Solana vs. Base: How Ethereum’s most active L2 compares against Solana

Base lags behind Solana, but it’s a mixed picture

Sky_light1000/Shutterstock and Adobe modified by Blockworks

This is a segment from the Lightspeed newsletter. To read full editions, subscribe.

Crypto Twitter loves its “Ethereum vs. Solana” debates.

But that framing is problematic.

Solana is built as a high-throughput execution layer. Ethereum, by design, offloads execution to L2 rollups and positions its L1 for settlement and data availability.

As such, the Ethereum vs. Solana comparison may amount to comparing apples to oranges.

This is explicitly acknowledged by leading developers on both chains. Solana’s co-founder Anatoly has said that “Solana isn’t at war with Ethereum” but with “centralized sequencer L2s.”

Ethereum researcher Justin Drake himself has echoed this in the past: “In my mental model, it’s the L2s that are competing with Solana, not the Ethereum L1 directly.”

If the real battleground is execution, then the more appropriate matchup may be Solana vs. Base, Ethereum’s most active L2 backed by the full weight of Coinbase distribution.

Let’s look at how both these chains compare on headline network metrics.

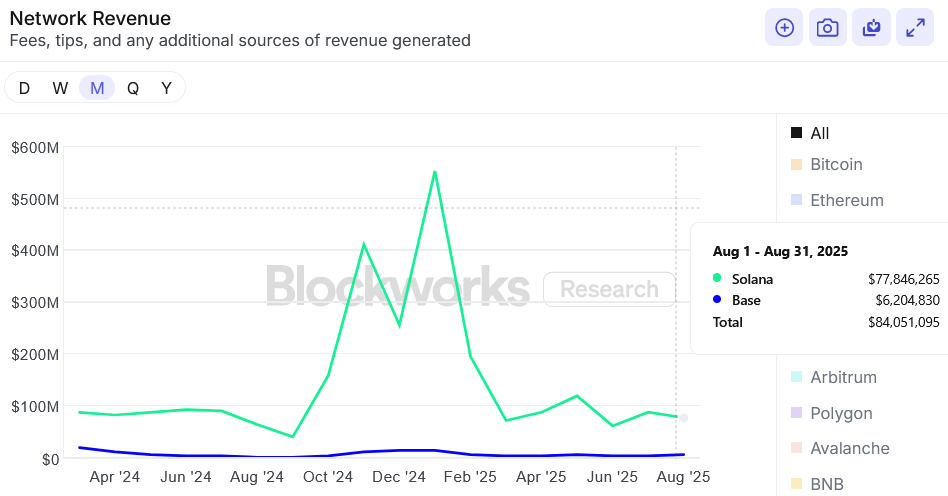

Network usage

In August, Solana’s REV (all fees and tips paid to transact on the network) was $77.8 million, far exceeding Base at $6.2 million.

Source: Blockworks Research

Source: Blockworks Research

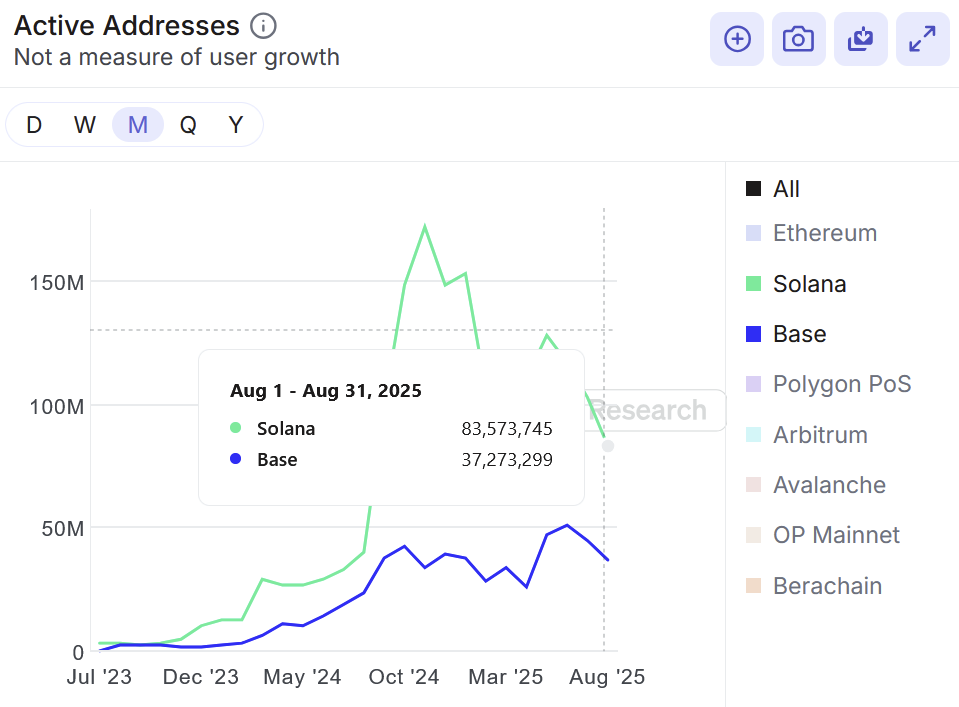

Active addresses on Solana too, outpaced Base by 124% in August.

