, the letter notes. Legislation must also shield developers from being misclassified or prosecuted as operators of money transmitting businesses.

I wrote a week ago about Sen. Scott’s remarks at the Wyoming Blockchain Symposium about the road to passing another crypto bill.

Even after getting the stablecoin-focused GENIUS Act to the finish line, Scott called market structure “a far more complicated piece of legislation.” He added that Sen. Warren, for example, standing in the way of some Democrats who might support it is “a real force to overcome.”

The letter also notes the importance of preserving “historical protections afforded to open-source software development.” This relates to what Interop Labs (initial developer of the Axelar Network) submitted to the Senate Banking Committee earlier this month.

Interop Labs compared today’s blockchain infrastructure to the early internet. Composability and open communications protocols can set the stage for an innovation boom in finance, it argued — like the economic transformation the Transmission Control Protocol/Internet Protocol (TCP/IP) framework unlocked at the turn of the century.

I feel lucky to have grown up as the internet evolved to what it is today. Seeing where the financial system goes from here as an adult will be a bonus.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.