What does a Trump takeover of the Fed look like?

With Governor Cook being dismissed and talk of pressuring the 2026 nominations of regional presidents, markets are beginning to price in a risk premium

Donald Trump | Joey Sussman/Shutterstock modified by Blockworks

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

To the keen observer, there are many crosscurrents hitting the Federal Reserve right now — and those currents are beginning to erode Fed independence.

The idea of a Fed independent from political influence has ebbed and flowed over the years.

During World War II, the Fed was entirely subservient to the Treasury and was not independent by any means. It existed mostly to fund the war and ensure Treasurys were well bid.

In 1951, the Fed Treasury accords formally established the Fed as independent from the Treasury and, therefore, the executive branch.

In the 1970s, Chair Paul Volcker solidified this independence by hiking rates to tame inflation despite pressure from the president at the time. Someone even showed up to the Federal Reserve building with a loaded gun to try and stop them from raising rates.

In the 40 years since, we’ve seen a steady, secular downshift in interest rates and peacetime for the Fed.

Now, that era is changing. President Trump, referring to his own nominees on the Fed’s board of governors, said Tuesday: “We’ll have a majority very shortly.”

The idea of viewing the composition of the FOMC as one party’s majority vs. the other is new.

Historically, governor appointments were seen as apolitical, although bias still naturally trickled in through the lens of academic perspectives on monetary policy leading more left or right, depending on their background.

With the attempted firing of Governor Cook — (setting aside how valid it was, that’s for the court to decide tomorrow) — it now opens the door to Trump being able to get a majority among Fed governors as well as a heavier hand in deciding which regional Fed presidents are elected. For a better explanation of these dynamics, check out Quinn’s explanation in last week’s roundup:

So, where does that shift bring us and how can we quantify this emerging tail risk?

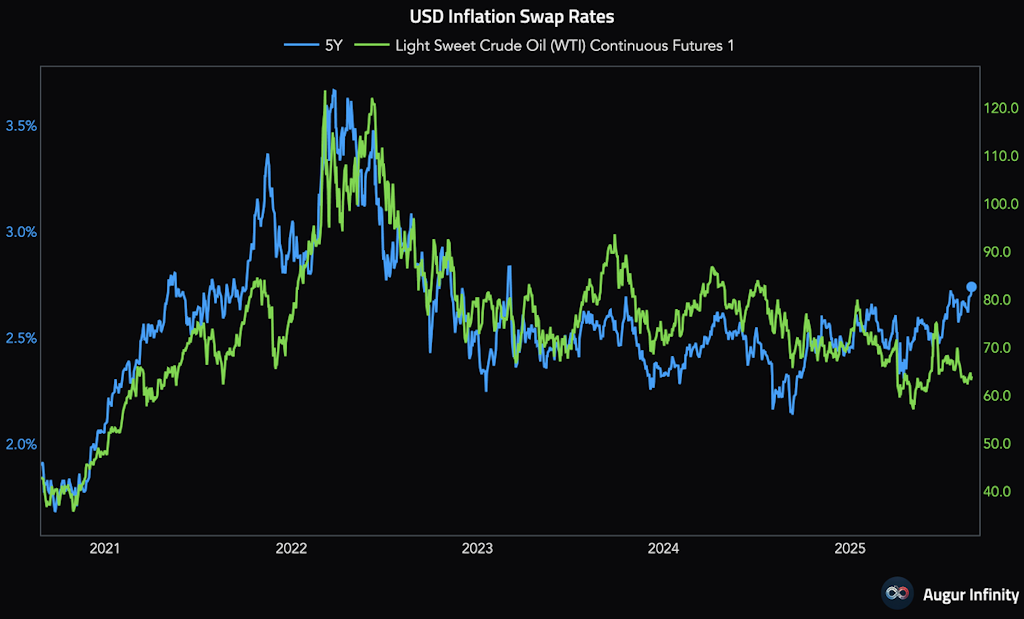

One method I’ve found helpful is the chart below, which contrasts five-year inflation swaps with the price of oil. Oil is one of the primary contributors to expectations of inflation on a medium-term basis, since it’s a large driver of headline inflation. It’s also a key input cost into nearly everything that is consumed.

Typically, when the price of oil rises, inflation expectations also rise.

What’s interesting about 2025, however, is we are seeing five-year inflation swaps grinding higher while oil does the opposite.

My read is that the market is beginning to price in a new risk premium associated with tail risks around the Fed. Specifically, the Fed losing control of prices and inflation expectations becoming unanchored due to the erosion of independence.

Whether this risk premium is warranted or not is a story for another day. Regardless, it’s evident that the market is beginning to worry about this dynamic.

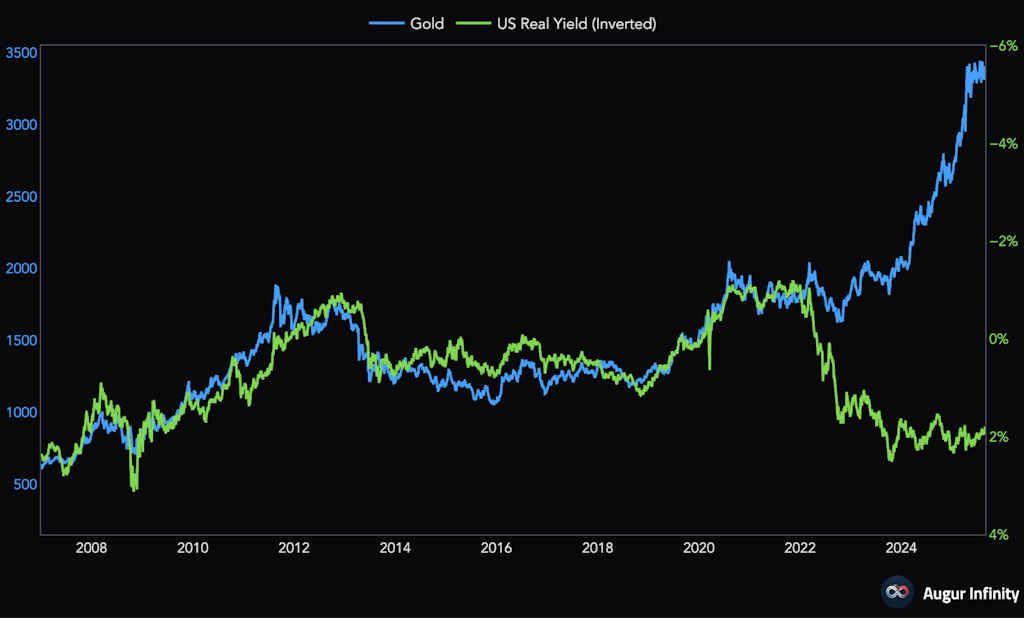

When long-held correlations like this diverge, they can be explosive. The last one was in 2022, when we saw gold meaningfully decouple from its long-held inverse correlation with real yields.

That divergence is only increasing as the market digests new variables, like concern for fiat currency stability.

Keep an eye out for these correlations over the next 12 months — I think it’s going to become very important to do so.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.