Where crypto markets stand heading into historically-notorious September

BTC price headed into the month straddling the average cost basis for short-term holders

Yuriy Kulik/Shutterstock and Adobe modified by Blockworks

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

September is here, marking the non-technical end of summer, back to school and — oh yeah — the worst month (historically) for bitcoin.

Some have attributed lower market returns in the year’s ninth month (not just for BTC, but for the S&P 500, too) to post-summer rebalancing. Investors — inside and outside the crypto segment — return from vacations, re-evaluate portfolios and, perhaps, choose to lock in gains/cut losses, putting downward pressure on prices.

I looked back at a piece I wrote exactly one year ago about the September events that could move markets. It discussed a possible mid-month Federal Reserve rate cut (which happened, sized at 50bps) and a then-upcoming SEC decision on allowing bitcoin ETF options (indeed finally approved).

The current odds for the Fed lowering rates in a couple weeks (albeit with a 25bps cut) are ~92%, according to CME Group’s FedWatch tool. While an interest rate cut is generally good for risk assets, the impact could be more nuanced.

Rather than the SEC approving options on BTC funds a year ago, the regulator could soon clarify the fate of many more crypto ETP proposals. But it’s not all that different.

To remind you, though, how much has changed since Sept. 2, 2024, that story featured a photo of Kamala Harris and questioned the fate of then-SEC Chair Gary Gensler. Also, bitcoin and ether have risen 94% and 78%, respectively, in the past 12 months.

Early into September 2025, we see bitcoin roughly 11% off its high of ~$124,000 hit last month. The asset’s performance in August (-6.5%) was its worst since February (-17.4%).

BTC dipped to ~$107,000 this weekend and hovered around $111,000 Tuesday afternoon. Compass Point analysts Ed Engel and Abdullah Dilawar noted the average cost basis for short-term holders (those who bought less than six months ago) is around $109,000. Of BTC supply bought in the past six months, they added, 30% was acquired above $115,000.

“This points to a top-heavy market, where short-term holders often accelerate selling when unrealized losses become too high,” Engel and Dilawar wrote. “While BTC has rebounded back above $109,000, we would like to see negative funding rates and/or more short-term holder capitulation before buying any dips.”

So they gave us a couple price points to keep in mind. Want another one? Bitfinex analysts have you covered.

“While this [BTC] breakdown carries technical weight, historical drawdown patterns and seasonality suggest the market is actually in the later stages of its corrective phase, with [$93,000 to $95,000] emerging as the most probable zone for a cyclical floor.”

Ether also dipped this weekend — about a week after hitting an all-time high. But it’s been more resilient than BTC of late, given ETH ETF inflows and institutional buying (NYSE American-listed BitMine Immersion held 1,866,974 ETH, as of Aug. 31). ETH, as of an hour ago, was trading around $4,300.

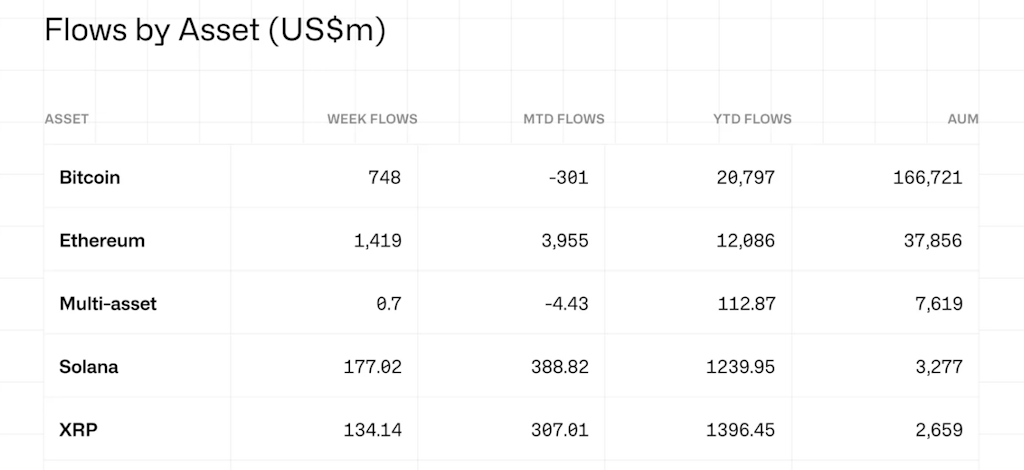

Spot ether ETFs had a big August, notching nearly $4 billion of net inflows. About $300 million, meanwhile, trickled out of bitcoin products, CoinShares data shows:

You can see, too, last month’s flows into solana and XRP products — in part reflecting optimism around potential US ETF launches.

SEC approval of such products, which I expect next month, would contribute to the potential “altcoin autumn” I wrote about last week. Particularly if we see the SEC unveil general listing standards for crypto ETPs.

And the growing number of crypto ETF filings continue to, well, keep growing. Grayscale Investments submitted S-1s for ETFs that would hold cardano (ADA) and polkadot (DOT) late last week — following up on previous 19b-4s linked to those proposed products.

The likely crypto investment product boom might have to wait for next month’s “Uptober” outlook. But it’s just another thing to be mindful of as various market narratives simultaneously play out.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.