What Are Corporations Going to Do With All That Extra Cash? Put it in DeFi

Corporations in the United States are sitting on a lot of cash. But what exactly are they going to do with it? Put it in a money market account and earn a paltry sub-1% return? Instead, according to Fireblocks’ CEO Michael […]

key takeaways

- Corporations in the US have a record amount of idle cash on their books earning interest rates of near 0%

- Placing that cash into DeFi protocols like Compound could generate significantly more interest, bolstering their balance sheets

- The ‘infrastructure’ to do this of stakeholders, education, and regulation is almost entirely in place.

Corporations in the United States are sitting on a lot of cash. But what exactly are they going to do with it? Put it in a money market account and earn a paltry sub-1% return? Instead, according to Fireblocks’ CEO Michael Shaulov, the infrastructure is in place for these firms to place their cash into Decentralized Finance (DeFi) protocols.

On a recent Blockworks webinar, Shaulov, who was joined by ParaFi Capital’s Kevin Yedid-Botton and Compound Founder Robert Leshner, argued that the stage has been set for firms to start moving their cash into DeFi protocols.

“Companies that have a substantial USD reserve now have a clear path to take this and earn pretty significant interest and offer this to their customers,” he said during the webinar.

Shaulov explained that the pathway involves putting it into USDC or another stablecoin with “good governance” then put it into Compound to begin earning 7-10% intraday interest.

Yield and Efficiency

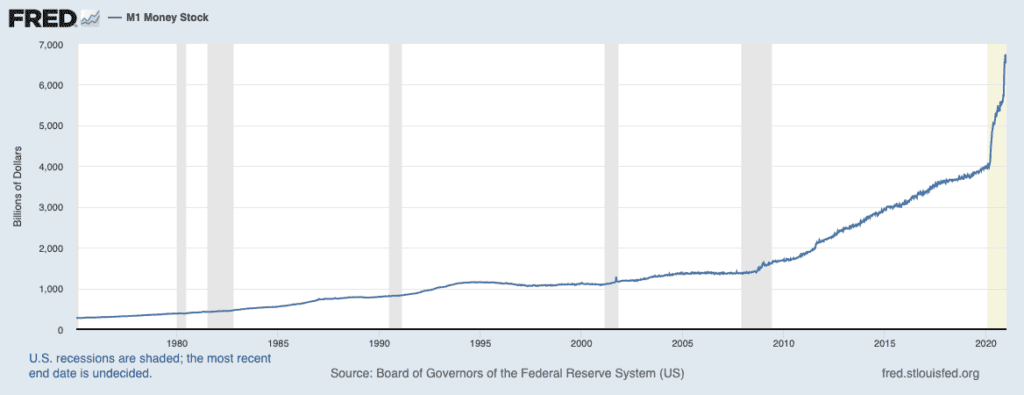

The M1 Money Stock is money that is readily accessible for spending and is nearing $7 trillion, according to Federal Reserve Bank of St. Louis [pictured below]. In a recent report cited in the Harvard Business Review, the cash on hand for non-banks is just over $4 trillion dollars as of January 2020, up from $1.6 trillion in 2000. For PayPal’s quarter ending September 2020, the payment processor had $14.2 billion in cash and short term investments on the books; Square, one of its smaller peers ended its quarter with nearly $3 billion of the same — and it’s understood that many of their privately held neobank contemporaries like TransferWise are in a similar position.

Companies that operate in multiple countries are routinely doing foreign exchange transactions and could save themselves a significant amount of money by batching together their cash into differently denominated stablecoins and swapping them on the blockchain in seconds all without the hefty FX fees that banks charge.

Panelists on the Jan. 14 “Building Institutional Grade Market Structure for DeFi” webinar. Source: Blockworks

Panelists on the Jan. 14 “Building Institutional Grade Market Structure for DeFi” webinar. Source: Blockworks

“You can take, say, $5 million or $10 million and in one Ethereum transaction over 15 seconds swap them for other stablecoins or some of the other protocols out there,” said ParaFi Capital’s Yedid-Botton. “It’s unheard of to have this level of speed, transparency and liquidity.”

And that’s not all: overall there’s approximately $16 trillion in negative yielding debt in the world. It would be tough to ignore the lucrative interest rates Compound can provide, at 9-10%, for only so long.

Moving this cash out of savings and money market accounts, treasury bonds, and other short-term low-yield products would create a huge demand for stablecoins — as an on-and-off ramp — and sustainable DeFi products.

The Infrastructure Puzzle

On paper, the technology seems to be there. But that’s not all that’s needed for the industry to engrain itself within traditional finance. There’s also the ‘infrastructure’ of service providers, regulation, and education. Are these parts ready?

On one hand yes. There are a plethora of enterprise-grade custody providers on the market, explained PraFi Capital’s Yedid-Botton that provide a number of best practices that would make any CFO feel comfortable: multiple approvals for every transaction, clear transaction logs, redundancies, and disaster recovery policies.

But there’s also the question of regulation. The Office of the Comptroller of the Currency (OCC’s) recent announcement of a crypto bank charter is definitely helpful, said Shaulov, but there’s some work to do.

“I think the regulators are still scratching their head around DeFi,” he said, pointing to recent FinCEN rulings that would place stringent Know-Your-Customer rules around wallets.

Shaulov also pointed out that the DeFi community has a role to play in this by whitelisting the protocols that are proven and work well with custody providers that can directly interact with the protocol.

“Direct access from an enterprise grade custody contract and managing the keys is so important,” he said, recalling how in the early days of cryptocurrency one might have to manually move their wallet from a hardware wallet, like a nano ledger, to their computer to sync it with the blockchain.

“From a cybersecurity perspective there’s so much that could go wrong with that.”

Compound’s Leshner added that DeFi is still an “incredibly early industry” comparing some of the spectacular hacks of crypto and DeFi companies, like the MakerDAO hack, to the colossal exploits and hacks of the early days of the internet.

“It didn’t jeopardize the future of the internet. It actually created lessons for how to build resilient systems,” Leshner said.

On the other hand, the technical infrastructure and regulations are only one part of onboarding DeFi into the financial stack of corporations. The other element of ‘infrastructure’ is education.

“The gap right now between this huge inflow capital is the educational focus, making the big-four audit firms, the CFO, and the VPs of Finance comfortable with it,” he said. “Once we are able to win them over and make them comfortable and explain that the technology risk is very limited then I think we will see a huge inflow.”

“It’s hard to sit on the sidelines and get 0% interest compared to 10%,” he added.