ETH Remains Strong Despite Coin Challengers

Whenever Ethereum is in the news, there’s often talk of an ‘Ethereum killer’, to siphon off some of the traffic from its clogged pipes. The scarcity of ETH on exchanges, and the potential for an upcoming price rally has only accelerated the hunt for an alternative.

Joe Lubin, Co-Founder of Ethereum at SXSW, Source: ConsenSys

- Outflow from ETH is at an all-time high

- Challengers like Cardano may aim to challenge; but analysts remain skeptical and cautious

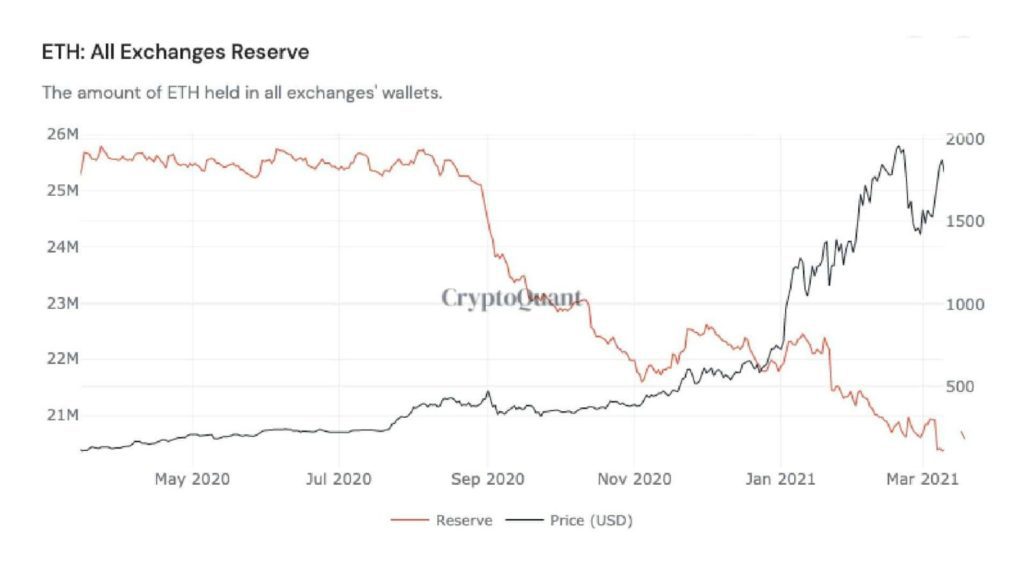

Data from analytics company CryptoQuant says outflow from Ether is at an all-time high as demand for Ethereum-based financial and utility applications hit new records.

This market has created fertile ground for competitors to take on the world’s “distributed computer”. Cardano, which has been grabbing headlines lately thanks to its rapid price appreciation and founder’s bold claims, wants to take this spot but analysts are cool to any real threat for now.

CryptoQuant’s data (below) shows that only about 21 million of the 115 million ETH in circulation, roughly 24%, are still on centralized trading platforms. Institutional demand for ETH 2 staking — effectively moving Ether to a bond-like savings product to start the transition to the ETH 2 network — has caused record outflow, while a constant demand from the DeFi industry and nascent NFT sector has created upward pricing pressure.

$ETH reserve in all exchanges hit the two-year low; Source: CrytpoQuant.com

$ETH reserve in all exchanges hit the two-year low; Source: CrytpoQuant.com

“Staking was at over $5 billion in early February (over 2% of ETH’s supply), and I sense that this movement out of exchanges and towards staking will continue to build momentum and is being locked in the ETH 2.0 deposit contract,” Michael Conn, CEO of Singapore-based digital asset fund Zilliqa Capital, told Blockworks.

In fact, CryptoQuant CEO Ki Young Ju tweeted that ETH saw its second highest exchange outflow on March 16 as institutional investors moved significant amounts of ETH to a custody service or self-hosted wallet.

