The megawatt trade: Are bitcoin miners just getting started?

As AI reshapes the demand for infrastructure, Bitcoin miners are reinventing themselves as energy-first compute providers

Artie Medvedev/Shutterstock and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Hi all, happy Wednesday. Markets are treading water as traders balance fading momentum with solid structural support. BTC holds near $108K, ETF inflows have softened and positioning looks cautious but orderly. Meanwhile, after years of neglect, BTC mines are having their time in the spotlight.

Indices

Equity markets traded mostly sideways this week as risk assets consolidated following recent strength. The S&P 500 (+0.3%) and Nasdaq 100 (+0.4%) held modest gains, while Gold (-0.2%) stayed rangebound. Crypto equities lagged broader markets despite stabilizing late in the week and ended flat after recovering from midweek lows near -5%. The overall tone leaned neutral-to-risk-off, with investors waiting for fresh catalysts amid quiet macro data and earnings-driven positioning.

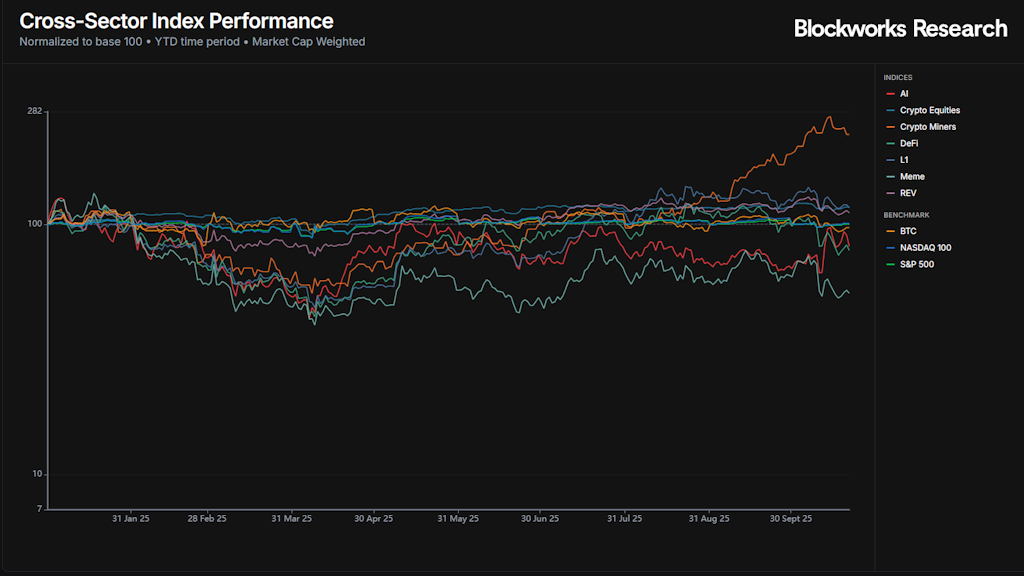

Crypto subsectors diverged sharply. AI-linked tokens were the standout, briefly surging midweek before closing the week near even. L2 and modular ecosystems underperformed, falling roughly 10-15% from the week’s open, reflecting cooling momentum after recent rallies. Solana ecosystem names also slipped, tracking broader altcoin softness, while crypto miners extended their slump, under pressure from declining BTC hash price and weaker sentiment in energy-sensitive assets. The pullback suggests selective rotation rather than a wholesale exit from risk.

Macro conditions offered little directional impulse. Treasury yields eased slightly, but risk appetite remained muted ahead of upcoming inflation and GDP data. With earnings season and key inflation prints ahead, short-term reactivity could rise. Crypto’s relative weakness vs. equities may persist until clearer macro or onchain catalysts emerge.

Market Update: Rotation without conviction

BTC holds ~$108K as ETF flows wobble and rates dip, while perps positioning looks cautious but not capitulated. The broader market seems hesitant to chase strength at these levels, with traders opting to protect gains rather than add risk. However, funding rates remain neutral, suggesting no extreme leverage buildup or panic selling despite softer sentiment.

The tape says “buy the dip, sell the rip” and spot is resilient around $108K, but weekly ETF flows softened and options skew implies demand for downside protection into Friday. This pattern points to a range-bound environment driven by short-term positioning and liquidity rotations rather than conviction buying. Still, structural support from longer-term holders continues to underpin price action, limiting the depth of pullbacks for now. Similarly, we also saw ~$500 million of net inflows into BTC ETFs yesterday.

