Ethereum Foundation under fire for lack of transparency in treasury management

Aya Miyaguchi, executive director of the EF, emphasized that the transfer was routine treasury management and not indicative of a sale

Natalya Kosarevich/Shutterstock modified by Blockworks

The lack of transparency around the Ethereum Foundation’s (EF) spending is in the limelight this week after an onchain transfer of 35,000 ETH ($94 million) from the Foundation’s treasury to Kraken was detected on Saturday.

This prompted EF Executive Director Aya Miyaguchi to clarify that the transfer was part of the Foundation’s “treasury management” activities and is not necessarily “equal to a sale.”

Miyaguchi said that, due to “regulatory complications,” the Foundation was prevented from sharing the plan in advance, but there will be “planned and gradual sales” going forward.

In a separate post yesterday, Josh Stark of the EF provided a first glimpse at a breakdown of the Foundation’s spending for the last two years. He clarified, however, that the full details are expected to be published before Devcon 2024.

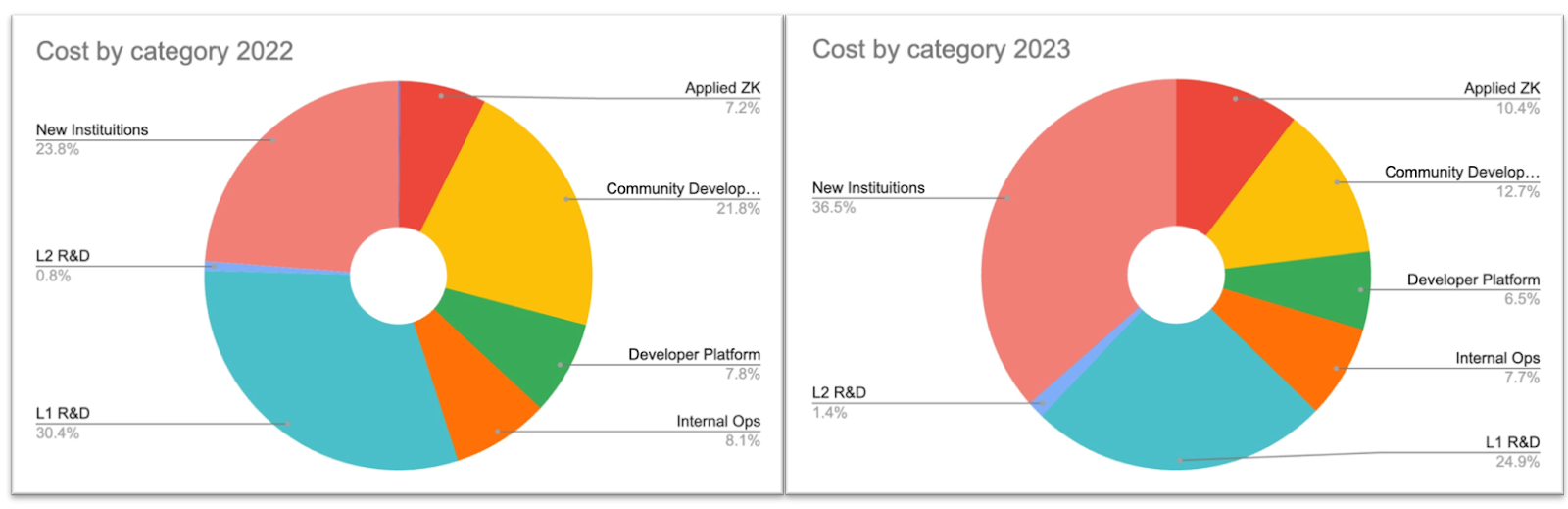

Source: Josh Stark

Source: Josh Stark

For the last two years, EF has spent 25-30% of its annual budget on “L1 R&D.”

This includes internal spending on EF-affiliated teams like Geth, the dominant Ethereum software client on the execution layer, Privacy + Scaling Explorations, Solidity, Devcon, Ethereum.org, and more.

