Square Unveils tbDEX Whitepaper; ETH Outperforms BTC: Markets Wrap

Square subsidiary TBD unveils the tbDEX whitepaper, while ETH has outperformed BTC since yesterday’s broader market sell-off

- Square subsidiary TBD looks to build an open platform to create a decentralized exchange for bitcoin

- ETH has outperformed BTC over the last 24 hours, according to TradingView data

TBD, a business created by Square this year, has released its whitepaper for the tbDEX protocol.

ETH has outperformed BTC since yesterday’s broader market sell-off. The crypto asset is showing strong similarities to bitcoin in 2017.

NFTs continue to show strength due to falling prices of the assets they are denominated in.

Latest in Macro:

- S&P 500: 4,697, -0.14%

- NASDAQ: 16,057, +0.40%

- Gold: $1,847, -0.62%

- WTI Crude Oil: $76.11, -3.67%

- 10-Year Treasury: 1.539%, -0.05%

Latest in Crypto:

- BTC: $57,960, +0.56%

- ETH: $4,273, +6.19%

- ETH/BTC: 0.07, +5.09%

- BTC.D: 42.74%, -2.28%

Square unveils tbDEX whitepaper

Square subsidiary TBD released its tbDEX whitepaper on Friday.

“We believe Bitcoin will be the native currency of the internet,” said Mike Brock, Square’s TBD lead. “While there are many projects to help make the internet more decentralized, our focus is solely on a sound global monetary system for all.”

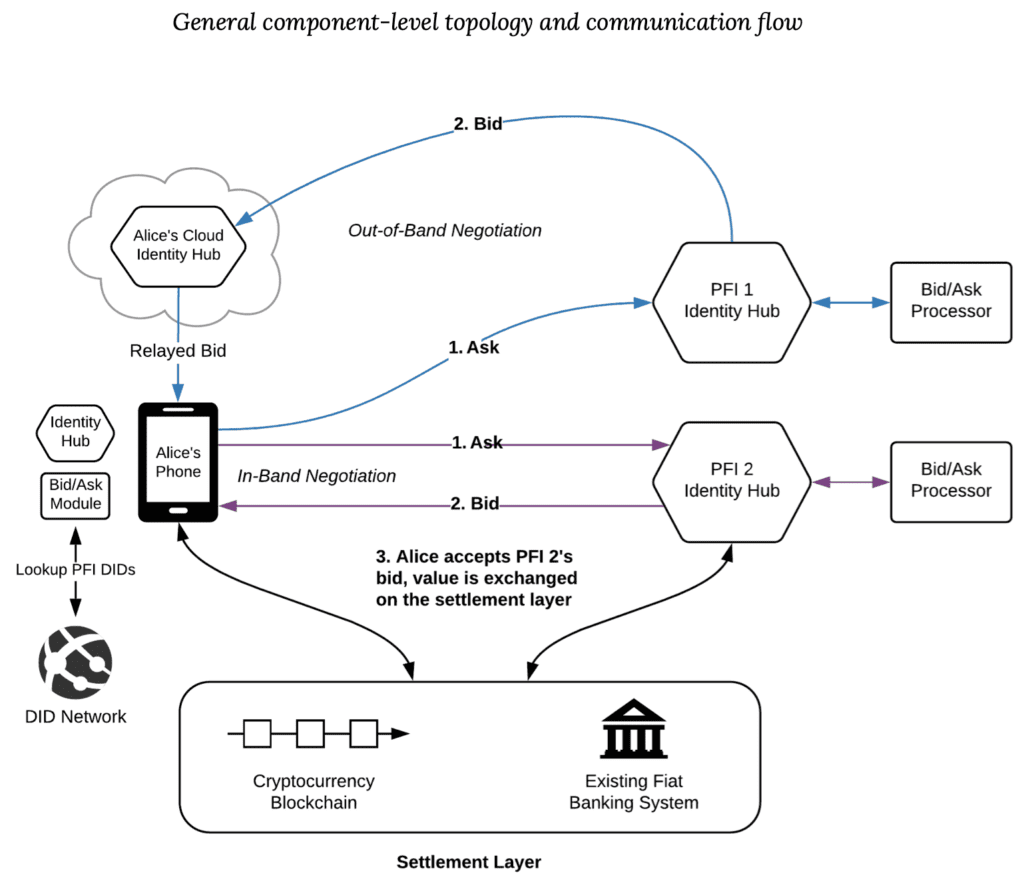

The decentralized exchange (DEX) hopes to make digital assets and decentralized financial services more accessible by creating a ubiquity of on-ramps and off-ramps directly between the fiat and crypto financial systems without the need for centralized intermediaries and trust brokers.

