Small cap summer: This bull market’s final form

Plus, what we’re learning from the latest raft of 13F filings

Arsenii Palivoda/Shutterstock modified by Blockworks

Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Small cap kings

Small cap summer may end up being this bull market’s final form.

Think of it like the internal waves churning thousands of feet deep beneath the ocean — ones that finally summon a real altcoin season.

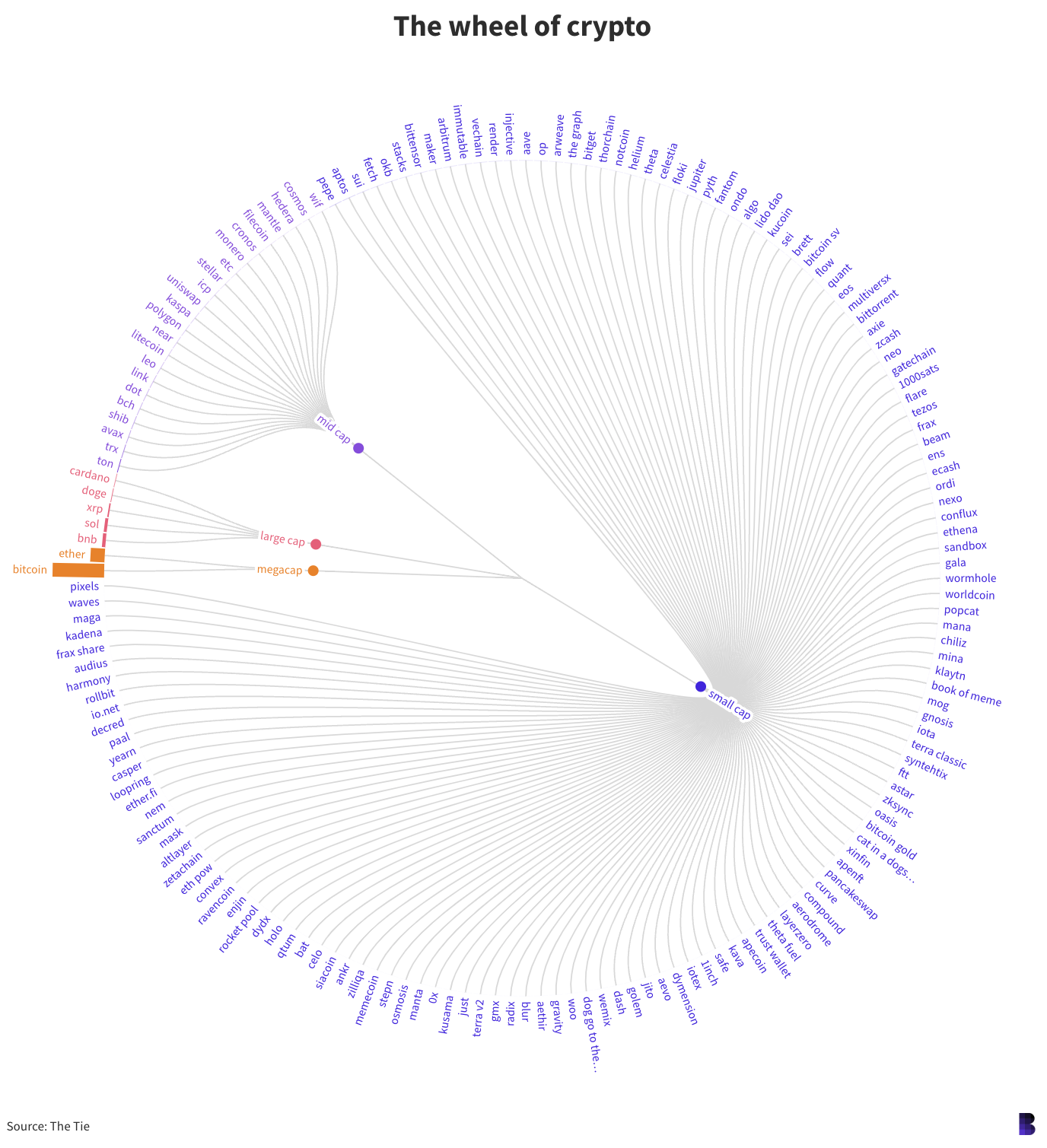

I spent the morning sorting the crypto market into different categories: mega-cap, large-cap, mid-cap and small-cap, based on the established stock market definitions:

- Mega-caps are worth $200 billion or more

- Large-caps between $10 billion and $200 billion

- Mid-caps between $2 billion and $10 billion

- Small-caps between $250 million and $2 billion

Riffing on those benchmarks, mostly to account for crypto’s volatility, tokens were placed in their respective buckets if they spent more than 50% of their trading days over the past three years above those benchmarks.