Source: Blockworks Research

Source: Blockworks Research

Application revenues

One measure of how successful a blockchain is looks at the value captured by apps built on top of it.

On this measure, Solana too beats Base by a mile. Solana app revenues generated $136 million in August, vs. $21 million for Base.

Source: Blockworks Research

Source: Blockworks Research

Source: Blockworks Research

Source: Blockworks Research

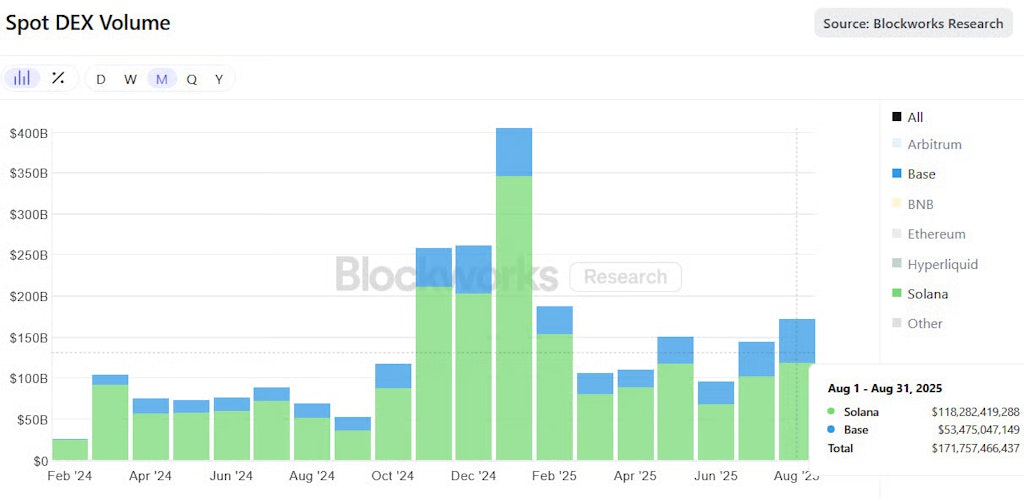

Spot DEX volumes

How much are users trading on Solana and Base? On spot DEX volumes, Solana has consistently outperformed Base. In August, Solana had about $118 billion in volumes, against $53 billion for Base.

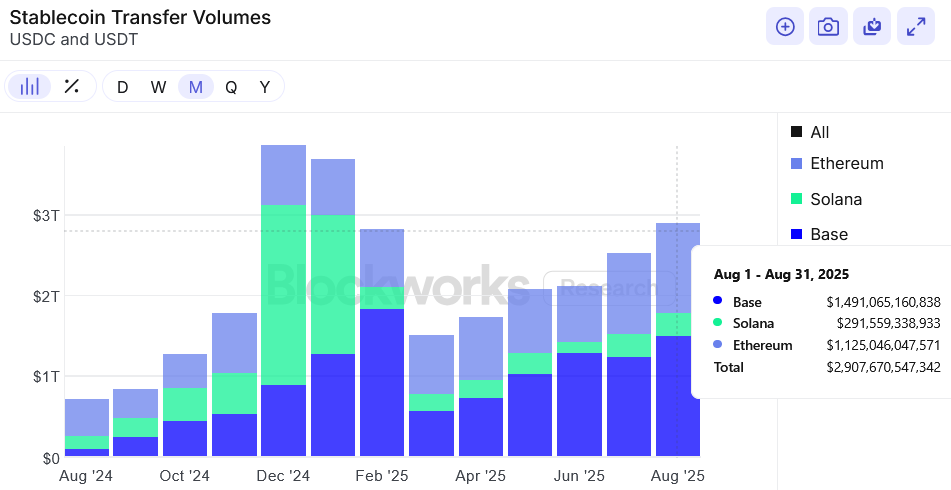

Stablecoins

The below charts compare Base and Solana’s stablecoin supply. Base has $4.3 billion, considerably lower than Solana’s stablecoin supply of $11.2 billion.

Source: Blockworks Research

Source: Blockworks Research

Despite lower supply, though, Base sees a higher velocity of stablecoin transfer volumes. Transfer volumes in August were $1.5 trillion, compared to Solana’s $292 billion.

Source: Blockworks Research

Source: Blockworks Research

While Solana outcompetes L2s in most metrics, the one area where Solana pales in comparison is circulating stablecoins, especially relative to Ethereum ($167 billion), Blockworks Research’s Carlos Gonzalez Campo told me.

