Tyler Winklevoss: Don’t Wait On Government to Fix Inflation

Most people don’t know what money is, but the politicians, central bankers and economists making the decisions that affect most people definitely don’t – at least not well enough, according to Tyler Winklevoss. That’s probably been the case for a long […]

TYLER WINKLEVOSS

- Politicians locally and globally are creating moral hazards by avoiding learning about what money really is and how it affects people in the long term, says Tyler Winklevoss

- Institutional investors are currently stepping up in their approach to digital assets, which could help get the ball rolling with industry peers and politicians

Most people don’t know what money is, but the politicians, central bankers and economists making the decisions that affect most people definitely don’t – at least not well enough, according to Tyler Winklevoss.

That’s probably been the case for a long time. But for the first time in a long time, the U.S. is facing extreme levels of inflation pressure as part of the Covid-19 pandemic fallout. If they haven’t already, now is the time for leaders to do the hard work of educating themselves about what money is and what it means, Winklevoss told Blockworks.

“I have very little faith that our leaders really understand how money works, what the long term consequences are, and frankly, whether or not they they ultimately care,” he said.

Winklevoss is the cofounder and CEO of Gemini, a digital assets exchange and custodian that provides a suite of products for institutional and retail investors across all levels of familiarity with digital assets.

“They understand enough of what to do to get elected over the next year four years,” he added. “I’m seeing politicians making bargains to stay in power or control, and the convenient decisions that keep them in their seat — not making the hard decisions that are the right decisions. It’s disheartening.”

Winklevoss, for whom New York City is “usually home base,” specifically pointed to New York’s restaurants, which are hurting from a government-mandated shutdown of indoor dining, even at reduced capacity, in order to lower the number of Covid-19 cases. (Data shows 74 percent of the state’s Covid spread comes from household gatherings, whereas 1.4 percent comes from restaurants and bars.)

“What I’m seeing locally, in terms our leaders understanding what our businesses need and actually caring about them, is either gross incompetence or something worse,” Winklevoss said. “Money is like language, it’s something that the average person uses everyday but very few of us stop and ask what it is or what the nature of it is.”

“Even internationally,” he added.

Last week the president of the European Central Bank, Christine Lagarde, blasted bitcoin, saying it “conducted some funny business” and some “interesting and totally reprehensible money-laundering activity.” This week Janet Yellen, President Biden’s pick to lead the Treasury Department, said in her confirmation hearing that cryptocurrencies are “a particular concern” for illicit financing.

Most people that have studied digital assets even a little bit tend to argue that any illicit activity that can be powered by bitcoin has been powered by fiat currencies. In September, BuzzFeed published a bombshell report (known as the FinCEN Files) that banks processed $2 trillion in transactions they suspected were tied to terrorists, drug dealers, corrupt foreign officials and other bad actors between 1999 and 2017, based on 2,100 suspicious activity reports filed by the banks to government regulators.

“They either haven’t done the work and they’re totally uninformed, or they have and they’re misleading people because it’s bad for their business, for their control of their power seat and what they want to do as a policy – not necessarily what’s in the best interest of the people,” Winklevoss said of central bankers and economists.

Education has always been the biggest barrier to adoption of bitcoin. The industry is so young that for most of its life, the only way for people to learn about it was to teach themselves about it using any publicly available information they could find. Even today, real authorities on the subject are pretty few and pretty niche. The computer scientist Nick Szabo, Blockchange Ventures general partner Ken Seiff and Hashcash inventor Adam Back are among those Winklevoss said he’s learned the most from about bitcoin.

Easy money, hard money

Winklevoss began buying bitcoin in 2012. In August he and his brother Cameron, who also runs Gemini as co-founder and president, published their thesis that bitcoin will surpass gold as a store of value and that the price will ultimately skyrocket to $500,000 within the next decade. Inflation, potentially hyperinflation, is upon us, he said – and the only way to combat it is with hard money and sound money.

“Bitcoin is the hardest money in the galaxy,” he said.

Hard money is determined by how difficult it is to produce it and increase its supply. Easy money is money whose supply is amenable to large increases.

“It’s not like there’s a strong political lobby or party in the U.S. advocating for more sound money” – money that isn’t prone to sudden appreciation or depreciation in purchasing power over the long term – “or running a tighter budget,” he said.

Winklevoss has been talking to “moderate folks who work in finance” over the last nine to 12 months. “They don’t see this ending well for the dollar,” he said.

