NEAR’s inflation reduction vote fails pass threshold, but it may still be implemented

L1 governance drama

AbdulHamidK9/Shutterstock and Adobe modified by Blockworks

This is a segment from the Lightspeed newsletter. To read full editions, subscribe.

The NEAR L1 blockchain is running into something of a governance debacle.

Since June, NEAR’s community has debated a proposal to halve protocol emissions from 5% to 2.5%.

The original proposal argues that fee burns have fallen well short of expectations, leaving “high inflation without high usage,” which is unsustainable.

The situation for NEAR is stark. NEAR is issuing roughly $140 million of tokens annually to secure a chain with $157 million in TVL and about $3.2 million in year-to-date fees.

For context, Solana’s estimated annual issuance is roughly $5.5 billion, but it supports a far larger, more active DeFi ecosystem with around $11 billion in TVL. From a purely economic lens, NEAR is definitely “overpaying” for security.

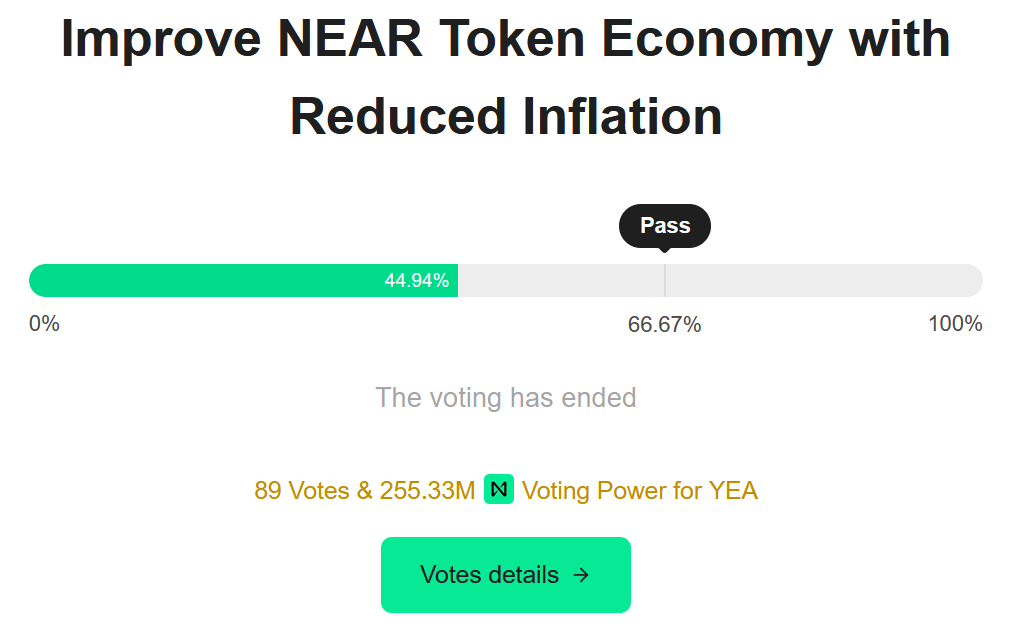

That discussion finally culminated in a vote that concluded earlier this week. But though the vote won a simple majority, it failed to clear the 66.67% approval threshold, leaving it technically unsuccessful under NEAR’s governance rules.

Source: Linearprotocol

Source: Linearprotocol

That’s where the controversy begins. Validator operator Chorus One is criticizing indications that NEAR’s core contributors may still ship a nearcore release containing the change, relying on a subsequent onchain upgrade mechanism to activate it.

Louis Thomazeau of L1D fund is pushing back against Chorus One, countering that cutting emissions is “common sense” economics and should take precedence over blind adherence to decentralization ideals. In other words: Sure, there are rules, but a startup’s main job is not to die.

It’s hard to say if there’s a clear right or wrong here; it fundamentally comes down to your philosophical values.

Breaking the rules delivers short-term efficiency, but it risks a dangerous “Fed put” precedent. Following the rules of governance, I guess, safeguards governance integrity, but that’s costly for the network and NEAR in the near term.

Crypto seems to run into the same kinds of problems all the time.

Hyperliquid recently faced a similar bind.

In March, a trader squeezed the JELLY perps market, saddling the HLP vault with large losses. The team delisted JELLY perps and manually overrode the oracle price to close exposure and stem the damage — an explicit break from crypto’s sacrosanct “code is law” principle to protect depositors.

There are countless examples: Should a chain halt during an exploit (e.g., BNB in 2022)? Should a community hard fork to reverse a hack (Ethereum in 2016)? You get the idea.

If NEAR wants legitimacy, it should probably take the loss and honor its own thresholds. Forcing the outcome through for a “good” outcome today signals that your governance rules are written in sand. But then again, this industry has the memory of a goldfish, so who are we kidding?

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.