Unpacking Trump’s potential tariff policies

You’ve heard a lot about Trump’s tariff plans and their potential economic impact. Here’s Felix’s take

Donald Trump | Shutterstock/lev radin modified by Blockworks

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

As investors and market participants begin to digest the impact of Donald Trump’s win and the red Congressional sweep that came with it, the focus is now on trying to unpack how Trump’s unique perspective on economics, global trade policy and the global American security complex will play out.

Many things were said during the campaign. The difficult part of trying to gauge which promises are both realistic and probable now begins.

This week I sat down with Dr. Stephen Miran, fellow at the Manhattan Institute and senior strategist at Hudson Bay Capital. Miran was also at the US Treasury during the first Trump Administration.

His latest economic paper provides a toolkit of how to unpack and understand a world of increased global tariffs and other protectionist economic policies.

Titled “A User’s Guide to Restructuring the Global Trading System”, the paper is a fascinating roadmap into understanding the ultimate question surrounding a heavyhanded tariff policy: Will it be inflationary or not?

Stephen began our interview discussing the “Triffin world” we live in. Simply put, a Triffin world is the consequence that comes with being the global reserve currency.

The dollar’s status has for decades resulted in an overvalued currency (when compared to interest rate parity theory) and persistent and rising twin deficits (both a fiscal and a trade deficit).

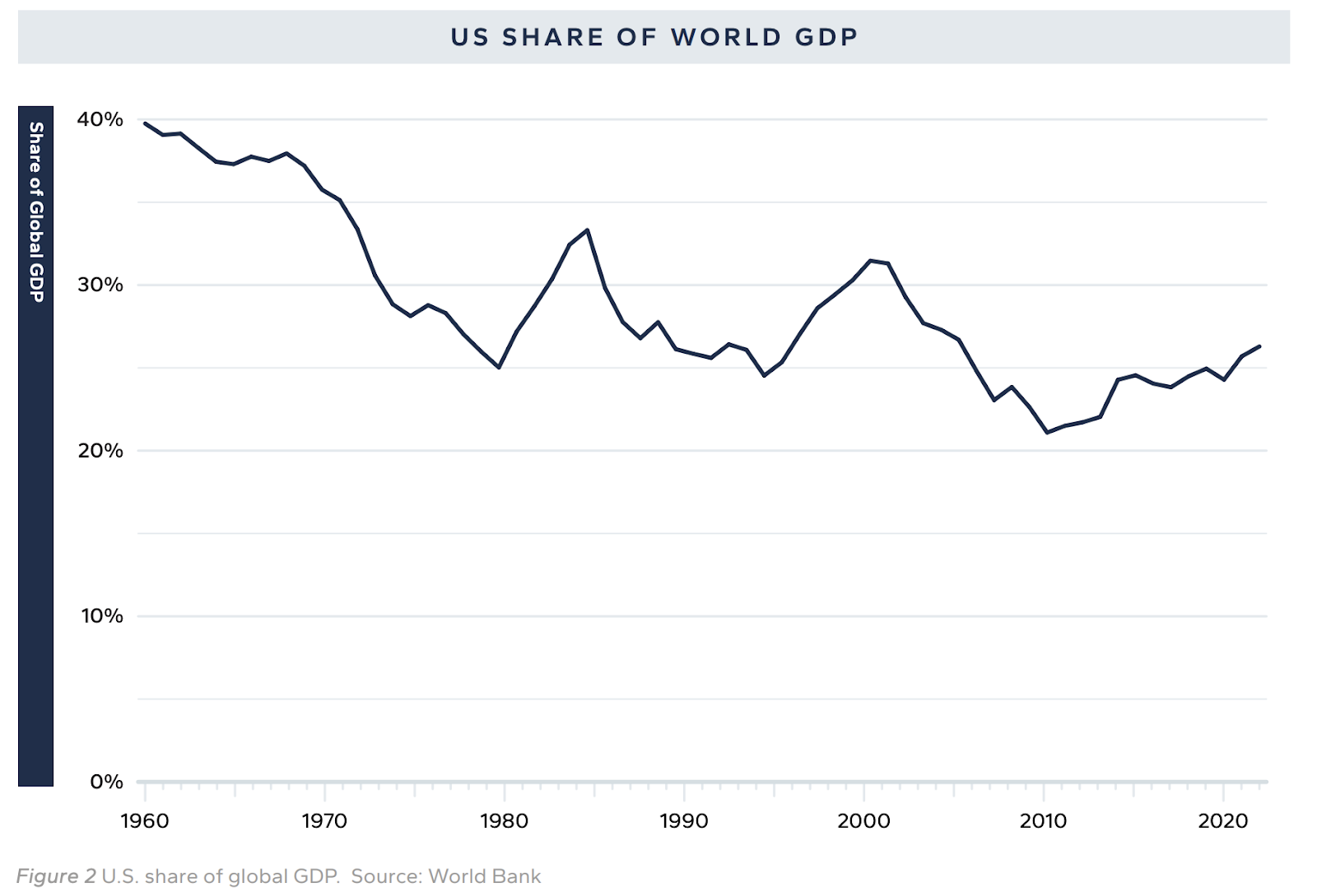

A Triffin world can quickly become a crisis for the reserve currency issuer – i.e a Triffin’s dilemma, when the total share of global GDP secularly declines — like it has for the US in recent years:

Because of this, deficits widen and further strain the priorities of the reserve currency, creating an imbalance between domestic and international priorities.

