Prediction markets boom as crypto pulls back

Polymarket’s new $9 billion valuation underscores how fast the sector is maturing

PJ McDonnell/Shutterstock modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

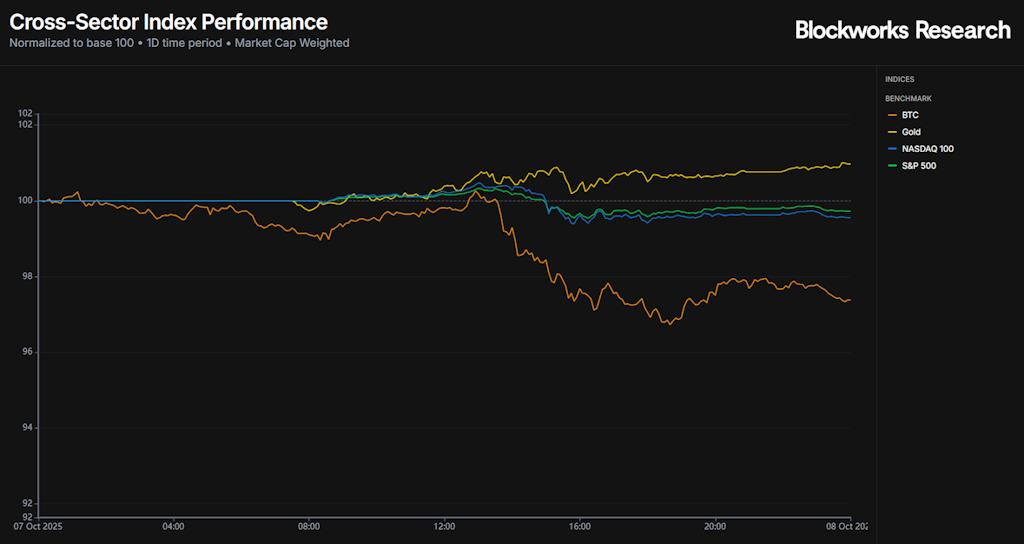

The market rally hit its first resistance yesterday, with every sector except gold closing in the red. BTC fell 2.6%, mirroring weakness in traditional markets as the S&P 500 and Nasdaq slipped 0.28% and 0.44%, respectively. Gold was the lone standout, gaining 0.97% as investors continue rotating toward safety as the metal continues setting new ATHs.

The pullback followed a New York Fed consumer expectations survey that showed worsening sentiment and higher inflation forecasts. After seven straight sessions of gains for the S&P 500, a correction was arguably overdue.

Amid the broader selloff, the AI sector showed surprising resilience, falling just 4.2% — relatively mild for a group that typically reacts sharply to market moves. IP, ICP, NEAR, and TAO all posted small declines, suggesting dip buyers may already be circling.

At the other end of the spectrum, memecoins were the hardest hit, sliding 7.7% on the day. The weakness was compounded by the ongoing meme season on BNB, which has siphoned liquidity from existing names as traders chase quick returns in new launches.

BNB has been on an absolute tear, climbing 27.5% over the past week and 45.5% over the last month. For the third-largest token by MC, those are staggering numbers in such a short span. The fundamentals back it up, too. BNB’s share of total network revenue has surged from 6.5% at the end of August to 24% today, recently overtaking Solana and even matching Hyperliquid in daily network revenue.

So what’s fueling this run? It started with Aster, hyped as the next Hyperliquid, which pulled traders and capital into BNB in hopes of farming a lucrative airdrop. But momentum has since shifted to a new memecoin wave sweeping across the BNB ecosystem. Since early October, CZ has subtly leaned into the movement, with memes like 4 and GIGGLE getting listed on Binance Alpha. The frenzy hit new heights when PALU, a small-cap coin with a $3 million market cap, pumped over 3200% after being added to Binance Alpha.

These explosive returns have supercharged activity on Four.meme, BNB’s native meme launchpad, as traders rush to buy the next viral token. Interestingly, this isn’t the first time we’ve seen this move. A similar meme season hit earlier this year and each wave lasted roughly a month before fading.

Bridging data shows capital rotating from Solana and Ethereum into BNB over the past week, signaling fresh inflows chasing the trend. The open question is sustainability. With the Aster drop still to come, this wave could run longer than the last. The simplest way to ride it is through tokens like BNB, CAKE, and FORM, which directly benefit from rising activity.

But history offers a word of caution. Past BNB meme seasons have been highly reflexive, with sharp drawdowns once liquidity rotated to the next narrative. While we’d all like to believe that this time will be different, it probably won’t. Manage risk accordingly.

Prediction markets battle it out

The past few days have again been dominated by prediction markets, which have now become increasingly focused on publicity, dominating CT narratives and mindshare.