The second largest chunk of spending is in the “New Institutions” category. That includes external grants to organizations such as L2Beat, 0xPARC Foundation, Nomic Foundation, Decentralization Research Centre, and other Ethereum-related organizations.

The stated goal of external funding to these organizations is to “strengthen and support the Ethereum ecosystem” in the long term, Stark said.

Internal spending made up about 38% while external spending was about 62%. That roughly translates to $62 million being allocated as external spending for grants, given the Foundation’s annual budget of roughly $100 million a year.

Assuming the annual budget is spent in its entirety, the EF has a run rate of 6-7 years at today’s ETH prices, given EF’s treasury of 273,274 ETH ($687.5 million).

Based on the EF’s Q1 2024 report, the Ecosystem Support Program allocated $11.4 million in funding to 109 different developers, research, events, and community projects.

Additionally, when asked on X, Vitalik Buterin clarified that he’s paid roughly $139,600 a year as a member of the EF.

To put the EF’s spending into context, Arbitrum DAO has spent about $70 million on its Short-Term Incentive Program (STIP), a grant that ran for three months since November 2023, and another $23.7 million for the Long-Term Incentives Pilot Program (LTIPP).

Arbitrum also passed in May 2024 a $215 million grant to support its gaming ecosystem.

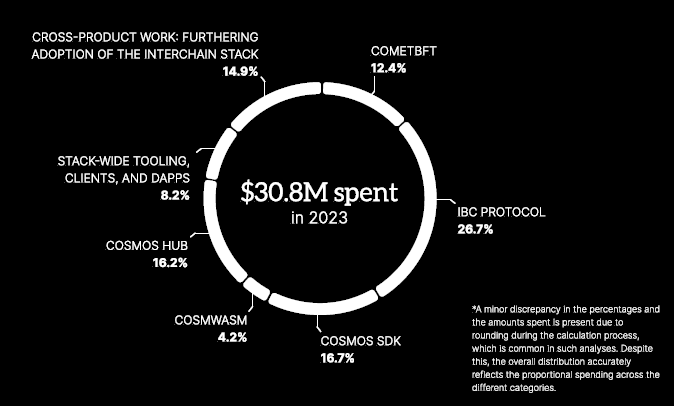

Cosmos’ Interchain Foundation spent $30.8 million in 2023 with the largest spending ($8.2 million) going towards the “IBC Protocol”, based on its 2023 annual report.

Source: Interchain Foundation

Source: Interchain Foundation

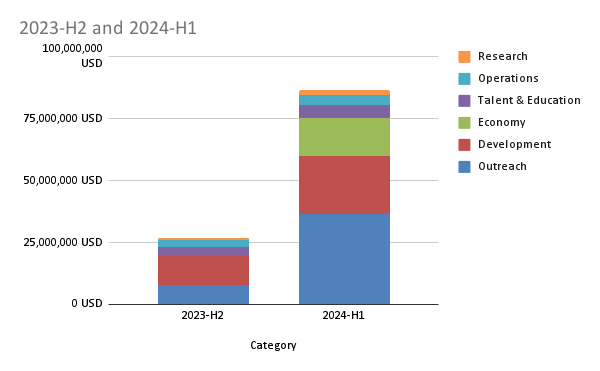

Polkadot, on the other hand, spent $87 million in the first half of 2024 alone, with $37 million going to “advertising and media, online and offline community building and events…big conferences and business development,” based on a treasury report released in June.

Source: Polkadot

Source: Polkadot

Other major L1 Foundations, including the Solana Foundation and the Aptos Foundation, have not released formal annual spending reports.

A Sui Foundation spokesperson told Blockworks that it may release treasury reports in the future in addition to its current updates.

The Solana Foundation and Aptos Foundation did not immediately return a request for comment.

Disclaimer: Blockworks Research is a delegate to Arbitrum DAO.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.