Stacks, for instance, only traded in the mid-cap range for 31% of its trading days since August 2021, so it was sorted alongside the other small caps.

There are currently over 50 megacap stocks but only two cryptocurrencies: bitcoin and ether. Crypto also only has five large-cap assets — bnb, solana, xrp, dogecoin and cardano — and around two dozen mid-caps including polygon, filecoin, cronos, monero and chainlink.

143 tokens otherwise represent small-caps. Coins such as pyth, dydx, worldcoin, blur, ondo, helium, celestia and bittensor.

Small cap summer has a sizable army in waiting.

Small cap summer has a sizable army in waiting.

Small-caps all spent most of the past three years (or however long they’ve been on the market) trading at a capitalization between $250 million and $2 billion. They may have spent weeks or even months above the $2 billion mark, but not long enough to transcend categories.

But when does small cap summer start? Just like how there’s no real definition of what makes an altcoin season (see my previous attempts here and here), what makes a small cap summer is really up to us.

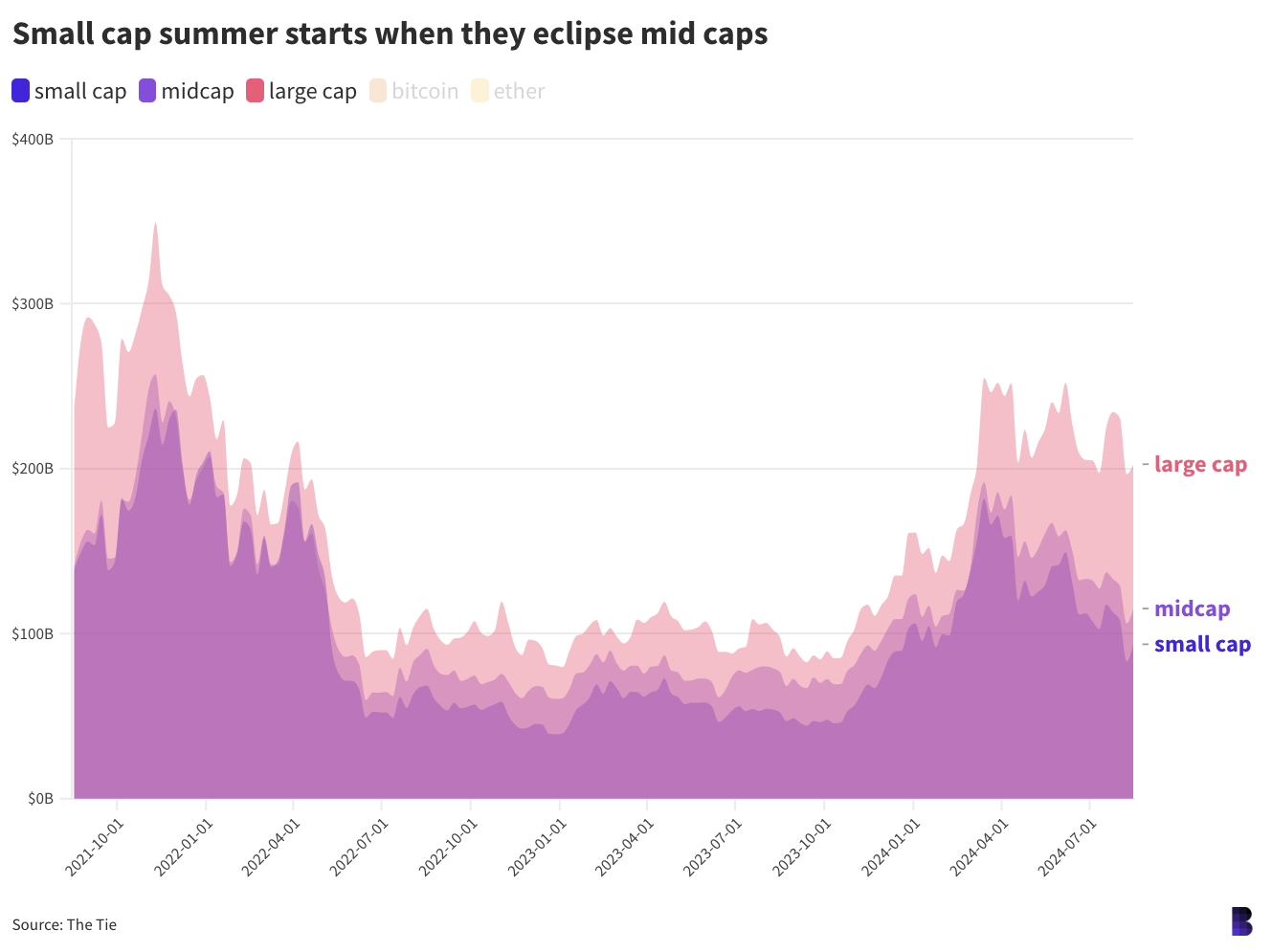

In my case, I’d probably say that small cap summer starts when, as a cohort, small cap tokens are altogether worth more than mid-caps.

That unfortunately hasn’t happened since April 2022.

But we are closer now than we were this time last year — small caps are altogether worth $93.6 billion to $115.2 billion for midcaps, a difference of only 19% compared to over 30% in August 2023.

Mid-caps and small-caps are losing ground against large-caps over the year to date.

Mid-caps and small-caps are losing ground against large-caps over the year to date.

