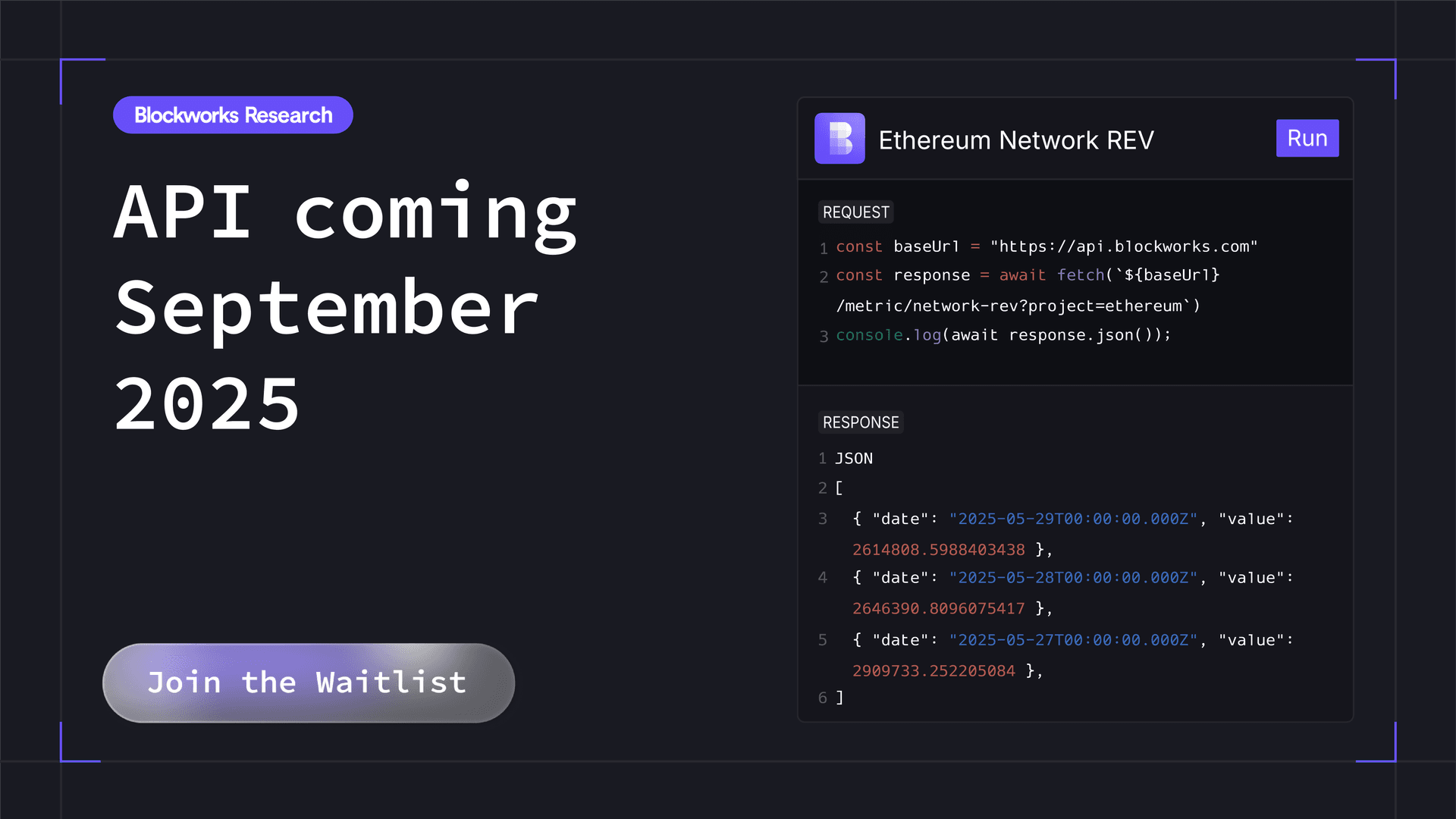

Data API: Blockworks Data, Anywhere

The next release in our data-first roadmap opens the pipes for programmatic access. Join the waitlist now.

Graphic by Crystal Le

Even the best dashboard can only take you so far.

Sometimes you need direct access to the numbers in your own environment: feeding models, powering tools, automating the boring stuff.

Your models, dashboards, and reporting pipelines are starving for rock-solid onchain data, yet you’re still babysitting CSVs and wrestling with unreliable sources.

We’re unclogging that pipe today. Blockworks Data API connects our entire warehouse straight to your stack so you can build, ship, and iterate at lightning speed.

Why Data API?

Earlier this year, we promised two flavors of access: customize inside, retrieve outside. Dashboard Builder nailed the first, Data API will deliver the second.

With Data API, you’ll be able to:

- Pull what you need, when you need it. No copy-paste, no manual exports.

- Integrate anywhere. Python notebooks, Excel models, BI dashboards, cron jobs, in-house apps.

- Trust the source. Every call hits the same validated warehouse that powers Blockworks Research.

- Go deep when it matters. Pull the complete onchain story in a single call, powered by proprietary metrics that reveal what really drives a protocol.

From daily reporting to backtesting to automating investor updates, the possibilities are wide open.

A measured rollout

We’re starting small:

- Private beta: A select group of partners will get early access over the coming weeks.

- Waitlist now open: We’ll expand access gradually as we scale infrastructure and refine endpoints.

If you want to be part of the first wave beyond our beta testers, join the waitlist.

What’s next

Coming soon, we’re shipping Chart Builder, a no-code workspace inside Blockworks Research that lets you pick the exact metrics you want and turn them into custom charts or tables in seconds. No coding, no extra infrastructure, just immediate insights.

Together, these tools will make Blockworks Research more than a platform: It will be your complete crypto analytics workspace.

The bigger picture

Blockchain transparency should make rigorous analysis easier.

Today, data collection and cleanup still waste too many hours.

Data API is our next step in removing that friction so you can spend less time wrangling and more time acting.

Join the waitlist

The waitlist is live. Sign up, get in line, and we’ll keep you posted as we open the gates.

Questions or ideas? Reach us anytime at [email protected].

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.