EIA to drop emergency bitcoin miner survey following court battle

The EIA said it will “destroy” survey responses and put out a new Federal Register notice

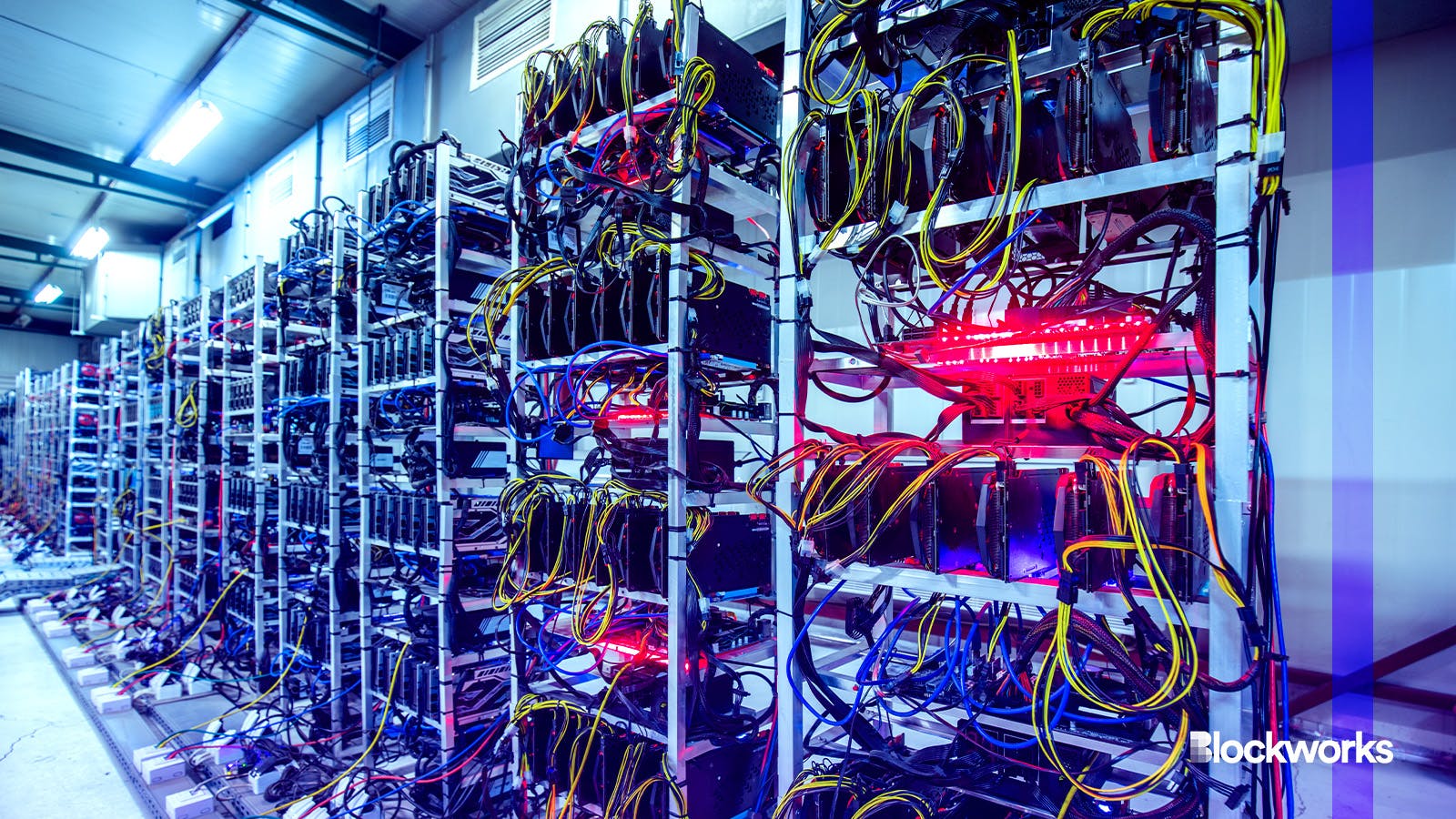

PHOTOCREO Michal Bednarek/Shutterstock modified by Blockworks

According to court documents filed Friday, the Energy Information Administration is dropping its emergency survey of bitcoin miners.

The move comes after the Texas Blockchain Council and Riot Platforms, alongside the Chamber of Digital Commerce and the National Civil Liberties Alliance, were granted a temporary restraining order in the case.

“If the EIA seeks to survey cryptocurrency miners in the future, the EIA must undergo the proper notice and comment procedure mandated by law, ensuring public input on the survey’s scope before any re-issuance,” the Chamber of Digital Commerce said in a statement.

Read more: Texas Blockchain Council says it has a ‘strong legal case’ in mining survey suit

“EIA has discontinued the emergency collection of data for Form EIA-862, Cryptocurrency Mining Operations Survey. Under the terms of our agreement, all data received as part of the emergency collection will be destroyed. Formal notice will be issued to all EIA-862 survey respondents about this update,” an EIA spokesperson told Blockworks via email.

“We’re hopeful we can work with companies in the cryptocurrency mining industry to provide the American public with a clear understanding of energy use from cryptocurrency mining operations in the United States, much in the same way we do with other industries,” they continued.

Earlier this week, the president of the Texas Blockchain Council told Blockworks that he was “confident” about the Council’s case against the Department of Energy and the EIA.

In court documents, the EIA said it would “destroy any information it has already received” in response to the survey sent out to bitcoin miners across the US.

Additionally, the EIA will publish a Federal Register notice of the proposed collection of information, which will replace the emergency notice issued in early February.

Read more: Standing united means the crypto industry wins

The complaint, filed in Texas last week, argued that Riot and other miners would be “immediately and irreparably harmed by being forced to divulge confidential, sensitive and proprietary information to the EIA.”

The survey notice was sent out at the end of January, and required miners to “respond with details related to their energy use.”

The Office of Management and Budget approved the survey request on Jan. 26, saying at the time it recognized “that this emergency collection is experimental and provisional with the understood intention that EIA wants to build to a new standard collection.”

The survey was pursued after parts of the US faced a brutal winter.

A spokesperson for the EIA told Blockworks in early Feb that “given the emerging and rapidly changing nature of this issue and because EIA cannot quantitatively assess the likelihood of public harm, EIA felt a sense of urgency to generate credible data that would provide insight into this unfolding issue.”

Updated March 1, 2024 at 4:56 pm ET: Added statement from EIA.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.