MicroStrategy and Galaxy ‘Bitcoin Mining Council’ Claims Mining is One of Most Sustainable Industries

According to the council’s new report, titled “The Global Bitcoin Mining Data Review,” survey participants are currently utilizing electricity with a 67% sustainable power mix.

- BMC surveyed “bitcoin miners around the world” but did not reveal names of individuals or companies that participated.

- The council, launched in May 2021 seeks to “shift the narrative” surrounding bitcoin mining and its environmental impact.

The Bitcoin Mining Council (BMC), MicroStrategy’s joint venture with Galaxy Digital and other companies in the digital asset space, released its first quarterly survey Thursday, revealing that mining efforts may be more sustainable than the public believes.

BMC surveyed “bitcoin miners around the world.” The organization did not reveal names of individuals or companies that participated, but each party surveyed was asked three questions about the amount of electricity used, the percentage that was sustainable and the hashrate of their fleet.

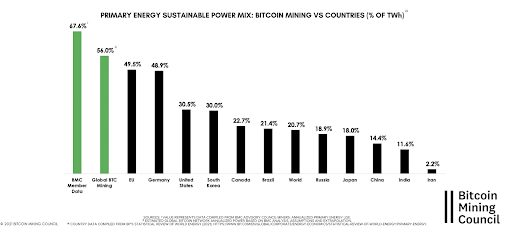

According to the report, titled “The Global Bitcoin Mining Data Review,” survey participants are currently utilizing electricity with a 67% sustainable power mix. Based on this figure, the global mining industry’s sustainable electricity mix is estimated to have grown approximately 56%, during Q2 2021, making it one of the most sustainable industries in the world, according to BMC.

When asked by Castle Island Ventures’ Nic Carter how the BMC determined the carbon emissions factor, MicroStrategy CEO and BMC founding member Michael Saylor said the council created an estimate using off-grid and unsustainable power.

“Then we allocated another portion that we applied to our BMC sample in order to get a blend,” Saylor said during a live virtual briefing following the release of the report. “The blend ended up being slightly more than the electricity grid.”

Saylor and BMC have received criticism for the report’s lack of transparency when it comes to methodology and who was surveyed.

The council, launched in May 2021 seeks to “shift the narrative” surrounding bitcoin mining and its environmental impact. Bitcoin’s energy usage has come under harsh criticism in recent months.

In May, Tesla CEO Elon Musk announced that the electric car company would no longer be accepting bitcoin as a form of payment because mining is too harmful to the planet. Musk has since stated that Tesla will accept bitcoin if 50% of it is mined using renewable resources.

While Musk acknowledged the creation of the BMC via Twitter, he holds no official role.