Memecoin wars

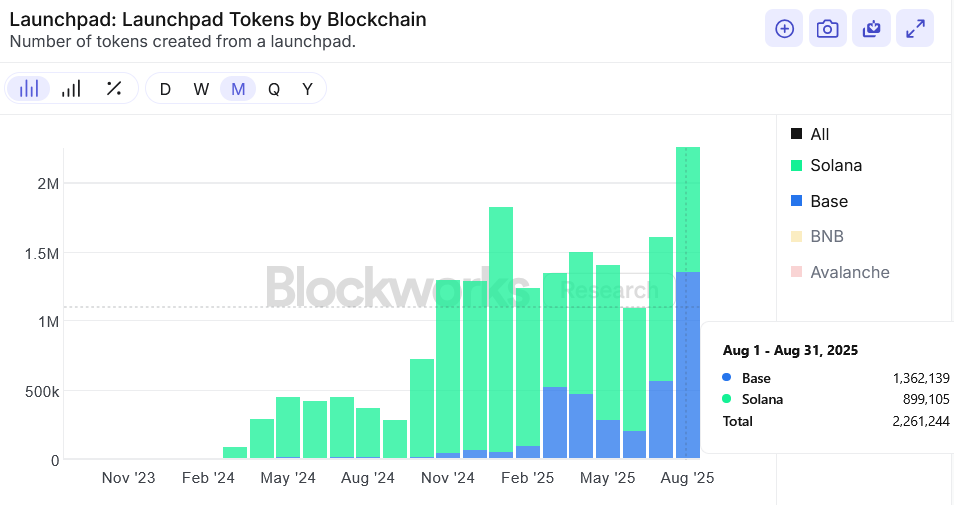

Solana’s top spot as the “memecoin chain” saw its first serious challenge last month. Tokens launched from memecoin launchpads on Base exceeded Solana, largely due to the rise of Zora.

Source: Blockworks Research

Source: Blockworks Research

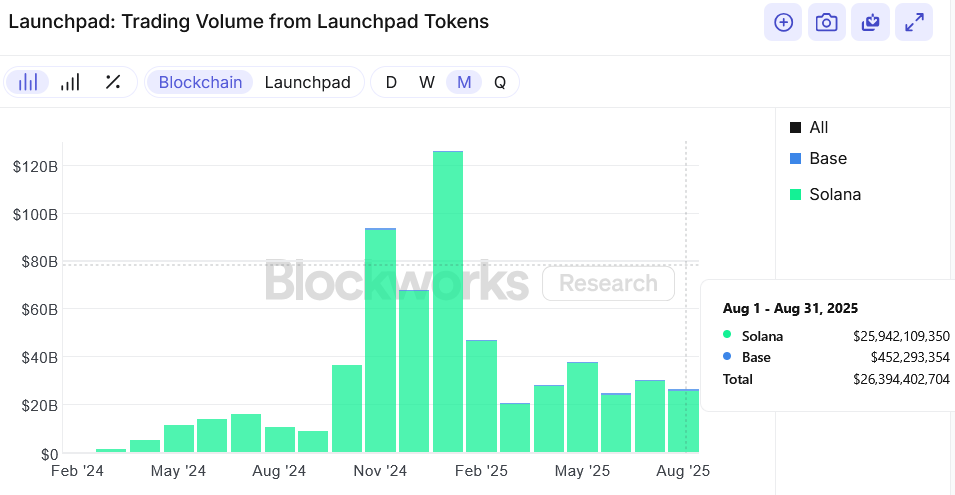

It’s too early to write Solana off, though. Launchpad tokens on Solana still command far higher trading volumes (and market caps) than their Base counterparts, a crucial data point since transaction activity is a key revenue stream for blockchains.

Source: Blockworks Research

Source: Blockworks Research

Base’s recent lead in new token launches over Solana indicates increased developer interest — likely aided by its Coinbase integration, Blockworks Research’s Dan Shapiro told me.

“However, Solana remains the revenue juggernaut, pulling in consistently higher network fees and boasting a significantly larger active user base.”

Conclusion

Aside from stablecoin transfer volumes and memecoins launched, Solana outcompetes Base on most headline chain metrics.

Solana is still the frontrunner, but there are a few caveats worth noting.

First, this comparison isolates Solana against a single L2. Yet, Ethereum’s broader rollup ecosystem has at least a hundred L2s. Put together, they may exceed Solana in aggregate throughput.

Second, benchmarking stablecoin supply and DEX volumes against Base alone doesn’t show the full picture. Ethereum itself posts larger figures than Solana on these measures, and remains an economic hub for the EVM ecosystem in its own right.

Finally, Ethereum’s chain security and decentralization remain unmatched. Compared to Solana, Ethereum’s validator set is vastly larger, has lower barriers to entry and greater client diversity. From that perspective, one could argue that Base inherits stronger security because it settles on a more decentralized foundation.

The contest over “which chain is better” ultimately depends on the weight given to different metrics, making the comparison less an objective truth and more a matter of subjective perspective.

Updated 9/12/25 at 3:30 p.m. ET with the correct chart for DEX volumes.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.