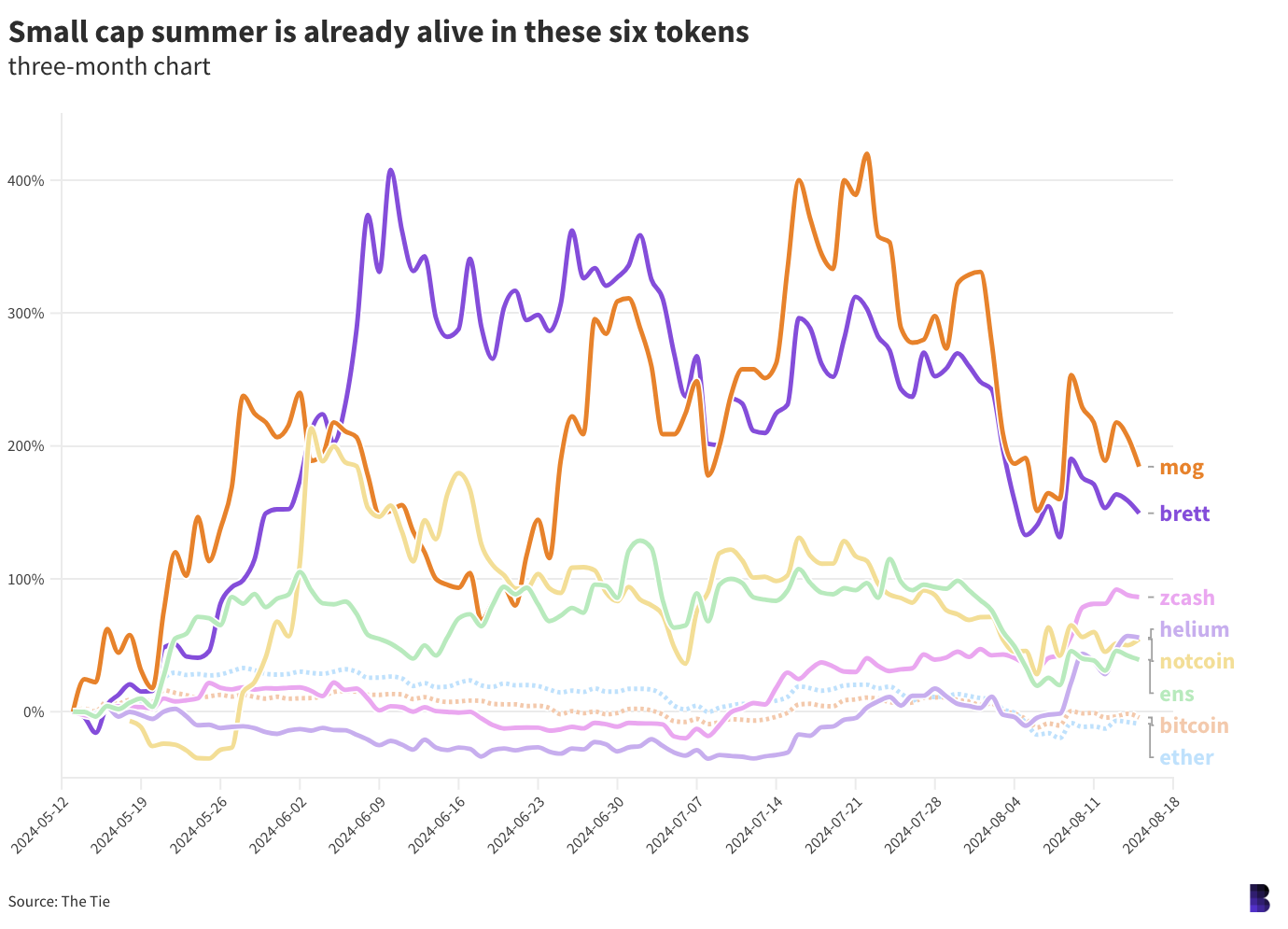

There is hope. An overwhelming majority of small caps may have lost significant value over the past three months — but six in particular are keeping the dream alive.

Memecoins mog, brett and not have all outperformed bitcoin and ether since May, and so has zcash, helium and ens.

In the memecoins’ case, they’ve all done multiples while bitcoin and ether are slightly underwater across the same period.

All small-cap summer needs is another batch of tokens to rally this hard.

All small-cap summer needs is another batch of tokens to rally this hard.

That only six out of 143 have shown real strength amid a bitcoin correction may however sound grim (it’s a strike rate of about 4%).

But if you’re looking for green shoots to mark the start of small cap summer, these could be it.

— David Canellis

Data Center

- BTC and ETH continue to be range-bound, both down 4% to give up yesterday’s gains (BTC: $58,800; ETH: $2,650).

- HNT and TON, alongside memecoins NOT, WIF and BRETT, have slid the most on the front page, losing between 10% and 6.5%.

- The Ethereum validator queue has picked up again, with 1,403 in waiting right now. The exit queue is empty.

- $141.3 million in liquidations on CEXs over the past 24 hours — over 80% coming from longs.

- Weekly DEX volumes have dropped 43%, per DeFiLlama, currently $35 billion in the past seven days.

Back on top

13F szn is back, y’all.