“We are at a crossroads in our financial system,” the project’s whitepaper states. “The emergence of trustless, decentralized networks unlocks the potential for a future where commerce can happen without the permission, participation or benefit of financial intermediaries.”

Unlike other DEXs, tbDEX will not have its own token or utilize atomic swaps, but will instead rely on the public key infrastructure that is used for securing the internet today in conjunction with digital identifiers. The whitepaper clearly acknowledges that on- and off-ramps to fiat currencies will never be fully decentralized.

An overview of the protocol can be seen in the image below.

Source: tbDEX whitepaper

Source: tbDEX whitepaperThe protocol will be open-source and is still in its early stages of development.

ETH/BTC

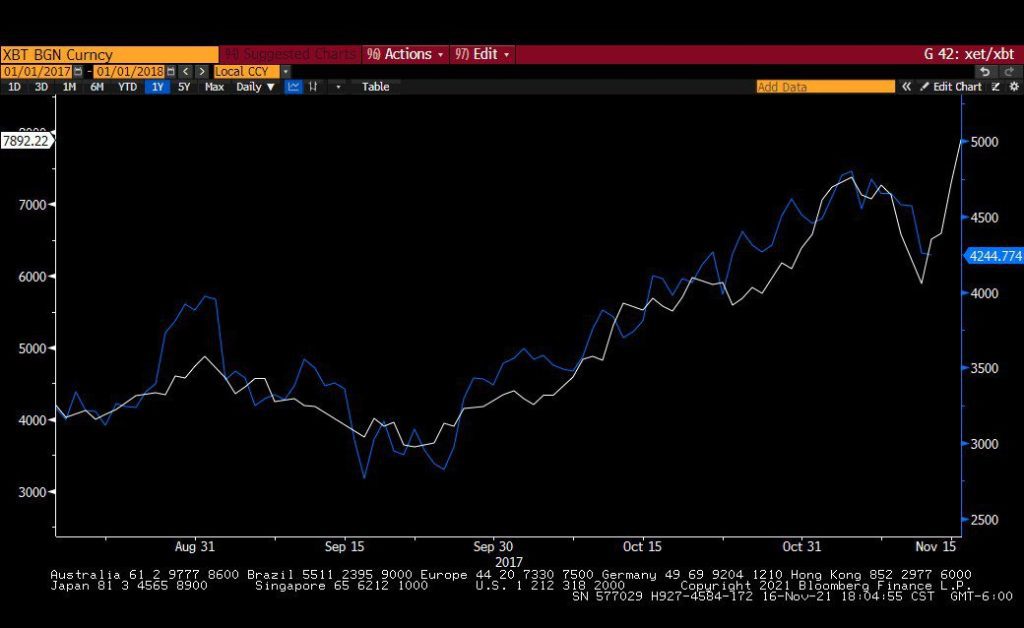

ETH has outperformed BTC over the last 24 hours, according to TradingView, with the ETH-to-BTC price ratio rising from 0.070 to 0.074 – an increase of about 5.3%.