Derivatives positioning looks cautious. Open interest has cooled and rallies stall quickly, consistent with fading impulse rather than trend reversal. Macro’s not helping either, as higher-for-longer rate chatter, tariff concerns and wobbly financials have kept risk appetite uneven. For now, traders appear content to stay light and reactive, with volatility compressing as markets wait for a clearer catalyst to define the next leg.

The megawatt trade: Are bitcoin miners just getting started?

A sudden outage at AWS’s US-EAST-1 region on Oct. 20 reminded everyone that the internet’s backbone still runs through a handful of centralized choke points. The issue stemmed from DNS resolution failures inside an internal network subsystem, knocking millions of users offline for hours. The incident underscored just how critical resilient, distributed compute capacity has become in an era increasingly shaped by AI.

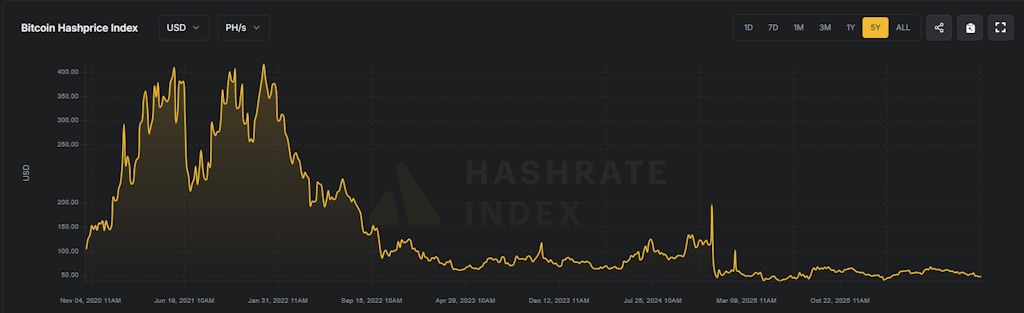

It’s moments like these that highlight why interest in more distributed forms of compute is growing, where power and resiliency matter as much as scale. Bitcoin miners, facing margin pressure since the halving as hash price falls and network hash rate climbs, are leaning into that shift. With access to cheap energy and industrial-grade infrastructure, they’re finding the next frontier isn’t more bitcoin: It’s more compute. Many are already recasting themselves as power-first infrastructure businesses built to serve future demand.

Source: https://hashrateindex.com

Source: https://hashrateindex.com

Crypto miners have left nearly every other sector in the dust this year. Our Crypto Miners Index is up roughly 130% year to date, far outpacing both traditional crypto equities and broader benchmarks like the S&P 500. As data-center demand soars and power capacity becomes the new currency, miners are no longer priced as just “bitcoin plays” but as critical infrastructure providers. That re-rating has pulled capital back into the sector, setting the stage for the next wave of deals and build-outs.

Activity across the mining sector is heating up as the AI-compute trade accelerates. CleanSpark recently brought on Jeffrey Thomas, formerly of Humain, to lead its new AI data center division. Bitfarms raised $500 million through convertible notes to expand its power and HPC footprint. CoreWeave’s proposed ~$9 billion all-stock acquisition of Core Scientific, set for a shareholder vote on Oct. 30, has become the industry’s main event. Recently, proxy advisor Institutional Shareholder Services (ISS) recommended that shareholders vote against it, with critics arguing the offer undervalues Core Scientific. However it plays out, it’s a reminder that miners’ real advantage lies in the power they already control.

Source: https://hashrateindex.com

Source: https://hashrateindex.com

Zooming out, capital is starting to value megawatts. Macquarie’s ~$40 billion sale of Aligned Data Centers to a BlackRock-led group values ~5GW of operational and planned capacity at an implied ~US$8 million per MW. For listed miners, the market is drifting toward a megawatt lens but it is still early days. The leaders are already turning megawatts into AI cash flows (higher revenue per MW and steadier, longer-dated contracts), setting the pace for the re-rate. IREN illustrates the trend — guiding to >$500 million in AI-cloud ARR by Q1 2026 and now standing out as one of the best-performing miners YTD.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.