US Slows on Jobs Gains in August

August’s jobs report shows that the economy is not maintaining its momentum in growth, likely due to an increase in coronavirus cases, and a Fed taper may be further off than expected.

Blockworks exclusive art by Axel Rangel

- The US economy added 235,000 jobs in August, missing analysts’ expectations of 750,000

- August’s employment rate dipped slightly from 5.4% in July to 5.2%

The United States added 235,000 jobs in August, majorly missing analysts’ estimates and showing a significant setback from gains made earlier in the summer, according to data from the Bureau of Labor Statistics.

In June and July the US economy added 962,000 and 1.05 million jobs, respectively. Friday’s disappointing jobs report is reminiscent of those during severe lockdown months and signals that a rise in Delta variant coronavirus cases is putting a strain on recovery.

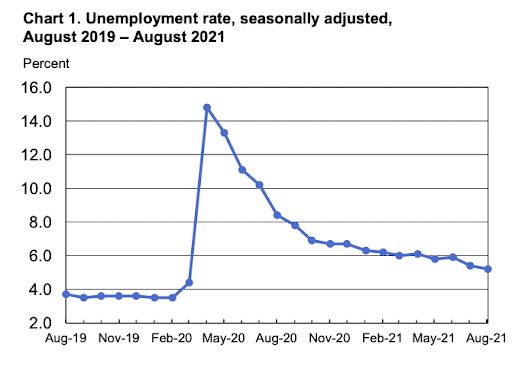

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

August’s unemployment rate was 5.2%, down slightly from July’s 5.4%. Pandemic-time unemployment peaked in April 2020, when it hit 14.8%.

Employment in the leisure and hospitality sector for August was unchanged, according to the Labor Department. There were “notable gains” in professional and business services, transportation and warehousing, private education, manufacturing and other services, the report revealed. Retail jobs declined by 29,000.

For the first time since December, there was an increase in employees working from home.

Equities mostly dipped slightly following the release of the report, with the S&P 500 pulling back from it’s intraday record high set Thursday. The Nasdaq was little changed while the Dow slipped about 0.2%.

“Over the past two days, thanks to the soft ADP jobs report and underwhelming employment index in the manufacturing PMI, markets have somewhat aggressively priced in a slightly disappointing jobs number in today’s report (say under 500K),” wrote Tom Essaye, founder of Sevens Report Research, in a note on Friday.

A mild decline in stocks was to be expected, but a larger dip would have been surprising given recent data, Essaye said. Jobs added coming in between 200,000 and 900,000 shows that recovery is continuing, but a more aggressive taper from the Federal Reserve is not yet needed.

August’s jobs numbers come in just weeks after Fed Chairman Powell revealed that tapering efforts may start before the end of the year. Powell noted that the economy has progressed since July in terms of employment numbers, but the rise of the delta variant may pose additional challenges following the Jackson Hole policy forum, held virtually for the second year in a row.

The slightly more hawkish stance from late August is likely to turn more dovish if labor data continues to disappoint.