Investment Products Shorting Bitcoin See Record Inflows

Products betting against the asset helped the space’s offerings avoid a fourth straight week of outflows, according to CoinShares report

blockworks exclusive art by axel rangel

- Ethereum products see slight outflows ahead of the Merge

- Assets under management in crypto products declined to roughly $28 billion, its lowest level since early July

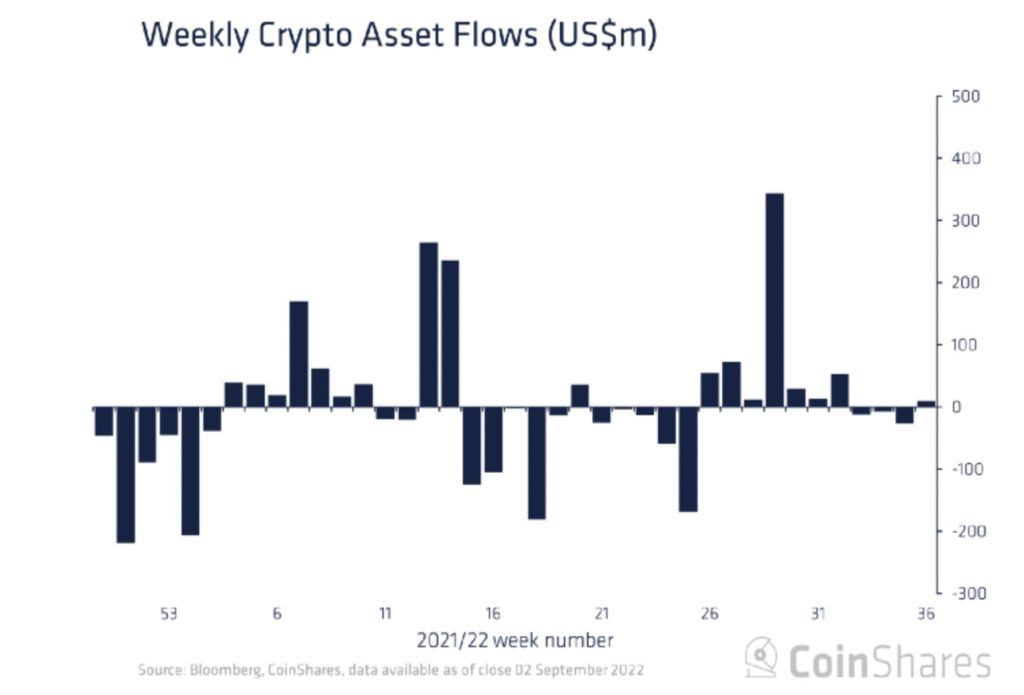

Despite continued low trading volumes and declining assets under management in crypto investment products overall, money going into the budding short bitcoin offering space reached an all-time high.

Crypto investment products had roughly $9 million in inflows last week, according to a Tuesday report by CoinShares, stopping a three-week run of outflows. Negative sentiment was highest in the US, which saw relatively flat flows masked by a record $18 million into products betting against bitcoin.

Source: CoinShares

Source: CoinShares

Short bitcoin investment products now have $158 million in assets under management — a new high — according to the report. The largest such fund is ProShares’ Short Bitcoin Strategy ETF (BITI), which launched in June after bitcoin’s price plummeted to less than $20,000.

BITI was up 20% from a month ago, as of Tuesday at 11:00 am ET, as bitcoin’s price was just above $19,800. The fund has roughly $90 million in assets under management, according to ETF.com.

Crypto investment products in Canada, Brazil, Switzerland and Germany saw slightly higher inflows than those in the US.

“This follows the recent FOMC meeting at Jackson Hole where a much more hawkish view was expressed, unexpected by some investors,” CoinShares Head of Research James Butterfill said in the report.

Federal Reserve Chair Jerome Powell said during the Aug. 26 event that there is still a long way to go before sustained price stability is reached. Some analysts predict another 75 basis point rate hike this month.

Despite additions to short bitcoin products, offerings focused on bitcoin and ether had about $11 million and $2 million of outflows, respectively.

Butterfill said last week that investors have apparently decided to wait for Ethereum’s upcoming Merge — the blockchain’s move from proof-of-work to proof-of-stake — before adding to positions.

Last week’s trading volumes in crypto investment products hovered around $900 million, similar to levels seen last week — the lowest since October 2020.

Recent price declines pushed assets under management in crypto products to roughly $28 billion, their lowest point since early July. Such offerings managed about $64 billion in assets at the start of the year.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.