If you’ve been with us for a while, then you know what a 13F filing is (and perhaps you already know just because you’re smart).

A 13F is basically a quarterly disclosure filing that gives us some insight into what firms with over $100 million in assets under management, like the big banks, held last quarter.

I’m not always a fan of digging into them, because like the VC data from yesterday, sometimes it can seem outdated since we’re looking back instead of forward. But it’s fair to say that it can allow us to read the tea leaves and better understand where we’re at.

Now before we dive in, I want to set expectations: These are only the holdings as of June 30, which means it’s all bitcoin and no ether ETFs, which launched in July.

All to say that closely monitoring 13F disclosures, as it stands, shows which firms have jumped into bitcoin ETFs and what changes have taken place since the previously disclosed ETF holders from Q1.

So far, we’ve seen bigwigs like Goldman Sachs disclose roughly $400 million of various bitcoin ETFs at the end of Q2, and Morgan Stanley’s filing last night revealed a hefty position of BlackRock’s bitcoin ETF (5.5 million shares, worth roughly $187 million at time of filing), making it one of the top holders of IBIT.

From Morgan Stanley’s 13F filing

From Morgan Stanley’s 13F filing

Goldman Sachs, to put that in perspective, disclosed roughly 6.9 million shares (worth roughly $238 million at the end of the quarter) of IBIT.

