US Stocks Continue to Rise After Slew of Fed News: Markets Wrap

U.S. equities whipsawed following the Fed’s mildly-hawkish announcement last week. The Dow spiraled after Chair Powell hinted at interest rate hikes, benchmarking its worst stretch in over six months. But the index rallied this week, after Powell reassured investors that a 5% inflation environment would be unacceptable.

Source: Shutterstock

- All 23 banks passed the annual Federal Reserve stress tests.

- PCE data shows its biggest increase since 1992, rising 3.4% year-over-year.

It’s been two weeks of mixed signals from the Fed and an array of economic projections. But a strong upturn for US equities and their not-so-phased investors show signs of optimism for further pandemic recovery.

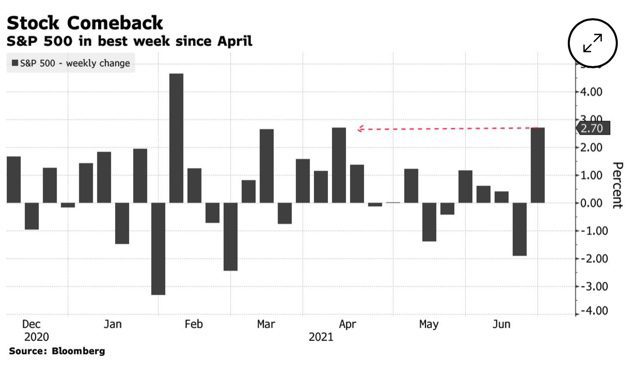

Wall Street indexes were on track for one of the best weeks since April for giants like S&P 500 and The Dow Jones Industrial Average on Friday morning. The tech-heavy Nasdaq Composite Index underperformed in comparison to its high on Thursday. All three mostly slowed pace by market close.

To recap, equities whipsawed following the Fed’s mildly-hawkish announcement. The Dow spiraled after Fed Chairman Jerome Powell hinted at looming interest rate hikes, benchmarking its worst stretch in over six months. But the index rallied this week after Powell reassured investors that a 5% inflation environment would be unacceptable.

In addition, this week was chock-full of economic data to sift through, leaving investors assessing the future for continued growth. Fed stress tests results gave major banks a thumbs up, including Goldman Sachs. This could mean a boost in buybacks and dividends upwards of tens of billions of dollars. Initial jobless claims fell by 7,000 to 411,000, reported on Thursday.

The latest personal consumption expenditures (PCE) data shows its biggest increase since 1992, rising 3.4% year-over-year. This exceeded the Fed’s 2% flexible target, revealing that they are unlikely to make any major monetary policy changes in the near future, Blockworks reported on Friday.

Equities

- The Dow boosted 0.69% to 34,433.

- S&P 500 shot up 0.33% to 4,280.

- Nasdaq was little changed but down -0.06% to 14,360.

Insight

“Even though last year’s ballooning monetary growth is now boosting inflation, could the recent tightening in real liquidity growth soon calm inflationary trends? Federal Reserve ambivalence is being met by “money-supply vigilantes!” Who knows who will ultimately win this epic inflation battle?” said Jim Paulsen, chief investment strategist at The Leuthold Group, in a recent note. “Nonetheless, as we head into the weekend, investors can take some comfort in the fact that ‘someone’ is indeed worried about and fighting the upward trend of inflation.”

Crypto

- Bitcoin is trading around $32,116.07, down -7.84% in 24 hours at 4:00 pm ET.

- Ether is trading around $1,847.07, falling -7.73% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.057, up 0.28% at 4:00 pm ET.

- VIX is down -3.69% to 15.38 at 4:00 pm ET.

Fixed income

- The US 10-year yields 1.526% as of 4:00 pm ET.

Commodities

- Crude oil had an intraday high of $74.18 per barrel and rose 0.95%.

- Gold is up 0.17% at $1,779.70.

Currencies

- The US dollar fell -0.05%, according to the Bloomberg Dollar Spot Index.

In other news…

El Salvador is still bullish on bitcoin. President Nayib Bukele announced that the government would be giving $30 worth of the cryptocurrency to each adult citizen who downloaded the e-wallet, Chivo, he said late Thursday night. The country has plans of officially adopt bitcoin as legal tender, which will go into effect on September 7, Bukele said earlier this month. Following the news, Bitcoin jumped 5%.

Insight

“Private unbacked cryptocurrencies like bitcoin may be hogging the spotlight, but the role of regulators and policymakers as key gatekeepers likely limits their potential to catalyze truly transformational change,” JPMorgan wrote in a report published on Monday.

That’s it for today’s markets wrap. I’ll see you back here on Monday.