Ex-US Labor Secretary Representing Michael Saylor in Alleged Tax Fraud Suit

Cadwalader, Wickersham & Taft first filed now-unsealed complaint in April 2021 after meeting with whistleblowers

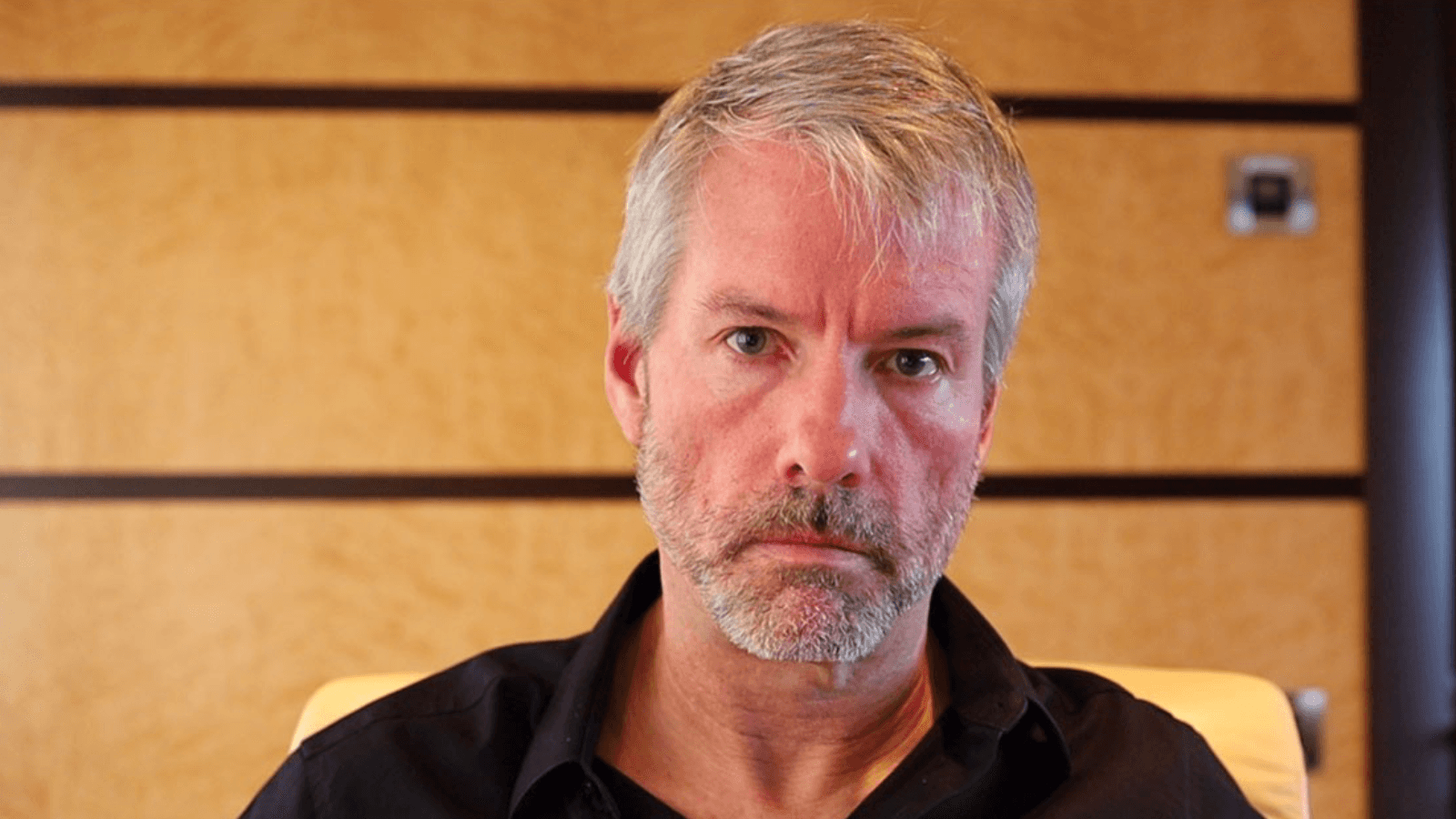

MicroStrategy’s Michael Saylor | Source: Michael.com

- Eugene Scalia was solicitor of the US Department of Labor from 2002 to 2003 and was its secretary from September 2019 to January 2021