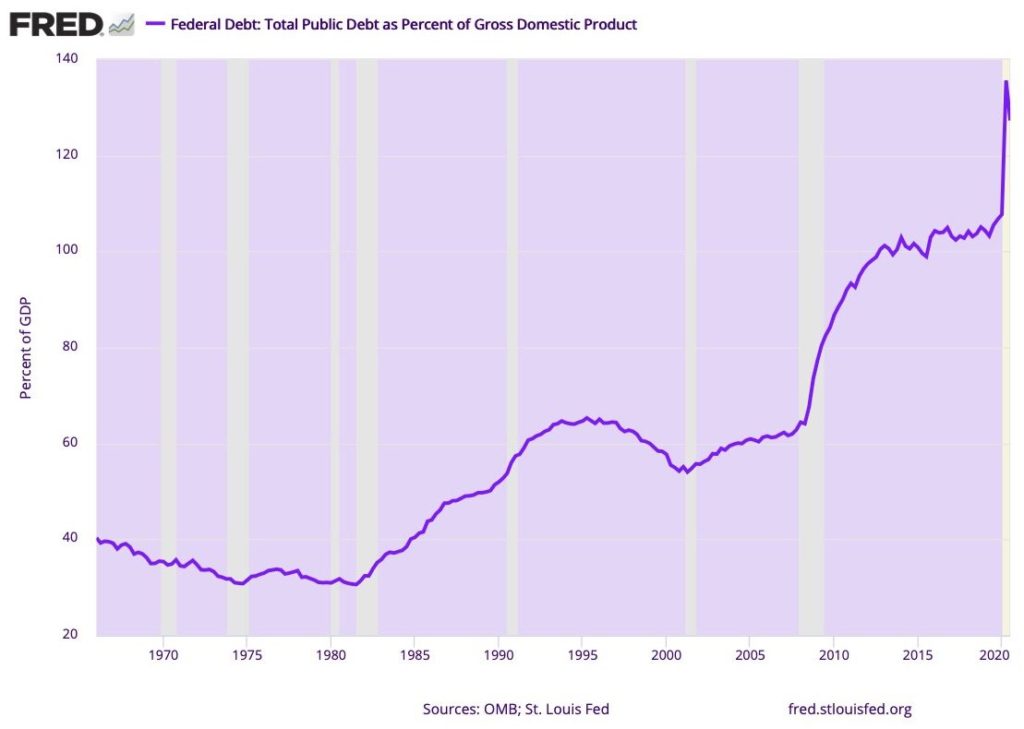

The U.S. debt to GDP ratio is about 127 percent as of late December, according to the St. Louis Fed. That’s the highest it’s ever been since just after World War II, when it was 118 percent. Then, the U.S. had record employment, as opposed to record unemployment, Winklevoss said, and because of the war effort it also had record production.

“We’re definitely not in record production mode right now, it’s the opposite,” Winklevoss said. “So I look at the numbers and, and I get worried.”

Last year, after one of the major stock market plunges, Gemini began receiving calls from people they previous spoke with, who “got close to taking the plunge” into digital assets in 2017 (the year of the last bitcoin bull run), but ultimately didn’t. Those people are having another look at their strategy now.

“People are worried about the ballooning debt burdens of the U.S. They’re worried about our ability long term to service our debt. No one really understands how we get off this path, if this train is going to ever slow down, if we’re going to become fiscally responsible about the budget.”

A different animal

Relying on government to find a better way is “a recipe for disaster,” Winklevoss said.

“It’s really dangerous to wait around for the grand Pooh Bahs to do the work and get with the program, to get the big picture. People can go and take their state into their own hands now by just opting out. Go into crypto,” he said.

But bitcoin and other digital assets are still risky business and for so many, approval by regulators and brand name institutions are an important factor when deciding to “go into crypto.” Institutional investors are coming around though.

In the last year billionaire investors Paul Tudor Jones, Stanley Druckenmiller and Bill Miller have come out as bitcoin bulls; S&P Dow Jones Indices revealed plans to launch cryptocurrency indexing services in 2021 for more than 550 of the top traded coins; BlackRock added bitcoin futures to the derivatives that can be traded in two of its funds; Fidelity Digital Assets began allowing investors to pledge bitcoin as collateral for cash loans; Square and MicroStrategy invested in bitcoin; the list goes on.

That alone could be a tipping point for their peers, who have felt tremendous career risk trying to get bitcoin into their portfolios.

Now they can and they are – and not just because of the rising inflation in the U.S. As much learning as there is for everyone to do to be able to consider how digital assets fit into their lives and their business, there’s also a great deal of required unlearning.

“They’re just getting there because it’s a different animal,” Winklevoss said. “They became wildly successful understanding the world in a certain way and doing that better than most everyone else. So when you’re saying ‘here’s a new species,’ there’s a tendency for their muscle memory to say, ‘wait, that doesn’t look like what I’ve known all these years or what my mentors taught me.’”

They may be the very ones that have the most sway with regulators too.

Rules and regulations

Gemini is doing its part to make it easier for people to get into digital assets, whenever they have their aha moment. Earlier this month the company revealed the latest addition to its product suite, a credit card for U.S. users that will offer up to 3 percent back in bitcoin and other cryptocurrencies, which it plans to launch this year.

The Winklevoss brothers are known for being obsessed with regulatory compliance and providing services that are safe for users. Two years ago Gemini ran a big ad campaign across New York City taxis, phone booths, subway cars and took over a full page in the New York Times calling Gemini “the regulated cryptocurrency exchange” with messaging like “The Revolution Needs Rules” and “Crypto Without Chaos.”

Gemini was founded in 2014 but the brothers were adamant about “asking permission” rather than “asking forgiveness” and waited for the New York State Department of Financial Services to grant them licensing before launching their bitcoin exchange in 2015. Gemini has since obtained licenses to trade other digital assets. In 2018 it created the Gemini dollar – a stablecoin, or digital asset designed to minimize price volatility – to “give fiat currency the same desirable technological qualities of cryptocurrencies.” The brothers are currently considering taking the company public.

“I certainly believe in thoughtful regulation builds the healthiest markets,” Winklevoss said. “At the same time, people don’t have to wait around for the U.S. to figure itself out. We’re seeing the high net worth individuals and institutions are super spooked about what’s been happening and what’s going to continue to happen.”