Source: Trading View

Source: Trading View

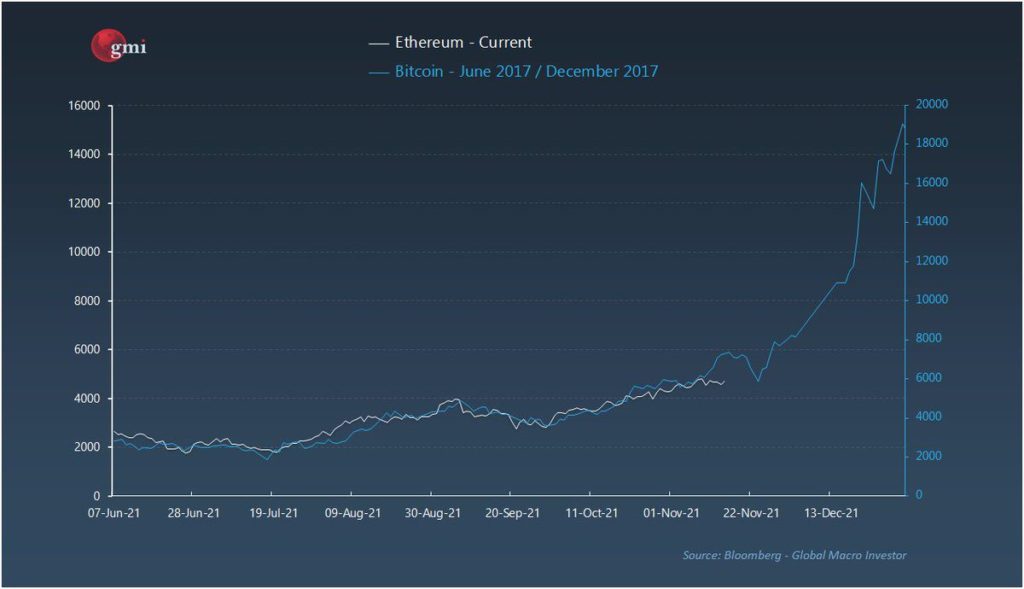

ETH today shows eerie similarities to BTC in 2017.

“I have been showing this spooky chart of ETH now vs BTC in 2017 in various forms,” Global Macro Investor Founder Raoul Pal wrote in a Tuesday Twitter post. “This is my live [crypto index] on Bloomberg … even nailed this sell off … to the day and price. What happened next? A 300% rally.

“Now, I don’t expect perfection, but with all the other analysis I have done, something like a 100% to 300% rally is highly probable into year end,” he added. “Nothing is a certain. After that, its a tougher call but I think it possibly elongates and sees significantly higher prices.”

Source: Raoul Pal

Source: Raoul Pal

Source: Raoul Pal

Source: Raoul Pal“ETH is also attempting a similar flip,” a Delphi Digital report stated. “If price holds above the May 2021 closing peak, ETH will also look primed for trend continuation to the upside. If price support gives way, the hope for bulls would shift to a possible retest and bounce off the upper trend line established from the May 2021 top to the Sep. 2021 high.”

Source: Delphi Digital

Source: Delphi Digital

Ethereum has seen the number of active addresses on the network continue to climb. The net issuance of ETH continues to fall towards zero, unique addresses are increasing, scaling solutions are seeing increased adoption and mainstream use cases continue to unfold, such as Sotheby’s denominating prices in ETH.

In addition, the Ethereum merge is right around the corner.

Non-Fungible Tokens (NFTs)

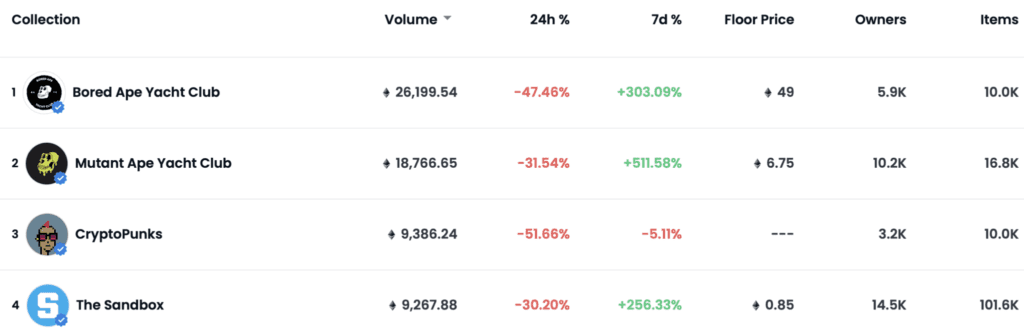

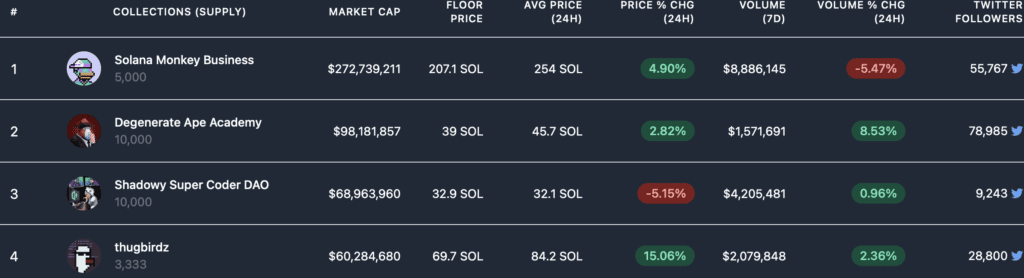

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up on Monday.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.