US users missed out on $2.6B in potential airdrop revenue: Dragonfly

A new report from Dragonfly suggests that US users were geoblocked from billions in potential revenue

Dragonfly managing partner Haseeb Qureshi | Permissionless I by Blockworks

This is a segment from the Empire newsletter. To read full editions, subscribe.

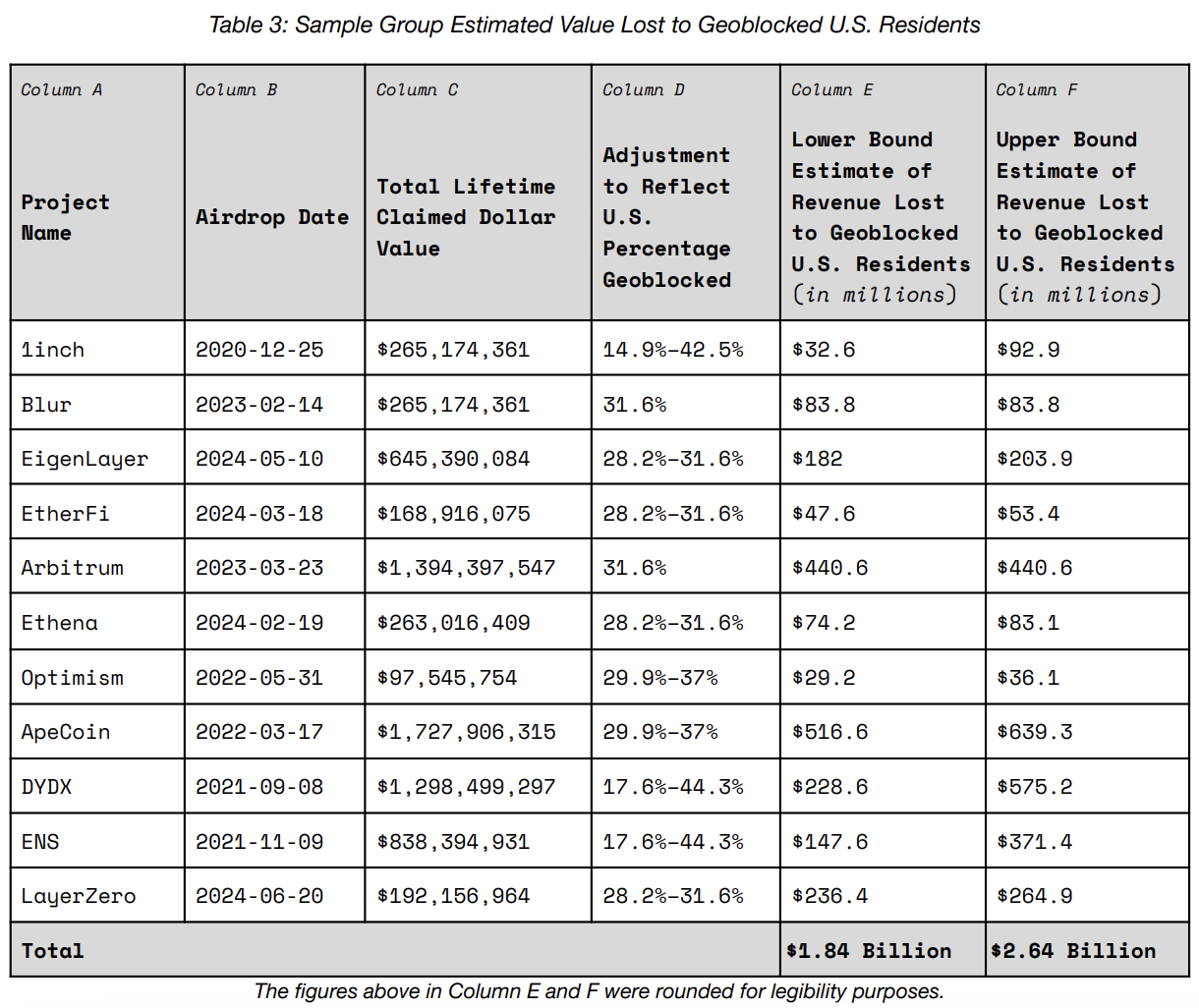

$1.9 to $2.64 billion.

That’s the amount of potential revenue that Dragonfly thinks US users have missed out on thanks to geoblocking.

Okay, really, it’s more because of the regulatory environment — or should I say former environment.

“As of 2024, we estimate that 22-24% of all active crypto addresses worldwide belonged to US residents. Our sample of 11 projects generated a total value of approximately $7.16 billion to date, during which approximately 1.9 million claimers participated worldwide with an average median claim value of around $4.6 thousand per eligible address,” Dragonfly wrote.

As we’re all aware, projects have had to protect themselves by excluding US users from the party. Sad.

If we want to look outside the box, it’s not just crypto folks who have lost out on potential bags.

Source: Dragonfly

Source: Dragonfly

“The federal tax revenue loss from these geoblocked airdrops ranges between $418 million and $1.1 billion, with an additional $107 million to $284 million in state tax revenue foregone,” Dragonfly wrote. “These figures do not account for further tax revenue that could have been generated from the capital gains taxes upon the eventual sale of these tokens.”

Oof.

Unless you’re a total contrarian — or anti-crypto — the consensus is that the last couple of years have not given us the regulatory clarity that crypto needs to survive and thrive.

Clearly, the data points to that. It also begs the question: Wen regulatory clarity on airdrops?

Right now, that’s not clear, though Dragonfly used its study to present a case that argues airdropped tokens aren’t securities under the Howey test.

As for recommendations, the report suggests that non-fundraising airdrops include a safe harbor that would protect them. This harbor would include issuer disclosures, insider lock-up, consideration, functional platform and token post-launch and, finally, strict rules to target manipulation.

A safe harbor could be grandfathered into previous airdrops, too. Bonus points if the projects have to hand over data that demonstrates they’ve complied with the standards set forth.

I know we have a lot going on when it comes to trying to figure things out from a regulatory perspective at the moment. But clarifying and protecting both the firms behind airdrops and their users could give crypto a much-needed boost. Just saying.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.