Is World Liberty Financial good for crypto? It doesn’t matter anymore

Everyone knows that crypto is psychological torture

World Liberty Financial and SYHM MEDIA/Shutterstock modified by Blockworks

This is a segment from the Empire newsletter. To read full editions, subscribe.

The “it’s all so tiresome” meme also comes to mind. Except the context surrounding the original scene doesn’t really apply. Unlike in the Empire of Dust documentary, there are lots of people doing great work in crypto, tirelessly so, and there’s plenty about the state of blockchain development to be excited about.

Instead, crypto is psychological torture in the same way that medieval tickling might be. In the early 16th century, the Italian monk Franciscus Brunus de San Severino described a dastardly practice known as the goat’s tongue, whereby townspeople would coat the feet of a criminal locked up in the stocks with salt. A goat would then lick the salt off the feet while commoners tickled them with feathers.

It’s not clear whether the goat’s tongue was actually a real punishment. But I imagine that it’s familiar to anyone who is unfortunate enough to be unceremoniously pulled towards crypto for one reason or another, whether it’s interest, work, curiosity, academics or simply the potential to make serious money.

A painting at the criminal museum in Rothenburg, depicting the dreaded goat’s tongue

A painting at the criminal museum in Rothenburg, depicting the dreaded goat’s tongue

Paul J. Dylan-Ennis in 2021 described crypto as a world surrounded by a trash moat of information — a barrier of toxic clickbait sludge that regular people must wade through to reach anything worthwhile:

“What happens in the trash moat rarely reaches the shores of mainstream crypto. It occurs in the sweet spot just beyond the attention of the clued-in observer, who is typically focused on high-minded talk of regulation, venture capital funding and whatever is currently hot, like NFTs, and yet it happens right there in public.”

The tickling torture described by our monk Franciscus Brunus would certainly feel a lot like the tide of that trash moat ripping past my ankles while I soak my feet on the shore.

Objectively, the details surrounding World Liberty Financial, a project for banking the unbanked, are hilarious and excruciatingly painful, all at the same time.

- The white paper is really a “gold paper.”

- President Trump is “Co-Founder Emeritus,” and his face is all over the gold paper.

- There is no live app, but the WLFI token has a $6.6-billion market cap and a $24-billion FDV.

- Justin Sun was WLFI’s largest backer and now holds more than 3% of the circulating supply.

- WLFI is a governance token with a buy-back-and-burn strategy. Large holders, including a firm linked to the Trump family, decide when token allocations are unlocked and can be sold.

- Binance reportedly wrote the smart contract for USD1, a stablecoin in the World Liberty Financial universe, as CZ seeks a pardon (CZ denies Binance’s involvement).

- The Trump family is technically $5 billion richer thanks to their stake in WLFI, per WSJ, making their crypto investments more valuable than their real estate.

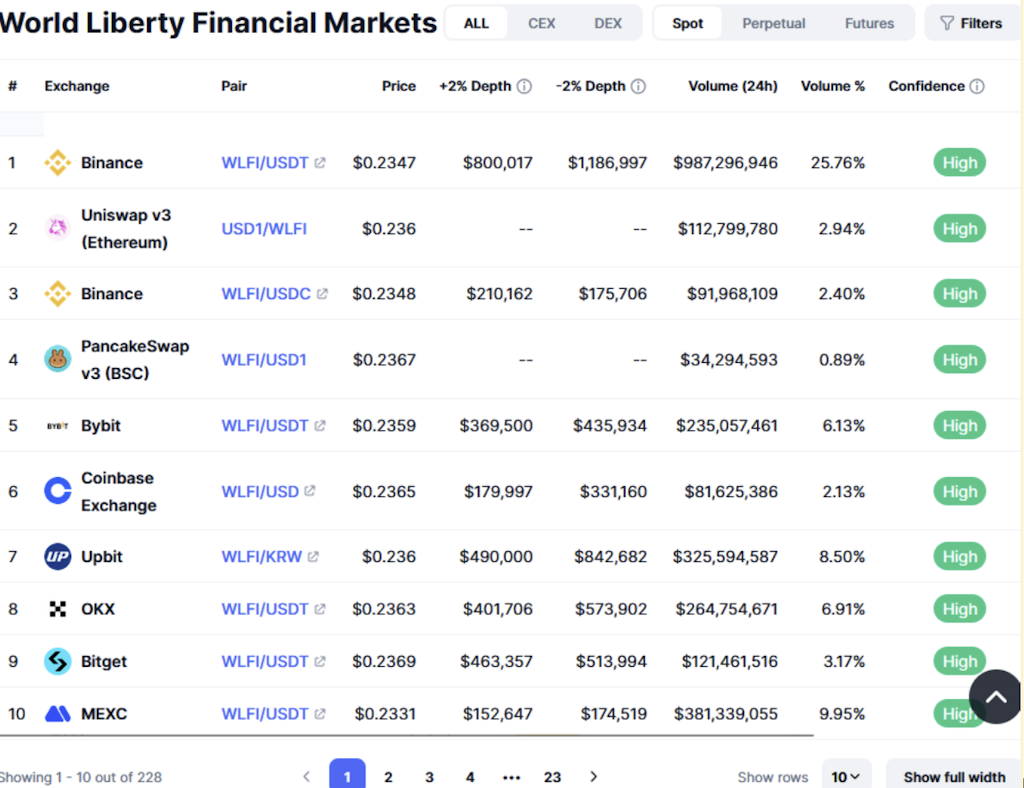

WLFI’s token claim temporarily pushed gas fees over $100 yesterday. Meanwhile, 26% of WLFI’s first-day trading volume occurred on Binance, with more spread across other offshore exchanges including Bybit, Upbit, MEXC and others. Uniswap contributed around 3%. (H/T: Rod, Blockworks Research analyst).

WLFI’s token claim temporarily pushed gas fees over $100 yesterday. Meanwhile, 26% of WLFI’s first-day trading volume occurred on Binance, with more spread across other offshore exchanges including Bybit, Upbit, MEXC and others. Uniswap contributed around 3%. (H/T: Rod, Blockworks Research analyst).

We could unpack and debate the finer points of WLFI’s tokenomics all day. Perhaps at the end of it, we’d decide whether World Liberty Financial is a net positive for the crypto space, whatever that might mean. I’m just not sure it will matter anymore.

Those of us who have learned how to tune out the trash moat — the constant low quality noise sloshing around crypto — may find it vastly more difficult to do so from here. At least, until a lengthy bear market cleanses the waters once again.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.