Kalshi has turned on its badging funnel, going above and beyond in terms of recruiting influencers and Twitter personalities. This came after the announcement of its new crypto focus (onboarding John Wang as head of crypto).

The Kalshi team has also increasingly become further integrated across financial information services, brokerages and news. Most recently, Kalshi has been integrated into Bloomberg. It’s also started working closely with Robinhood. In addition, both Polymarket and Kalshi have increasingly been cited across media, including TBPN and MSM.

While Kalshi has been focused on integrations and publicity, Polymarket recently announced that Intercontinental Exchange (ICE), the parent company of NYSE, made a $2 billion strategic investment at a $9 billion post-money valuation. It also announced a $150 million round (at $1.2 billion) led by Founders Fund, and a $55 million round (at $350 million) led by Blockchain Capital. It seems that thus far, with the exception of regular, non-institutional capital, everyone has found ways to gain exposure to Polymarket, Kalshi and the growing prediction market sector.

Kalshi and Polymarket are in a fight to dominate prediction markets. This initially became apparent in earlier leaks that Kalshi had attempted to sabotage Polymarket’s (using Antonio Brown, amongst others to disparage Polymarket and Shayne Coplan).

Although we in crypto have historically been more aware of Polymarket, it’s led us to assume it’s the largest prediction market, and this isn’t true.

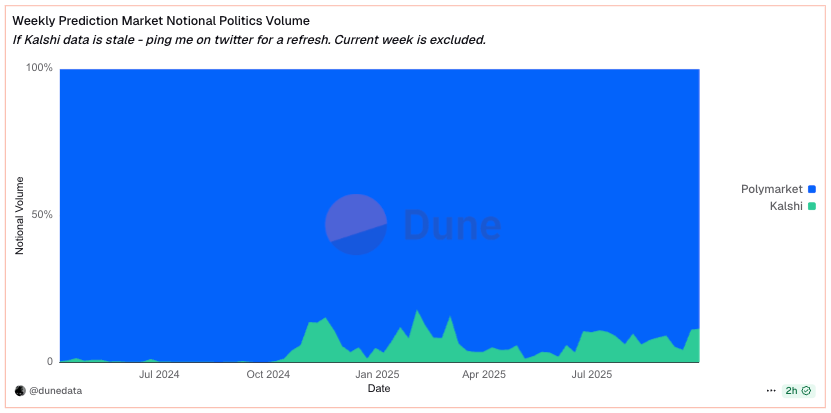

Kalshi’s notional prediction market volumes are significantly higher compared to those of Polymarket. Over the past week, Kalshi saw $956 million (nearly 66% of all volume) in weekly volume, while Polymarket saw only $464 million (32% of all volume).

Notably, the majority of Kalshi’s volume comes from sports betting. Sports made up $877 million of the $956 million over the past week (around 92%). This has been an ongoing shift, following Kalshi’s partnership with Robinhood to launch NFL and College Football markets. Excluding sports, Kalshi’s market share (15%) compared to Polymarket’s (85%) was significantly lower.

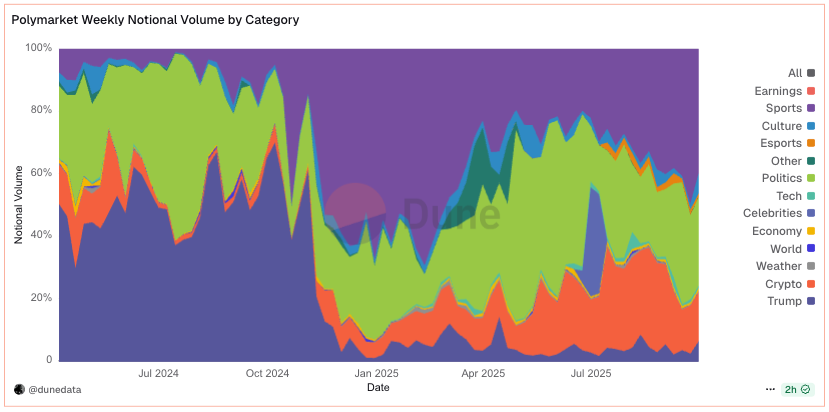

We’ve seen that sports on Polymarket have similarly historically been dominant (barring weeks involving important geopolitical or election news). Over the past week, 50% of volumes have been sports-related.

In terms of politics, Polymarket captures more than 90% of the volume between the two. Unfortunately for Polymarket, sports betting is much more widespread compared to political betting, and is less influenced by seasonality.

Going forward, we’ll have to see whether Polymarket is able to match the distribution that Kalshi gets with Robinhood. Historically, many have commented (including us at Blockworks Research) on how sports betting through prediction markets is not as entertaining or optimized as it is through traditional apps, like DraftKings. However, it’s clear that it has allowed Kalshi to gain mindshare and market share despite Polymarket announcing large, impressive raises and backers.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.