Financial Advisers Mostly Unfazed by Crypto’s 2022 Volatility

78% of advisers that allocate to crypto intend to keep or boost their commitments this year

Sodel Vladyslav/Shutterstock.com modified by Blockworks

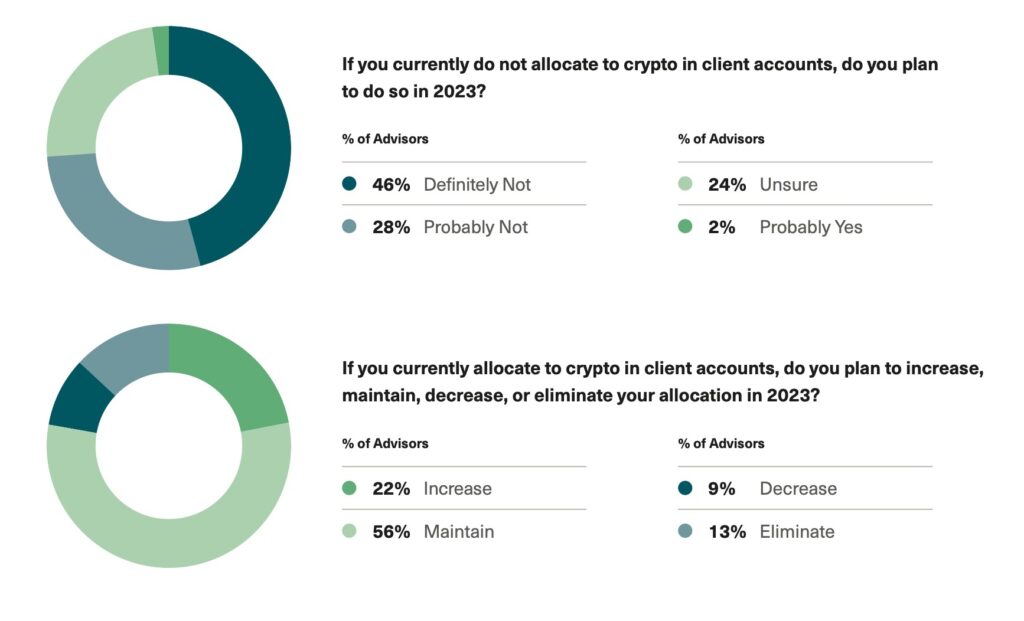

A majority of financial advisers plan to maintain or increase their clients’ exposure to crypto despite the extreme market volatility seen last year.

About 15% of advisers said they allocated to crypto in client accounts in 2022, according to a survey by Bitwise Investments — down from 16% in 2021.

But nearly 80% of advisers who currently have a crypto allocation in client accounts plan to keep or boost those in 2023. Still, allocations remain small, as 95% of advisers with crypto exposure weight 5% or less to the segment.

Those who aren’t invested in the space don’t show much willingness to get involved. More than half of advisers named regulatory uncertainty, volatility and failures of centralized institutions as barriers to greater adoption.

Chart by Bitwise

Chart by Bitwise

The survey collected the responses of 491 advisers, including registered investment advisers (RIAs), broker-dealers, financial planners, wire house representatives and institutional investors.

Responses were gathered from Nov. 25 — two weeks after crypto exchange FTX filed for bankruptcy — to Jan. 6.

Christopher King, the CEO of crypto-focused separately managed account platform Eaglebrook Advisors, previously told Blockworks “the lowest-hanging fruit” for crypto is the $30 trillion wealth management market.

Bitwise Chief Investment Officer Matt Hougan said in a statement that the latest survey findings show crypto is “one of the best business development opportunities in the financial advisor market.”

“Ninety percent of advisors report fielding questions from clients, and a majority say they have clients who invest in crypto outside the advisory relationship,” Hougan said. “2023 is the year to bring those investments in-house.”

Advisers’ willingness to continue allocating to the segment comes despite a bearish short-term view on crypto’s asset, as 63% of respondents believe the price of bitcoin will fall this year. Six in 10 advisers, however, think bitcoin’s price will be higher in five years, according to the survey.

Bitcoin’s price was about $22,580 at 1:00 pm ET Wednesday, up nearly 7% in the past week.

As for how surveyed advisers plan to offer exposure to the space to clients in 2023, the top choice is utilizing crypto equity ETFs.

Such investment products have become more prevalent, industry participants have said, in part because the SEC has not yet approved ETFs in the US that invest directly in bitcoin.

While performance for such ETFs was all over the map, all saw negative returns in 2022 as several segment-altering events rocked the crypto industry.

The largest blockchain ETF in the US is Amplify Investments’ Transformational Data ETF (BLOK), which has roughly $430 million in assets. Its top holdings include MicroStrategy — the largest public holder of bitcoin — Coinbase, Accenture, IBM, GMO Internet Group and SBI Holdings.

BLOK is down about 42% in the past year, but is up 22% so far in 2023. Bitcoin meanwhile is down 39% from a year ago, but has gone up 36% year to date.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.