ETH’s price isn’t the only metric trending up

ETH onchain is slowly coming back while Crypto Twitter’s falling in love with a new flavor of gambling

scoutori/Shutterstock modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

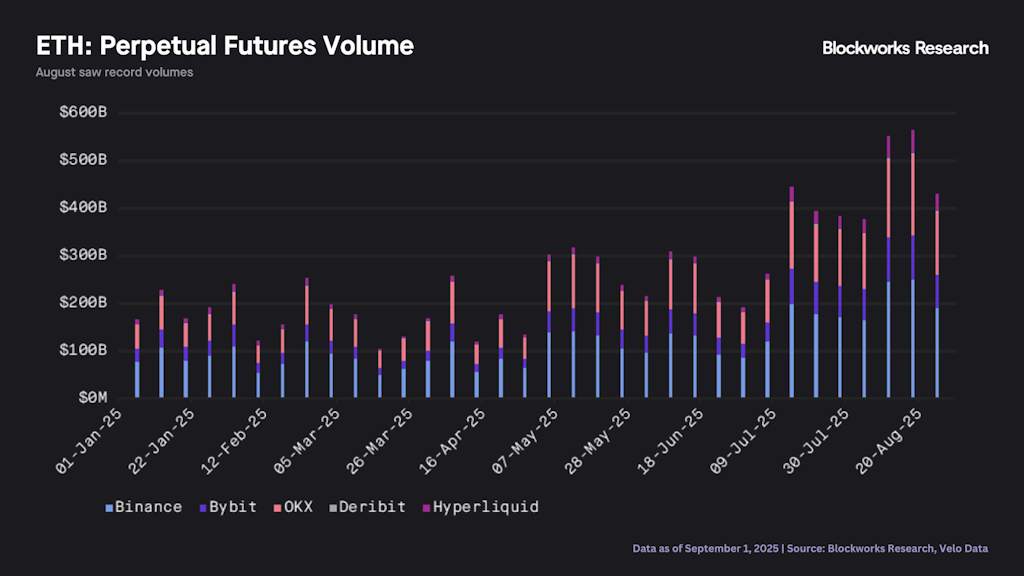

Ethereum is having its moment in the spotlight, and while its performance has been attributed to flows from digital asset treasury companies (DATCOs) and ETFs, its price wasn’t the only metric that hit an all-time high. For the second consecutive month, ETH’s price action was accompanied by record levels of perp volume. August saw nearly $2 trillion in volume, 30% more than July’s $1.5 trillion.

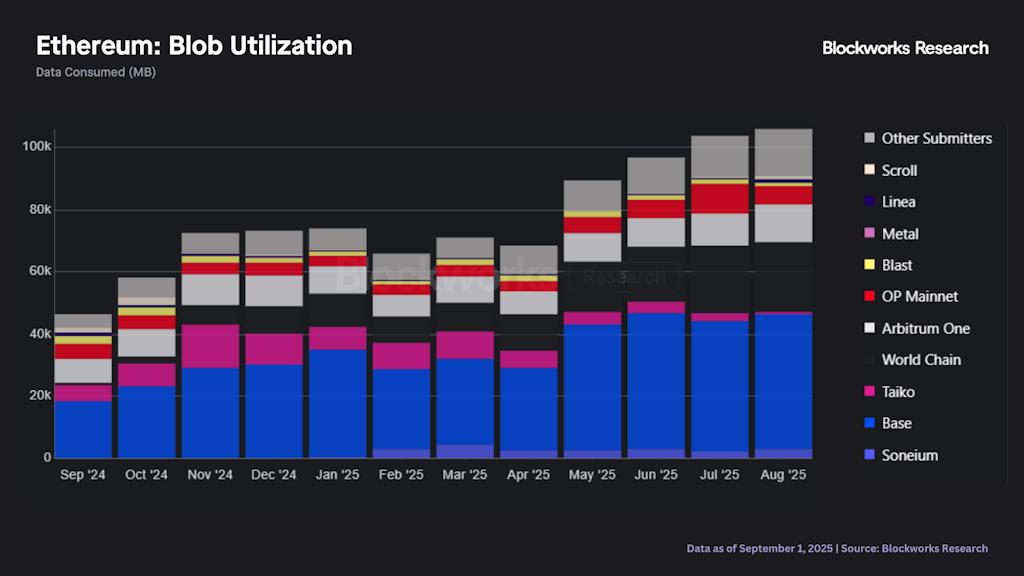

August also marked Ethereum’s highest DA usage ever, and its market share increased from ~53% in July to 63% in August. However, since the blob target of six still hasn’t been hit (average of 4.17 in August vs. 4.13 in July), the cost of blobs remains extremely low (near one wei). In the upcoming Fusaka upgrade, a “floor price” will be implemented to help address this issue.

