Singaporean ZebPay Creates First Female-Led DAO

In simple terms, decentralized autonomous organizations (DAOs) are governing technologies that allow people to coordinate and self-govern on a secure blockchain network, the company said.

Kajal Dalai (left) and Maria Shaikh; Blockworks exclusive art by Axel Rangel

- ZebPay is using distributed ledger technology (DLT) to enable traditionally marginalized, vulnerable, and disenfranchised communities and help them participate in the global economy and attain financial security, said Maria Shaikh, co-founder of ZebPay’s DAO.

- The average daily traded volume across the top four Indian cryptocurrency exchanges, ZebPay, WazirX, CoinDCX and BitBNS, was about $22.4 million in mid-December 2020, up 398% from about $4.5 million in March 2020, according to data from CoinGecko.

India’s digital assets industry has been going through a heavy transition period since cryptocurrency trading was officially re-legalized in the country in March of 2020, and ZebPay, one of the country’s most popular crypto trading platforms, is hoping to level the gender playing field by creating the world’s first female-led decentralized autonomous organization (DAO) in India.

Founded in 2014, ZebPay, has over 3 million users globally and $2 billion in fiat transactions on its platform, the Singapore-based company said.

What’s a DAO?

In simple terms, DAOs are governing technologies that allow people to coordinate and self-govern on a secure blockchain network, the company said. A DAO dilutes centralized control of organizations and distributes governance power to its people by using majority voting rules on platforms.

After relaunching in India during March 2020, ZebPay’s DAO hopes to give underrepresented women in blockchain a voice, while increasing their role in decision making and visibility in the technology industry, said Maria Shaikh, data scientist and co-founder of ZebPay’s DAO, who is based in Mumbai, India.

“It’s both a proof of concept for a blockchain program and an experiential process in the issue of gender inequality,” Shaikh said.

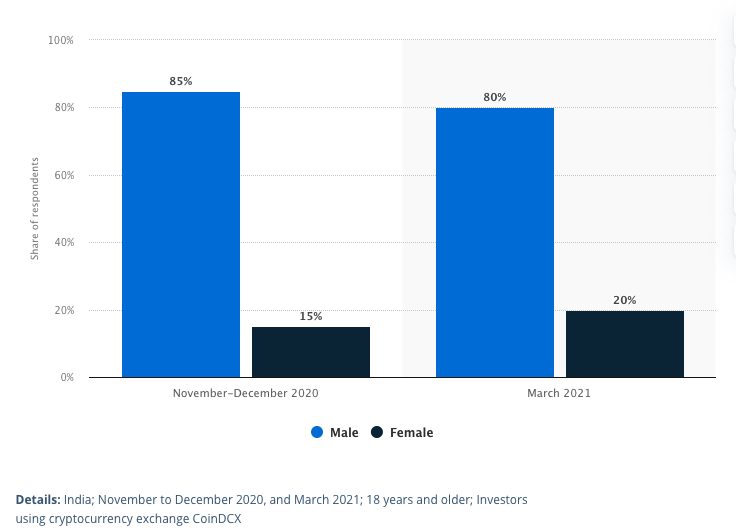

From November 2020 to March, the number of women in India that own a cryptocurrency on CoinDCX exchange increased from 15% to 20% while the male ownership went from 85% to 80%, according to a Statista study.

The number of men vs. women in India that own a cryptocurrency on CoinDCX; Source: Statistica

The number of men vs. women in India that own a cryptocurrency on CoinDCX; Source: Statistica

This means about 1 in 5 customers on the platform are female but ZebPay’s organization hopes to reduce the male-to-female crypto investor ratio significantly and give Indian women greater visibility in the technology industry, Shaikh said.

“Although we’ve seen a steady rise in female investors entering the crypto market…the number of women remains far lower than their male counterparts,” Shaikh said.

‘Just the beginning’

While there are many companies that help organizations create DAOs on its platforms, like Ethereum’s model or dxDAO, having the first female-led DAO is “just the beginning,” for the future of the technology and the blockchain revolution, said Kajal Dalai, full stack developer and co-founder of ZebPay’s DAO, who is also based in Mumbai, India.

“Non-fungible tokens have very quickly reached wild popularity, we believe the next phase will be DAOs,” Dalai said.

ZebPay uses Aragon, a platform for building and running DAOs, which has created over 1,700 DAOs and has about $900 million assets under management.

The company also uses distributed ledger technology (DLT) to enable traditionally marginalized, vulnerable, and disenfranchised communities and help them participate in the global economy and attain financial security, Shaikh said.

As more people realize the massive potential of blockchain and the focused empowerment of the individual that it brings, the industry will continue to see the space reach new heights, said Dalai. Cryptocurrencies combine the elements of finance, law and technology, but DAO’s go further by adding human organizations to the list, Dalai said.

The team at ZebPay’s DAO

The team at ZebPay’s DAO

Right now, Indian millennials have recognized the generational opportunities that come with crypto and as a result, Indian crypto exchanges have seen exponential month-on-month growth in trading volume, Shaikh said.

The average daily traded volume across the top four Indian cryptocurrency exchanges, ZebPay, WazirX, CoinDCX and BitBNS, was about $22.4 million in mid-December 2020, up 398% from about $4.5 million in March 2020, according to data from CoinGecko.

Although cryptocurrency in India is deemed completely legal, people will realize that adopting cryptocurrencies can mean more than just a quick buck and it can liberate people with cutting-edge technology, Shaikh said.

There needs to be equity through representation and bringing cryptocurrency to those who are likely to benefit the most, like women or rural Indians without bank accounts, who are historically underrepresented in technology and crypto fields, Shaikh said.

“We are not aiming to remove men entirely from the process, but provide a platform where women hold the governance keys,” Dalai said. While the future is promising, there is still work to be done, she said.