A whale’s world

As Blockworks previously reported, whales — defined as those that hold 10,000 or more ETH, which would include many institutional investors — now hold 70% of all the ETH tokens in circulation.

“ETH reserves on exchanges have declined despite being at historic lows. The outflow should be due to people switching to ETH 2.0 for staking reward,” said Benedict Ho, Managing Partner of MaiCapital, a licensed Hong Kong-based bitcoin fund. “The adjusted staking reward for ETH 2.0 is around 7.6% right now. The reward rate has gone down since Feb which indicates more ETH has been staked in the last few weeks.”

Sidrath Sogani, founder of Singapore-based digital assets research firm Crebaco, added that a continued upward trend in Ethereum’s network activity thanks to DeFi and NFTs has pushed up demand for the remaining ether — as has the use of high transmission fees by traders to ensure their transactions are settled expeditiously.

At the same time, the re-opening of some major Ethereum mining operations balances out supply and demand meaning the price is appreciating, but has faced some resistance. But not all mines are re-opening; some are hesitant due to the upcoming move to Proof of Stake which would devalue miners’ role in the ecosystem.

Cooling the Cardano claims

Whenever Ethereum is in the news, there’s often talk of an ‘Ethereum killer’, to siphon off some of the traffic from its clogged pipes. The scarcity of ETH on exchanges, and the potential for an upcoming price rally has only accelerated the hunt for an alternative.

The latest Ethereum-killer to be pitched is Cardano, which has seen a meteoric rise of nearly 30% during the last month, or 4000% on-year, according to data from CoinGecko. Cardano isn’t exactly new. It’s been around since late 2017 and rose accordingly with the ICO bubble at the time. But like many other tokens, it crashed back down to earth with its wings clipped by a bear market.

However, development on the project continued and the token’s price accelerated as the rise of DeFi in 2020 began to cause serious congestion issues on the Ethereum protocol creating incentives for developers to build alternatives. A Cardano token was worth 10 cents in late 2020, and now it’s over $1 per CoinGecko.

In a recent Bloomberg interview, founder of the protocol Charles Hoskinson was bullish on its future prospects highlighting that his team had solved Ethereum’s gas problem: “you can take your DeFi, and you can run it on my system for 1/100 to 1/1000 of the cost.” Hoskinson also said that there were 100 companies “in the pipeline” looking to shift over to Cardano.

“My goal is to run countries on this blockchain,” Hoskinson also said during the interview. “I don’t care about Uniswap and CryptoKitties and other things. It’s a bubble, and it comes and it goes like Pet Rocks and Beanie Babies.”

But to get to this stage and run the world on his blockchain, Cardano will first need to implement smart contracts which is something that’s still a work in progress.

“The exchange outflow of Ether should not be related to Cardano although we have seen Cardano price surging recently to take the third spot in terms of market cap. The price should be related to the market turning bullish on the Shelly upgrade [a major infrastructure milestone],” said MaiCapital’s Ho.

“I personally do not think Cardano can replace Ethereum because the number of Ethereum developers are much higher than Cardano. We have seen a lot of DeFi projects built on Ethereum and the user community is much bigger,” said Ho.

“Taking into account the trust and authority of Ethereum, it will be challenging to compete with it. The success of the Cardano token in reaching the greatest position in terms of capitalization is mostly due to not infrastructure improvements, but the general positive background in the cryptocurrency market,” added Sergey Zhdanov, COO of EXMO, a digital assets exchange in Europe.

Zilliqa Capital’s Conn doesn’t believe that there’s a credible contender to Etherum’s dominance, but also says that the future isn’t one of monopolies.

“I firmly believe that there will not be ‘one coin or protocol to rule them all,’ but rather through multi-chain collaboration and cross-chain bridging will we see the greatest possibility for value creation and financial inclusion taking place on a global basis,” he said.

Learn more about the smart contract platforms challenging Ethereum: sign up for our upcoming webinar on April 1, 2021 at 12:00 PM ET.