As proposed by Trump and analyzed by Dr. Miran, one way to “recalibrate” this strain is through either tariffs that rebalance these trade imbalances or an outright currency devaluation that brings the US dollar back in line with interest rate differentials.

The big question from here is what could the impact of a tariff-heavy policy on domestic inflation be? How much of the price increases gets passed onto consumers?

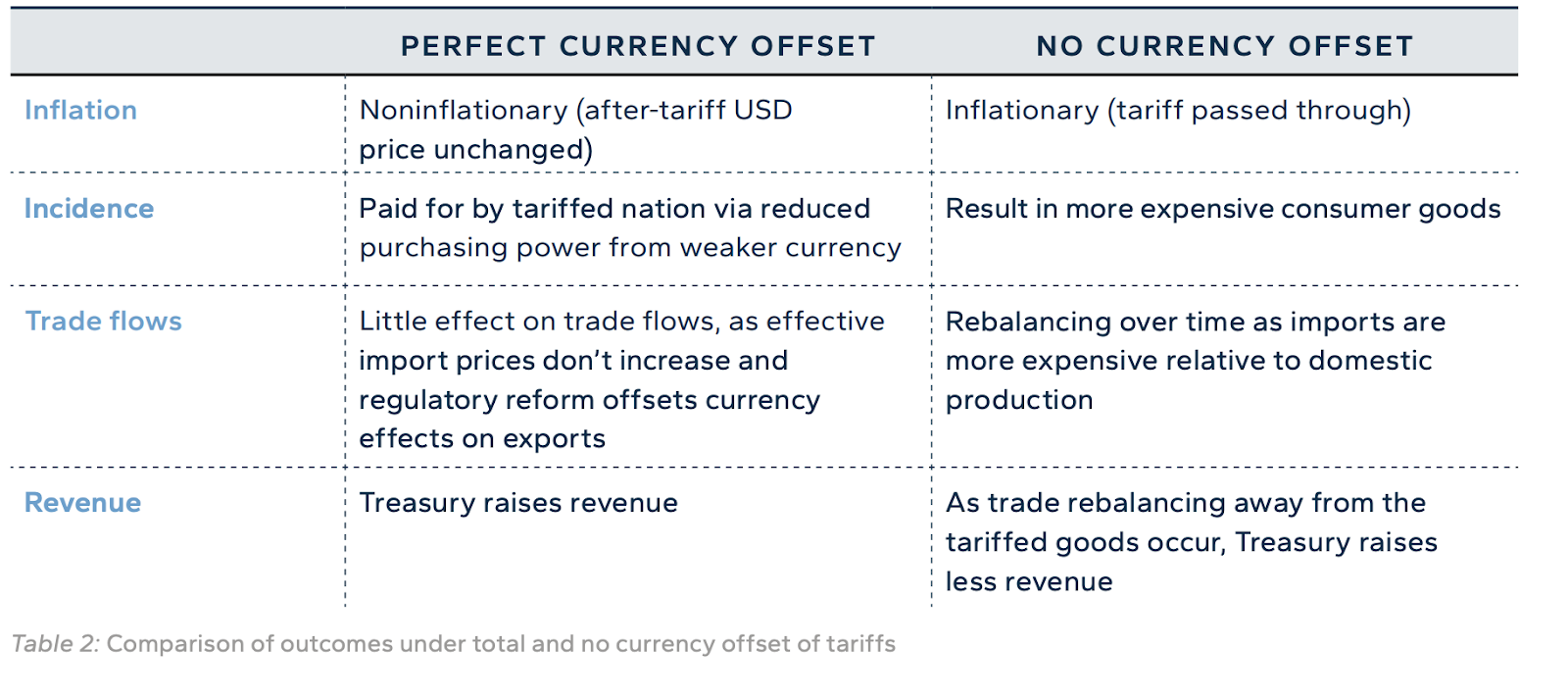

As Dr. Miran analyzes in the paper, the key to this question lies in how much the currency offsets the increase in price:

Further, one of the key considerations for these tariffs being implemented is the context of the business cycle that we are in, as this will, in part, determine the tariffs’ success.

The other side of the coin that the paper and interview discuss is outright multilateral and unilateral currency agreements and how they could also help recalibrate the USA from spiraling into a Triffin dilemma.

As for understanding the specifics of what style of currency agreement would work best, well you’re just going to have to listen to the interview to find out.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.