VanEck plans to file for Hyperliquid staking ETF, European ETP

The firm’s upcoming filing comes as competition heats up over the USDH stablecoin

CryptoFX/Shutterstock and Adobe modified by Blockworks

VanEck plans to file for a Hyperliquid spot staking ETF in the US and an exchange-traded product in Europe, two employees at the firm told Blockworks.

HYPE would become the youngest token to earn an ETF filing from the crypto-friendly investment management firm, which currently offers bitcoin and ether ETFs among other crypto funds.

Hyperliquid has been a major focus for VanEck’s liquid fund this year, VanEck senior digital assets investment analyst Matt Maximo said.

The firm is considering allocating a percentage of the investment products’ net profits to HYPE buybacks, digital assets products director Kyle Dacruz added. Hyperliquid currently performs HYPE buybacks equal to nearly all of the platform’s revenue.

The pair declined to comment on when VanEck’s HYPE ETF filing may go live. A spokesperson for the firm did not immediately return a request for comment.

Hyperliquid is a layer-1 blockchain that underpins a popular perpetual futures exchange. The chain grew quickly after launching in 2023.

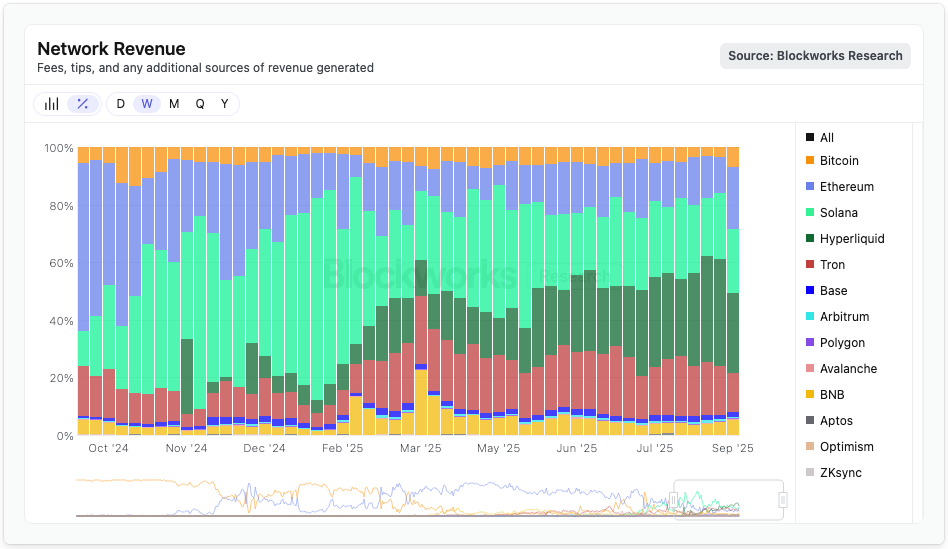

It has led all blockchains in network revenue for four consecutive weeks, according to Blockworks research data.

Source: Blockworks Research

Source: Blockworks Research

VanEck finds Hyperliquid to be an attractive ETF candidate because it has “plenty of demand” but does not currently trade on major US crypto exchanges like Coinbase, Dacruz said. A HYPE staking ETF would give US investors better access to the token — and perhaps nudge exchanges to list the token, he added.

The firm’s Hyperliquid products would depend on regulatory approval, although 21Shares successfully launched a European Hyperliquid ETP in August.

In the US, approvals may take a little more time. The SEC has a slew of crypto ETF applications to work through, including ones for larger tokens like XRP and SOL.

VanEck has also applied to list ETFs for AVAX, SOL, JitoSOL, and BNB.

The move comes amid a sweepstakes to issue USDH, a ticker reserved for a Hyperliquid-aligned stablecoin. One of the contestants is Agora, a stablecoin startup co-founded by Nick van Eck, son of VanEck CEO Jan van Eck. The senior van Eck posted on X defending Agora’s proposal to issue USDH, and VanEck reportedly helps manage Agora’s reserves.

The CEO also added that the firm is “bullish Hyperliquid.”

Dacruz said VanEck’s decision to file for Hyperliquid ETPs is“completely separate” from Agora’s USDH bid and stressed that the products are not contingent on Agora being USDH’s issuer. He also noted Agora and VanEck are separate entities.

If VanEck gets its HYPE ETF filing in first, it would continue a trend for the firm, which was also first to file for both Solana and Ethereum ETFs.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.