bitcoin futures etf

A BTC futures fund offered by Hashdex and Tidal Investments has gotten regulatory clearance to hold bitcoin directly

The fund’s assets under management sit at about $50 million, while a competing offering by ProShares recently eclipsed $2 billion

Grayscale remains in talks with the SEC and intends “to move as expeditiously as possible” in its quest to convert GBTC to an ETF

The Jacobi bitcoin ETF is overseen by Guernsey’s financial authority, and Fidelity Digital Assets manages its custodial responsibilities

A court ruling in favor of Grayscale does not necessarily offer a clear path for spot bitcoin ETF approval

The firm’s bitcoin-linked products account for roughly $770 million in combined assets under management

First such fund approved under the Securities Act of 1933 takes name of Brazilian asset manager

Grayscale CEO Michael Sonnenshein said the decision weakens the agency’s argument to deny spot bitcoin ETFs

The approval of bitcoin futures-based ETFs is a key first step, both in terms of the regulatory environment and allowing institutions to grow comfortable holding digital assets.

Valkyrie has withdrawn its leveraged bitcoin futures ETF application after being instructed to do so by the SEC.

The VanEck offering will likely see less demand than a pair of similar funds that launched last week, industry professionals say.

Filing follows milestone launches by ProShares, Valkyrie and plans for leveraged bitcoin futures ETF.

The entire digital asset market took a sharp nosedive on Wednesday, as BTC and ETH shed 5% and 8% respectively. But there were a few notable exceptions in DeFi.

Firm’s commodities-focused Managed Futures Strategy Fund now looks to invest up to 5% in bitcoin futures.

Valkyrie made history last week as the second issuer to bring a bitcoin futures-based ETF to market, now it seeks approval for a leveraged product.

The world’s first bitcoin futures ETF sustained high volume throughout the trading session.

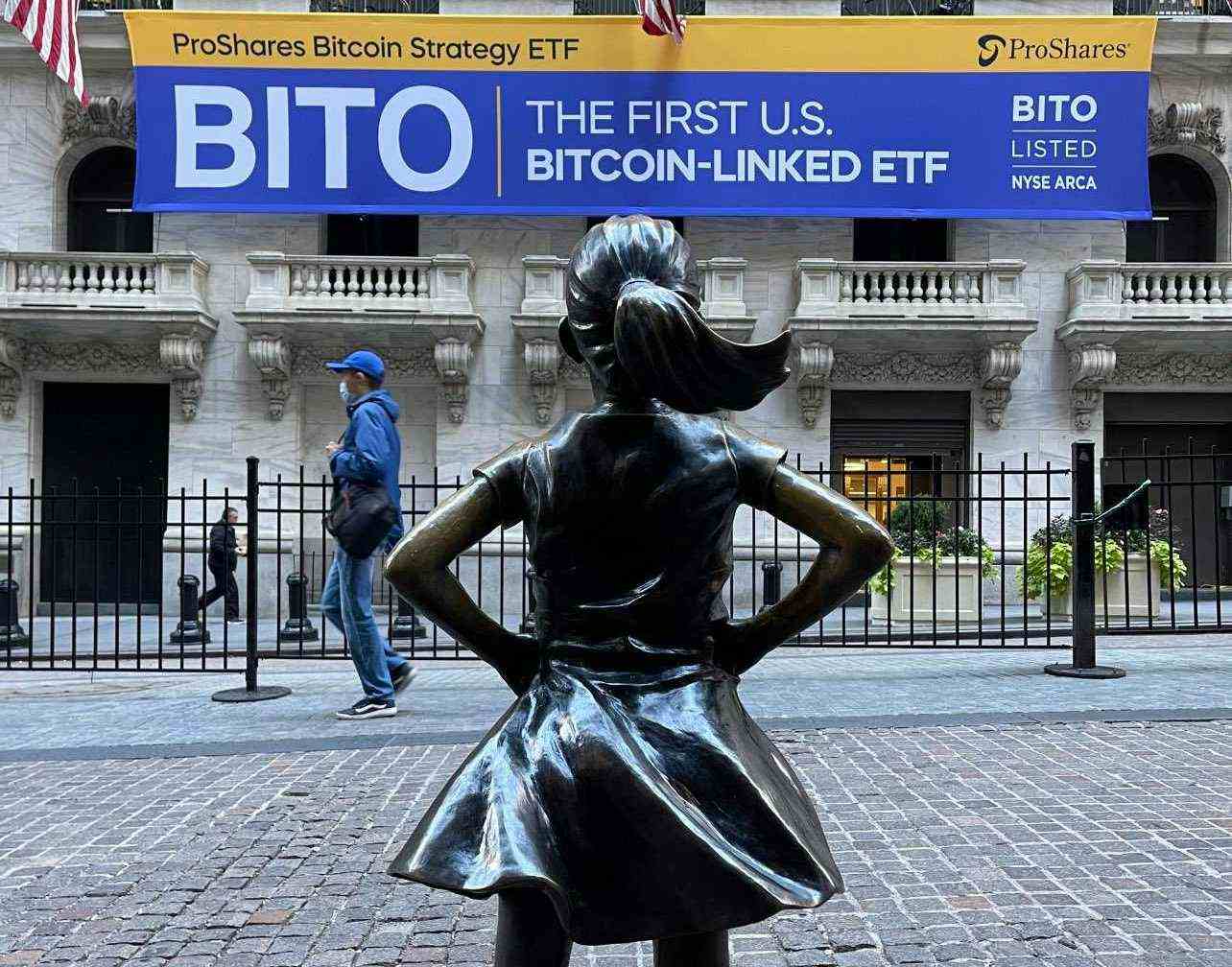

The product will be the first bitcoin-linked ETF in the US, as physically backed products still wait for green light.