What’s next for crypto markets as Fed rate cut expectation holds?

21Shares exec says CPI and PPI data supports a Fed rate cut, with market leaning toward a 25bps decrease

BART SADOWSKI PL/Shutterstock and Adobe modified by Blockworks

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

No one is really arguing whether the Federal Reserve will cut rates next week. The conversation has become: by how much? And how will that impact crypto markets?

It’s perfect timing for such a question, as more data dropped today.

The Consumer Price Index (CPI) increased 0.4% in August (on a seasonally adjusted basis) — up from a 0.2% rise in July. It rose 2.9% for the 12 months ending August, slightly up from the 2.7% annualized figure last month. Core CPI (excludes food and energy) rose 0.3% in August, as it did in July.

21Shares crypto investment specialist David Hernandez said this data reinforces that inflation continues to moderate to a level that supports next week’s rate cut expectations.

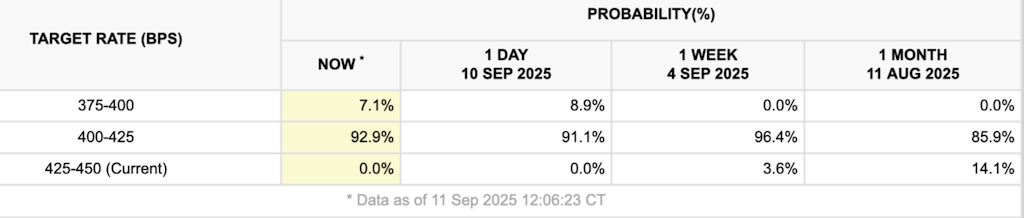

CME Group’s FedWatch tool (using price data of CME Group’s 30-day fed funds futures contracts), shows a shift in recent weeks. A month ago, the data implied a ~14% chance the Fed would hold rates steady on Sept. 17. That is now at 0%.

The market, as of Thursday afternoon, thinks a 25bps cut is much more likely than a 50bps cut:

Source: FedWatch

Source: FedWatch

“This comes on the heels of yesterday’s PPI report, which pointed to a sharp softening of producer prices, suggesting that pipeline inflation pressures are easing,” Hernandez explained. “Together, the CPI and PPI data support the view that the Fed can afford to cut rates at their FOMC next week, increasing investor confidence across risk assets.”

Along with the CPI and PPI prints, we saw initial claims for state unemployment benefits rise to 263,000 last week. This was above some expectations and the highest total in about four years.