- The case is “a warning shot across the bow,” partner at Cadwalader, Wickersham & Taft says

A former US secretary of labor and the son of the late Supreme Court justice Antonin Scalia is representing MicroStrategy founder Michael Saylor in the lawsuit alleging that he evaded paying $25 million in Washington, DC, taxes, Blockworks has learned.

Eugene Scalia, a partner in the DC office of Gibson, Dunn & Crutcher, returned to the firm after serving as US Secretary of Labor from September 2019 to January 2021. He previously worked as solicitor of the US Department of Labor from 2002 to 2003.

Scalia is co-chair of Gibson, Dunn & Crutcher’s administrative law and regulatory practice group, as well as a senior member of its labor and employment and financial institutions practices.

Working in private practice, Scalia has represented employers in matters under the National Labor Relations Act and in other actions related to employment discrimination, according to a bio. He has worked on “whistleblower” investigations and litigation since the 2002 enactment of the Sarbanes-Oxley Act.

A representative for Scalia has not returned requests for comment.

DC attorney general takes the case

Washington, DC Attorney General Karl Racine launched a lawsuit against Saylor and his company on Aug. 31. The legal action was brought under DC’s False Claims Act — passed in January 2021.

MicroStrategy, the Virginia-based business intelligence platform Saylor founded in 1989, is also a defendant in the case, as Racine alleges the firm conspired to help him evade taxes. MicroStrategy said in a statement that the District of Columbia’s claims against the company are “false,” adding that the case is Saylor’s personal tax matter.

The stock price of the publicly traded company, which holds about 130,000 bitcoins, was down roughly 16% over the past month, as of Monday at 12:00 pm ET. The price of bitcoin has fallen around 12% in the same period.

Whistleblowers first came to law firm Cadwalader, Wickersham & Taft about the tax fraud allegations against Saylor, former Maryland Attorney General Douglas Gansler, who is also a partner at the firm, told Blockworks.

Though Gansler declined to share the identities of these whistleblowers, he said they are “people intimately familiar with [Saylor’s] whereabouts.” Saylor claims to be a resident of Florida despite residing in the Georgetown neighborhood of DC for a majority of the year, according to the complaint that Cadwalader, Wickersham & Taft filed in April 2021.

Saylor, in a statement sent to Virginia Business last month, said he “respectfully disagrees” with the tax fraud allegations. He added that he bought a house in Miami Beach a decade ago, noting that he lives, votes and has reported for jury duty in Florida.

The DC attorney general’s office did its own investigation and concluded it was “a case very worthy of being brought,” Gansler said. The complaint was unsealed after it was brought to a DC Superior Court judge.

“Typically the government does not take over the case, nor do top tier law firms like Cadwalader take the case, unless there’s a reason to do so,” he added.

What now?

The passage of the False Claims Act — which permits the court to impose damages of three times the amount of the taxes evaded — has opened up a new way to report alleged fraud to the attorney general. This is the first suit brought under the new law in DC.

Gansler said the damages could total roughly $165 million. Though evading taxes is nothing new, he noted, the allegations stand out because of the magnitude of money allegedly not paid to DC.

Most defendants in Saylor’s scenario seek to get the case dismissed, Gansler added, though no such motion has yet been filed.

A representative for MicroStrategy has not returned Blockworks’ requests for comment about the allegations.

“This case is a warning shot across the bow that if you in fact live in the District of Columbia and you owe the District of Columbia money, you should pay your taxes,” Gansler said. “It’s been illegal forever.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.