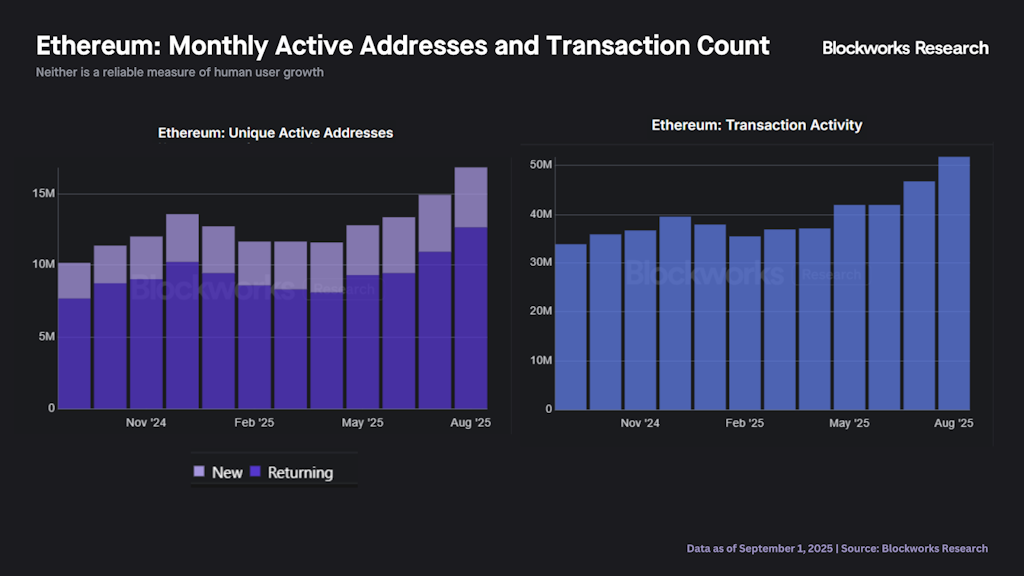

Thanks to a 50% increase in the gas limit YTD, monthly active addresses (MAAs) also hit an all-time high of 16.8 million (a 12.7% increase from July’s 14.9 million) while transaction count followed suit with ~51.7 million (an 11% increase MoM).

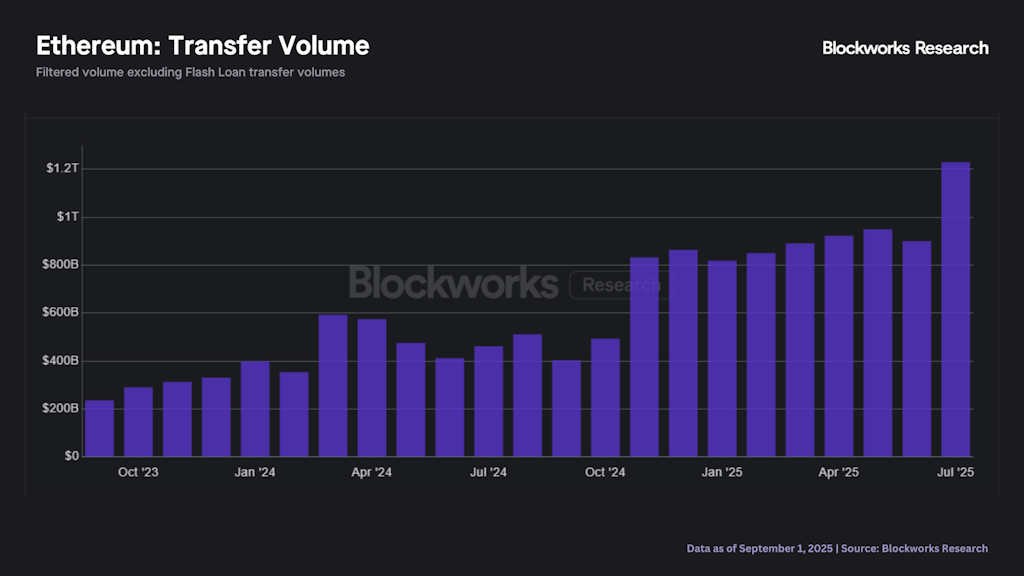

And just in case you were wondering why Ethereum has the stablecoin narrative — the stablecoin supply on Ethereum reached $163 billion, a new all-time high and the highest among any chain. Stablecoin transfer volume on Ethereum also hit an all-time high in August, rising 17% MoM to $1.43 trillion (vs. $1.23 trillion in July). This marked the second month on record with (filtered) transfer volumes over $1 trillion.

Maybe flows alone aren’t telling the full story?

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.