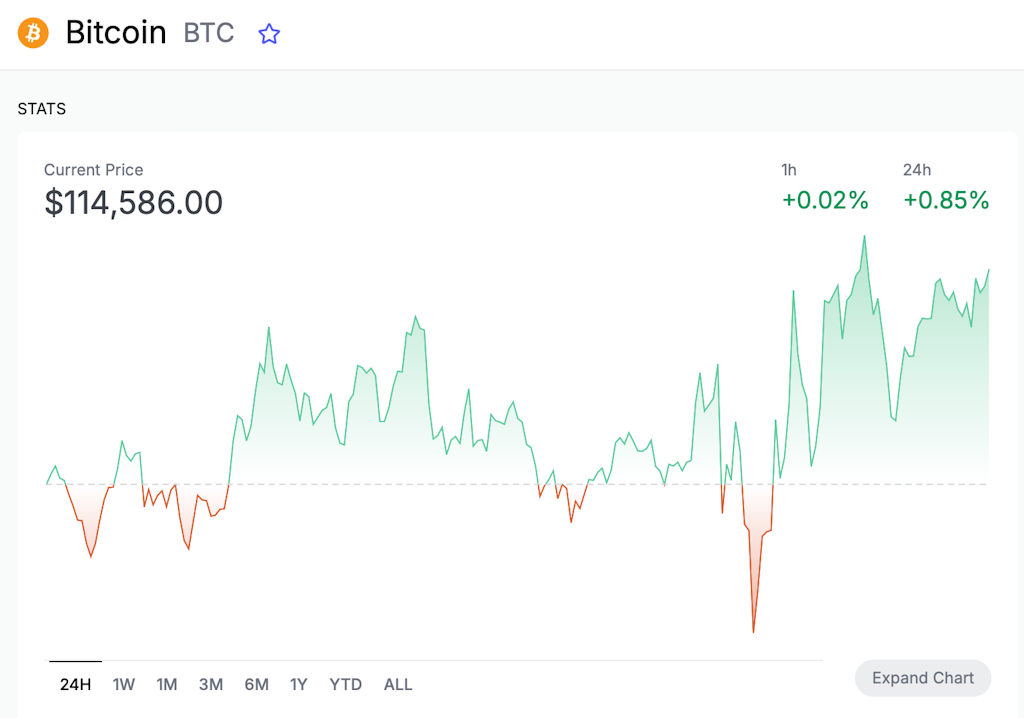

Bitcoin rose above $114,000 yesterday before retreating a bit. It then reached as high as $114,700 this morning. It wasn’t far off that level at 1:45 pm ET:

Bitcoin’s next key technical level is just above $115,000, Hernandez explained — “where significant liquidation clusters could fuel increased volatility.” A Fed rate cut and dovish guidance could lead BTC even higher, he said.

“The rate cut opens the door for risk-seeking investors to look beyond bitcoin too — to tokens like solana and XRP, whose ETFs are highly anticipated to debut this fall,” the 21Shares pro argued.

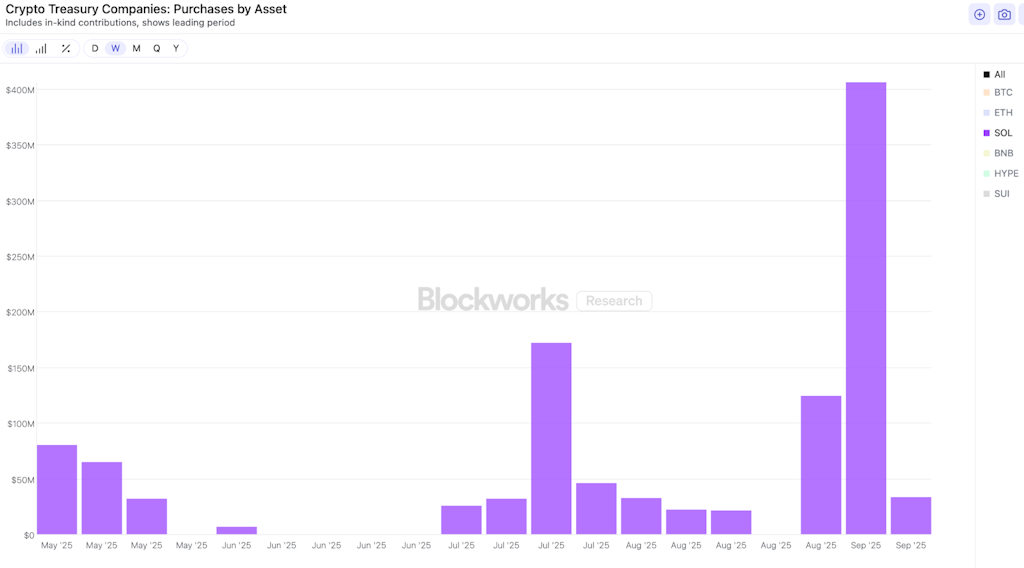

The SEC is set to rule on various US solana ETF proposals by Oct. 10. Not to mention, we saw corporate buying of SOL spike last week, per Blockworks Research data.

These SOL buys are much smaller than those by companies acquiring BTC and ETH, but they’re becoming more frequent nonetheless. The below chart shows the same time span but with more assets — giving us a sense of the different scales of acquisition.

Bitwise’s Matt Hougan noted in his latest CIO memo, called Solana Season: “Its promoters argue that Solana is the only blockchain fast enough to support the tokenization of major assets at a global scale.”

There’s that word tokenization again. I’m doing my best to give it a rest.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.