Brace yourselves, the massive unlocks are coming

We’re about to see a batch of newer projects release billions of dollars worth of their tokens over the next year

Akif CUBUK/Shutterstock modified by Blockworks

This is a segment from today’s Empire newsletter. To read full editions, subscribe.

Crypto is in a constant state of flux. Tokenomics is no different.

Of course, there are absolutes in crypto. Private keys always grant access to digital assets within that public-key pairing, for example. That someone will inevitably launch a memecoin for every passing fad in our collective culture is another.

But crypto’s non-stop experiments with tokenomics have become integral to the asset classes’ core thesis.

How projects fund themselves, entice venture capital and encourage early participation is, in many cases, a large part of the identity of those individual coins.

For bitcoin, there can only ever be 21 million coins, claimable only by expending a certain amount of energy. The scarcity is Bitcoin’s meme.

Solana’s private sales to venture capital firms have otherwise morphed into its value proposition: All those VC dollars have encouraged a vibrant ecosystem of projects that utilize the protocol.

That has in turn generated real value for both institutional and retail backers across the Solana space. Or, at least, enough for the market to absorb the roughly $70 million in fresh SOL being printed for the benefit of network validators every week. Abundance is Solana’s meme.

While we’ve had huge token unlocks before, we’re about to see a batch of newer projects release billions of dollars worth of their tokens over the next year.

If altcoin season really hits, expect these numbers to rise drastically

If altcoin season really hits, expect these numbers to rise drastically

Five coins in particular are worth paying attention to, all of which debuted on public markets within the last year: ONDO, JTO, W, PYTH and TIA.

ONDO and JTO’s circulating supplies are set to more than double, while TIA and PYTH will increase by over 80% and 58%, respectively.

Between them, crypto worth over $3.9 billion will be unlocked at today’s prices. If token prices rise between now and those unlocks, the real number will be higher. (Additional tokens are usually seeped into the system outside of these big unlocks, often at daily or weekly intervals.)

PYTH’s unlock, currently valued at $725 million, won’t happen until May next year, earmarked to be directed toward ecosystem growth and rewarding network participants. W’s happens one month earlier and ONDO’s in January, while JTO’s is in December.

TIA’s enormous $1 billion unlock occurs this time next week, on Halloween, one year after its trading debut.

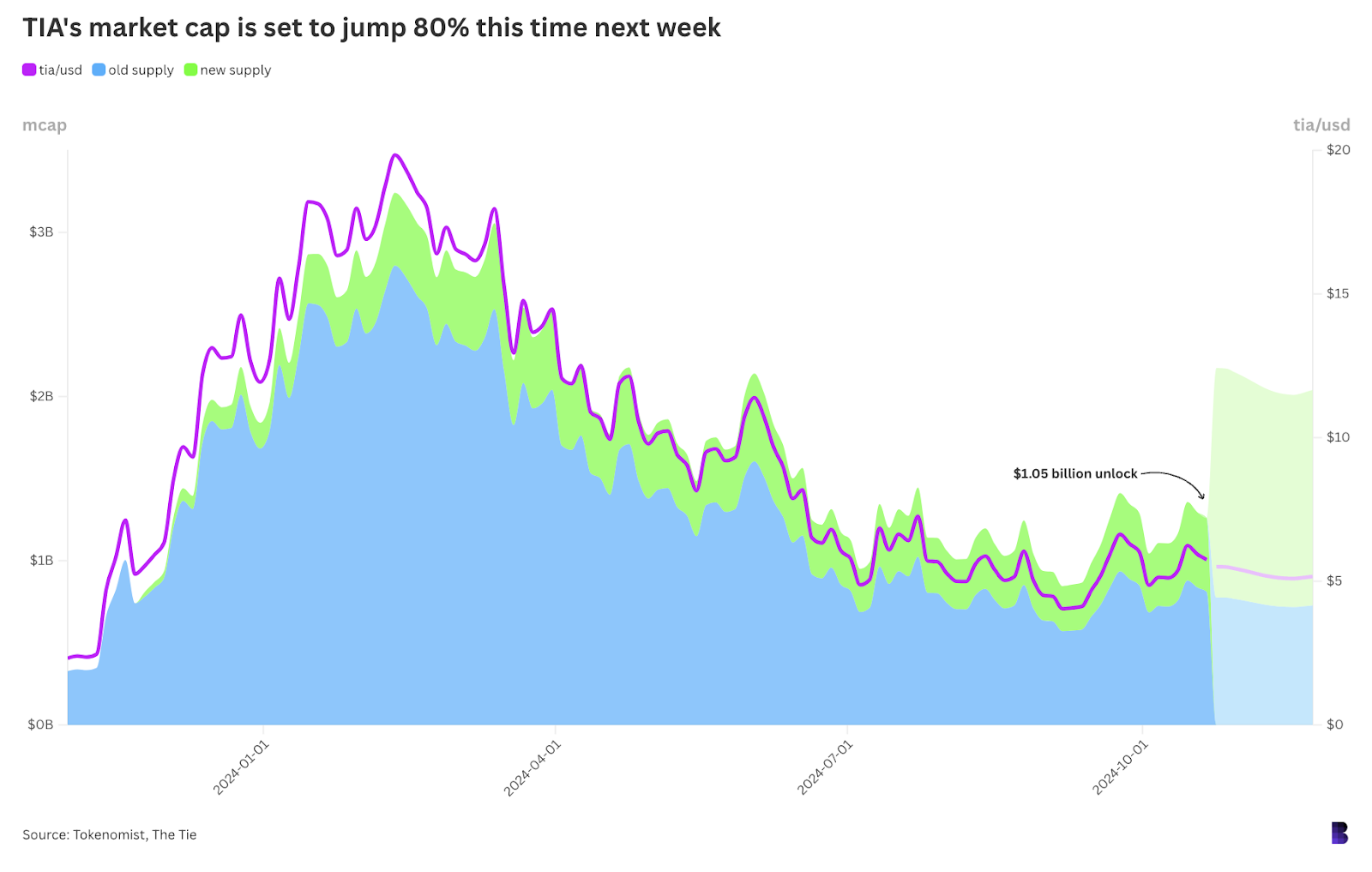

Add the blue and green areas together and you get TIA’s market cap

Add the blue and green areas together and you get TIA’s market cap

65 million tokens will go to backers from Celestia’s Series A and B rounds, per The Tie, which included Polychain Capital, Galaxy and Delphi Ventures, among others as well as 52.5 million for those in its 2021 Seed round, including Binance Labs and Maven 11 and more.

Another 58 million TIA will be unlocked for initial core contributors.

It’s unlikely that all those tokens will be sold at once. We also don’t have too many examples of what happens to token prices around these big unlocks. But the chart above shows just how drastic the change will be, at least in TIA’s case.

The blue area is the market cap of TIA’s circulating supply when it first started trading last year. The green area is the value of the TIA supply that has been printed since then, and the purple line tracks its price.

Faded areas on the right side of the chart show TIA’s market cap directly following next week’s unlock. It’s impossible to say exactly how much its market cap will jump, because it depends on the price of TIA, but the chart assumes TIA will trade in line with its rolling average over the past three months.

Whether the market agrees TIA should stay the same price, even with 80% more sellable tokens out there, is a whole other story.

Still, so far so good: TIA has more or less trended sideways for the past quarter and then some.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.