Fund Managers Reflect on ETH Strike Price Rally

“The impressive strength that ETH has shown over the past few weeks along with positive sentiment about the future of the protocol have helped to drive both prices and volatility higher,” said Chad Steinglass, CrossTower’s Head of Trading.

Source: Shutterstock

- One fund manager worries that momentum-focused investors are struck with fear of missing out rather than an understanding of Ethereum’s value capture

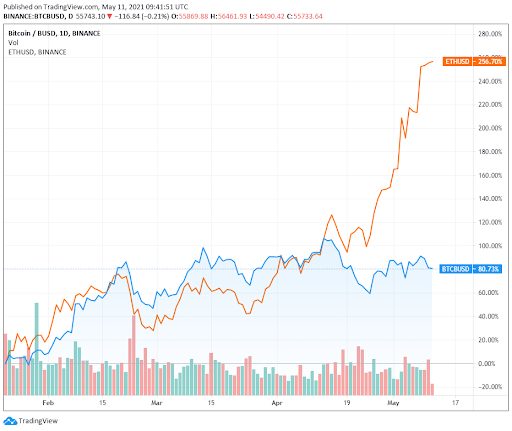

- As Ether continues to decouple from bitcoin and rallies calls are showing major year-end gains for the token. But this isn’t the same as a price forecast

Ether’s recent rally has seen the token for the ‘world’s computer’ spike by over 250% since the year began. On the one hand, the rally is a product of investors’ understanding that ETH’s inherent programmability is its value. However, one fund manager, David D. Tawil of ProChain Capital warns that something else is afoot: amateur yield-hungry investors looking beyond fundamentals.

“Momentum-focused investors witnessed the massive growth in the price of bitcoin over the past couple of years. In their eyes, bitcoin no longer has the same upside potential. In contrast, they think ether has that potential; Dogecoin even more so. And, they are stricken with FOMO,” he told Blockworks in an interview.

While Tawil believes that many investors understand the unique, fundamental differences between bitcoin and ether there are enough that don’t and are pushing an investment thesis “detached from fundamentals” to be concerning.

“Although absolute dollar-price should have nothing to do with valuation and potential gains and losses, some investors, look at a $55K Bitcoin, a $3.5K Ether, and a $0.50 Dogecoin, and may ridiculously think, ‘it’s much easier for Doge to get to $1, than for Bitcoin to get to $100K’,” he said to Blockworks, arguing that these investors aren’t thinking about the converse.

“It’s also a lot easier for Doge to go to $0.05 than for Bitcoin to reach $5.5K. They are not thinking in a risk-adjusted manner and that’s bad for everyone,” he continued.

Strike calls

Tawil’s comment brings up the issue of strike calls on options contracts, effectively a bet of future value.

The strike price is where the security can be bought by the option holder; for put options, the strike price is the price at which the security can be sold. Strike price is also known as the exercise price, according to Investopedia. Far out put calls are often used as an insurance premium against volatility.

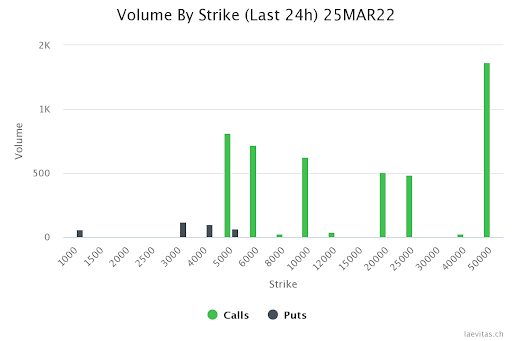

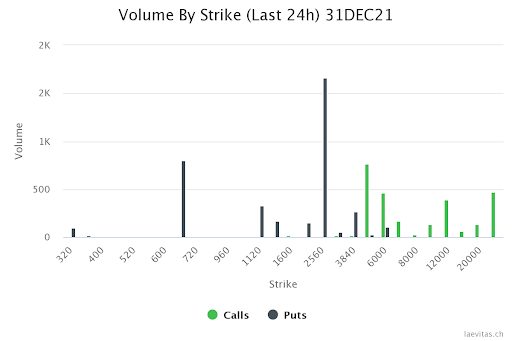

Data from Laevitas, an aggregator, shows aggressive moves towards $20K ether by end of year from $8,000 — a doubling — by June and onwards to $50K by next year. (See comparison charts below for ETH volume by strike.)

Chad Steinglass, CrossTower’s Head of Trading, isn’t quite sure of the reason explaining that it could be legitimate belief that speculators believe the price will hit $8,000 by June by speculators, or it could be from those that are “caught short vega and gamma” (meaning a short that benefits if volatility falls, or shorting options in general aka a premium collector trader).

“These traders might be exposed to losses if the price continues to surge, and might be buying far out of the money calls as insurance and to protect themselves against a potential margin call,” he also speculated, arguing that these calls can also be traders working the convexity in the volatility curves.

The Ethereum angle

Steinglass also says that all the aggressive moves could be traders putting a long on Ethereum, the protocol ether trades on.

“The impressive strength that ETH has shown over the past few weeks along with positive sentiment about the future of the protocol have helped to drive both prices and volatility higher,” he said. “As volatility and price become positively correlated, out of the money calls pick up a lot of convexity.”

As of the early afternoon US trading session, ether is now resting at $4,030, having breached the $4,000 mark during the last hours of the Asia trading day and early morning start of Europe’s.