SEC Commissioner Hester Peirce on Crypto and GameStop: ‘People Want to Get Involved’

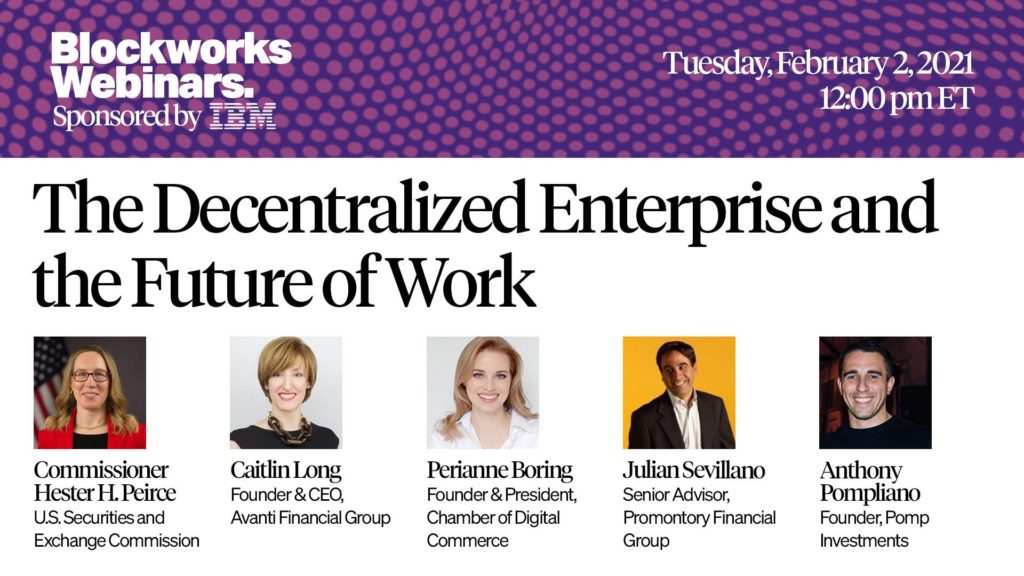

SEC Commissioner Hester Peirce thinks a sense of financial exclusion is driving people to cryptocurrency, and more recently, meme stocks like GameStop. “Some of the same things in the [Gamestop rally] are also in crypto,” she said during a recent Blockworks […]

- During a recent Blockworks webinar Hester Peirce, an SEC Commissioner, was asked for her opinion on the GameStop Rally

- Peirce touched on some of the themes driving people to the markets, and said she sees similarities to retail investors’ interest in crypto

SEC Commissioner Hester Peirce thinks a sense of financial exclusion is driving people to cryptocurrency, and more recently, meme stocks like GameStop.

“Some of the same things in the [Gamestop rally] are also in crypto,” she said during a recent Blockworks webinar. “People are wanting to get involved, pushing back on our accredited investor rules that say there’s a certain set of investments that we are only going to let rich people have access to.”

Peirce has long been an advocate for expanding the definition of what is an accredited investor, which is effectively the ticket for participation in high-risk/high-reward private capital markets. Although the SEC has begun to expand this definition, announcing last August it would not solely be based on wealth, Peirce thinks that the regulator can do better.

Currently, the expanded definition now includes those that have experience at a financial institution or licenses like a Series 5/7 from FINRA. However, this only encompasses a small percentage of Americans: there are plenty of people with the knowledge and confidence to invest in startups. But even with this expanded definition, they still can’t.

“These newly minted accredited investors are not your typical mom and pop retail investors, a fact that should assuage the concerns of those that fear any expansion of the definition,” said Peirce in her dissenting statement, pointing out the new requirements which emphasized education, licenses, or work experience in finance are a step in the right direction but also exclusionary in their own right .

“It does not assuage my concerns. Why shouldn’t mom and pop retail investors be allowed to invest in private offerings? Why should I, as a regulator, decide what other Americans do with their money?”

As Gamestop’s stock crashed Tuesday, erasing $27 billion in value as it went from $140 to $90, Peirce said that there were likely a lot of people learning an expensive lesson about due diligence, cautioning people to not get involved during these exciting and volatile times if something doesn’t make sense. But, despite this, Peirce defended capital markets as a tried-and-true way to build wealth even if accredited investor rules may be imperfect.

As the WallStreetBets move on Gamestop fizzles away with the stock’s price returning to earth, she says the whole episode is an exercise in political rage — and there are parallels to crypto.

“People are weighing in via crypto and equity markets in response to what the government is doing,” she said. “They are seeing some policies that they may not think are so wise. And they are reacting, and getting involved in markets to express their opinion.”