WLFI claims send ETH gas over 100 gwei

World Liberty Financial opened WLFI claims at 8:00 am ET, driving a rush of on-chain transactions that pushed Ethereum gas into triple digits

CryptoFX/Shutterstock modified by Blockworks

An otherwise quiet US Labor Day Monday in markets was disrupted onchain by the opening of claims on WLFI tokens at 8:00 am ET.

Ethereum gas fees quickly spiked into triple digits, the highest readings in 2025, as recipients rushed to claim tokens, alongside immediate secondary trading.

World Liberty Financial had flagged the unlock flow last week and announced its “Lockbox” ahead of today’s window.

One reason on-chain swapping skewed high: several large centralized exchange listings were scheduled for later in the day. OKX, for example, set spot trading for WLFI/USDT to begin at 9 am ET, after the claims window was already live — pushing early flow toward Uniswap in the interim.

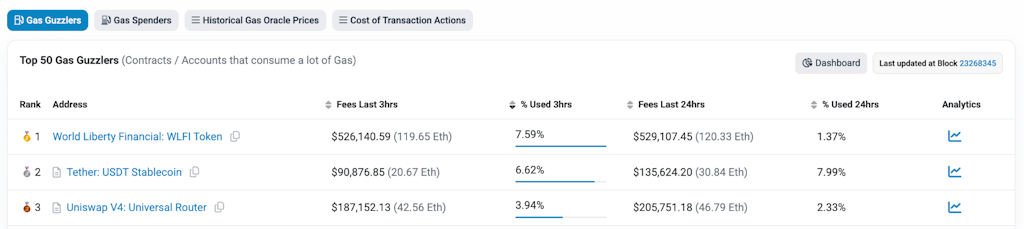

Etherscan’s Gas Tracker showed the network’s median/base fee serge putting the WLFI token into the top spot on the site’s Gas Guzzlers list.

Source: Etherscan

Source: Etherscan

While fees eased later, utilization remained elevated with a deep pending queue.

The Uniswap v3 WLFI pool on Ethereum registered over $20 million in volume within the first hour, according to CoinGecko as claims boosted DEX activity.

All this despite the fact the token drop was widely anticipated. WLFI’s unlock site outlined the process on August 25. Derivatives flows had already picked up into the event, with WLFI perps volumes jumping to more than $3 billion ahead of the unlock.

After weeks of sub-1 gwei medians, the WLFI unlock is a reminder that large, coordinated claim events can still overwhelm blockspace on Ethereum, when thousands of users hit contracts at once. That had users complaining of gas fees upwards of $100 to execute the claim. As recently as this morning, a similar claim transaction would have cost less than $0.10.

For teams planning comparable unlocks or airdrops, today underscores the operational need to stagger claims, consider off-chain batching where appropriate, and set realistic user expectations around gas.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.