Switzerland-based Index Provider Offers DeFi Exposure

Compass Financial Technologies’ index will offer exposure to 10 DeFi tokens

Blockworks exclusive art by axel rangel

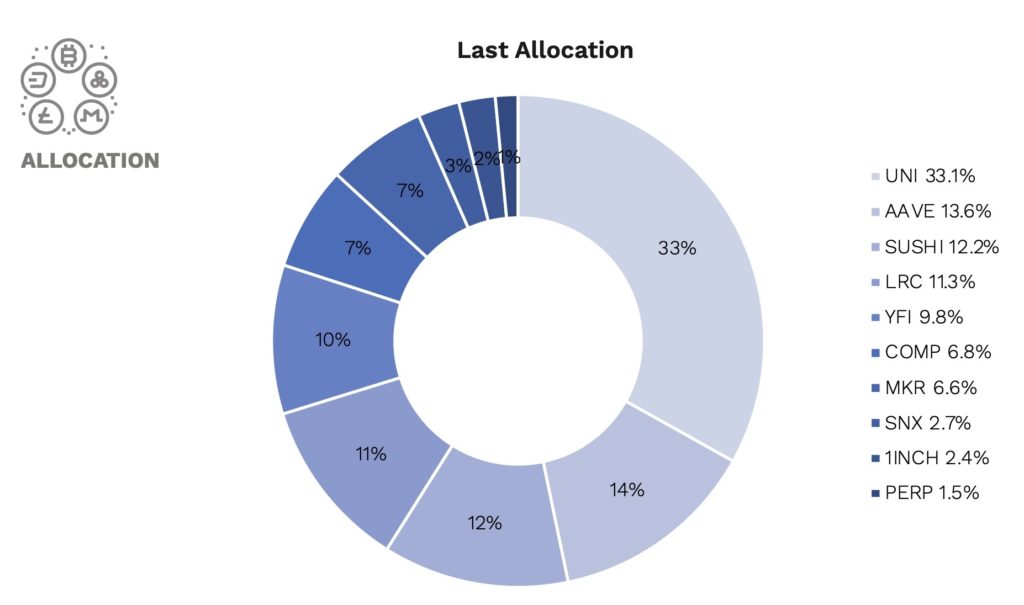

- Uniswap (UNI) makes up a third of the index, while Aave (AAVE), SushiSwap (SUSHI) and Loopring (LRC) each exceed 10%

- Compass Financial Technologies plans to launch thematic, volatility, options-based and multi-asset indices in 2022

A Swiss index provider has launched an index offering exposure to 10 DeFi tokens as crypto investment vehicles continue to proliferate.

Compass Financial Technologies’ indices have about $5 billion of assets and are tracked by ETPs across Europe.

Appetite for digital asset exposure through institutional-quality solutions is growing significantly, CEO Guillaume Le Fur told Blockworks.

“We have clearly identified the DeFi [theme] as one of the fastest growing sectors in the crypto industry, and the index is designed to offer broad and dynamic exposure to this sector,” Le Fur said.

The index is the first such institutional product that determines weightings by tracking token liquidity and revenue produced by DeFi (decentralized finance) protocols via on-chain data, according to the firm.

The largest allocation is to Uniswap (UNI), with a weighting of roughly 33%. Aave (AAVE), SushiSwap (SUSHI) and Loopring (LRC) each exceed 10%.

Compass Financial Technologies’ DeFi index allocation

Compass Financial Technologies’ DeFi index allocationThe index can be used under a license agreement by issuers in any country, subject to local regulations. It is compliant with EU Benchmarks Regulation and is live on Bloomberg, as well as Refinitiv.

The launch comes as crypto offerings continue to multiply in Europe.

Compass partnered with CoinShares in June 2020 to create the CoinShares Gold and Cryptoassets Index (CGCI) — the first EU Benchmarks Regulation-compliant index that combines crypto and gold.

CoinShares more recently launched two crypto ETPs (exchange-traded products) designed to share staking rewards with investors. WisdomTree and 21Shares have continued bringing crypto ETPs to the European market, with the latter planning to support what it considers the top 50 cryptocurrencies by the end of the year.

“2022 should be an important year for us in terms of index offerings, with new thematic basket indices, volatility, options-based indices and multi-asset indices,” Le Fur said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.