From Goldman Sachs’ 13F filing

From Goldman Sachs’ 13F filing

MacroScope (shout out for being so on top of these filings, which isn’t an easy thing to do) rightfully pointed out that the Morgan Stanley disclosure shows that the shares were allocated to the Investment Management arm.

Perhaps Morgan Stanley’s sudden interest is due to its changing approach to the ETFs, as previously noted by my colleague Ben Strack. Again, I have to preface that the holdings are nearly two months old now and things could have changed, but the timing lines up with Morgan Stanley later opening the door for some clients to invest in the ETFs (specifically BlackRock’s IBIT, though they can also offer Fidelity’s fund) post-13F due date.

Last time we talked about these filings, one of the biggest stories was that Wisconsin had disclosed holdings in both BlackRock and Grayscale ETFs. In a filing yesterday, we got another glimpse at its holdings.

Wisconsin still has a decent amount of IBIT, and it even added to its position. The state, as of the end of June, held 2.8 million shares of IBIT (up from 2.4 million last quarter). However, it sold out of its position in Grayscale, which means sometime between the two disclosure periods it offloaded over a million shares in GBTC, or about $47 million at current prices.

Bitwise Invest’s Ryan Rasmussen noted that there was a 30% increase in the number of institutional bitcoin ETF holders since the first quarter. And we did see a number of firms — 44% — boost their stacks as well, though I only really highlighted some of the biggest disclosures so far.

Out of all of the firms that disclosed their holdings, hedge funds have stayed on top as the biggest institutional players.

Let’s be real though: I’m more impatient to get a look at who’s holding the ETH ETFs, which we can see in just a few months. The countdown starts now.

— Katherine Ross

The Works

- Binance wrapped up its registration with India just months after it was fined.

- Senate Majority Leader Chuck Schumer, at a Crypto4Harris event, said he wants to pass “sensible” crypto legislation.

- The head of digital asset management at Fidelity told The Block that the firm is looking into tokenization.

- Bitcoin miner Marathon bought $249 million worth of bitcoin after closing its $300 million senior notes offering, the firm said.

- Eric Trump told the New York Post that the crypto initiative he teased on X is “digital real estate.”

The Riff

Q: Binance executive Tigran Gambaryan has now been held in Nigerian custody for nearly 6 months. Why is he still there?

This story is a tough one, but it’s one I continue to follow closely.

Gambaryan was detained by the Nigerian government back in February after flying in from his home in the US to have meetings with officials about accusations that his company, Binance, was facing.

He’s now being held in Kuje prison and doesn’t have a court date until October 11. And his health is not in great condition, according to a family representative.

Gambaryan, per a family representative, is “mostly bedridden.”

So those are the facts as they currently stand. It’s important to note that Gambaryan — even though he’s facing a trial — is being used, basically, as a scapegoat for Binance. The Nigerian government’s claims and issues are aimed at the exchange, which exited the country earlier this year.

Two US lawmakers introduced a resolution to demand the release of Gambaryan last month, but there haven’t seemed to be any updates since then.

Hopefully Gambaryan can come home before that October hearing. He’s already had tax violation charges dismissed.

— Katherine Ross

The whole thing is bureaucracy at its most malignant.

Nigeria’s government was hellbent on proving that Binance had accelerated the collapse of its local currency, the naira.

On the surface it almost made sense: While the naira was spiraling 40% to become the worst performing global currency in the first half of 2024, Binance had effectively given its citizens a fiat offramp, where they could dump the naira for bitcoin, stablecoins and a mess of other tokens.

At the same time, crypto exchanges had become so popular that local forex traders had reportedly begun to use the Binance rate for naira, rather than official government figures.

If naira on sellers tanked prices day-to-day, then it’s easy to see how the platform would make an easy scapegoat. But Binance itself never set the rate — that was naira holders themselves.

What’s happening to Gambaryan and Binance is likely to happen elsewhere. And if crypto continues its current long-term trajectory, it seems inevitable that the existence of a crypto on-ramp could actually accelerate the collapse of smaller sovereign currencies racked by hyperinflation and devaluation.

But it’s not right for governments to blame exchange executives, or even crypto itself, for that situation. For Gambaryan, all we can do is hope that Nigeria could be convinced of that, very quickly.

— David Canellis

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.