Ether Shatters All-Time High, Derivatives Are Bullish

With interest from retail and institutional investors on the rise, Ether, the eponymous cryptocurrency of Ethereum hit an all-time high of $1,428 Tuesday, according to TradingView, breaking through its previous record of $1,392 set in 2018. All this comes as the […]

- ETH is continuing to appreciate while record-high open interest suggests new money is entering the market

With interest from retail and institutional investors on the rise, Ether, the eponymous cryptocurrency of Ethereum hit an all-time high of $1,428 Tuesday, according to TradingView, breaking through its previous record of $1,392 set in 2018.

All this comes as the Total Value Locked in Decentralized Finance (DeFi) protocols pushes past $25 billion — up from about $15 billion the same time last month. TVL is a measure of the value of capital being used for DeFi applications. Effectively, it’s a measure of their market capitalization.

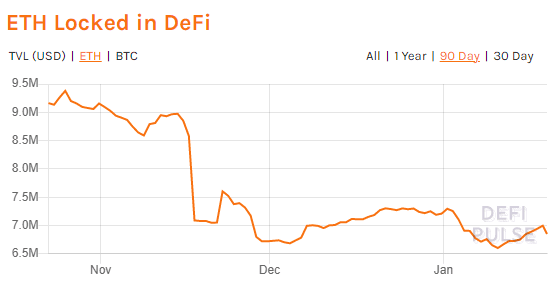

While the Ethereum blockchain protocol is used for many DeFi applications, the actual amount of ETH, the currency, locked in DeFi is dropping. According to DeFi pulse, the TVL of ETH in DeFi is $6.85 million, and this has followed a similar downward trend for Bitcoin. It should be noted that dollar-pegged stablecoins such as DAI, Tether, or USDC have historically contributed the majority of assets locked into DeFi. This is likely because investors are looking to capitalize on the rising price of ETH and swap it out of DeFi protocols for dollar-backed stablecoins.

Data shows that traders are swapping out ETH locked in DeFi for alternative assets. (Source: DeFi Pulse)

Data shows that traders are swapping out ETH locked in DeFi for alternative assets. (Source: DeFi Pulse)

The amount of ETH locked in DeFi applications peaked at 9.25 million in late October, and since then has fallen more than 25%, even as TVL rose approximately 23% based on increasing ETH prices as investors continued to swap out ETH from DeFi. Concurrently, the Ethereum Foundation launched a staking campaign for ETH 2.0 which required users to lockup a minimum of 32 ETH, worth around $45,000, to participate. Investors may have been intrigued by the interest paid out from ETH 2.0 staking in addition to the accelerated price gains on the new ETH token when the revised protocol launches.

At the same time, open interest in ETH derivatives have hit an all-time high per data from Glassnode breaking past $4.5 billion. Open interest reflects the total value of derivatives contracts that have not been settled yet. Historically, increasing open interest represents new money flowing into the asset looking for contracts to pick up — and potentially at a higher price than what the contract is currently trading at.

Of all the exchanges, Deribit holds the most volume of open interest at $1.6 billion followed by OKEx at $183 million.

This recent price rally makes ETH the 75th largest asset by market cap in the world, ahead of the stocks of T-Mobile, Texas Instruments, Costco, and McDonald’s.