Jane Street: Digital Assets is a Growing Industry for Us, We Are Excited About it

The approval of bitcoin futures-based ETFs is a key first step, both in terms of the regulatory environment and allowing institutions to grow comfortable holding digital assets.

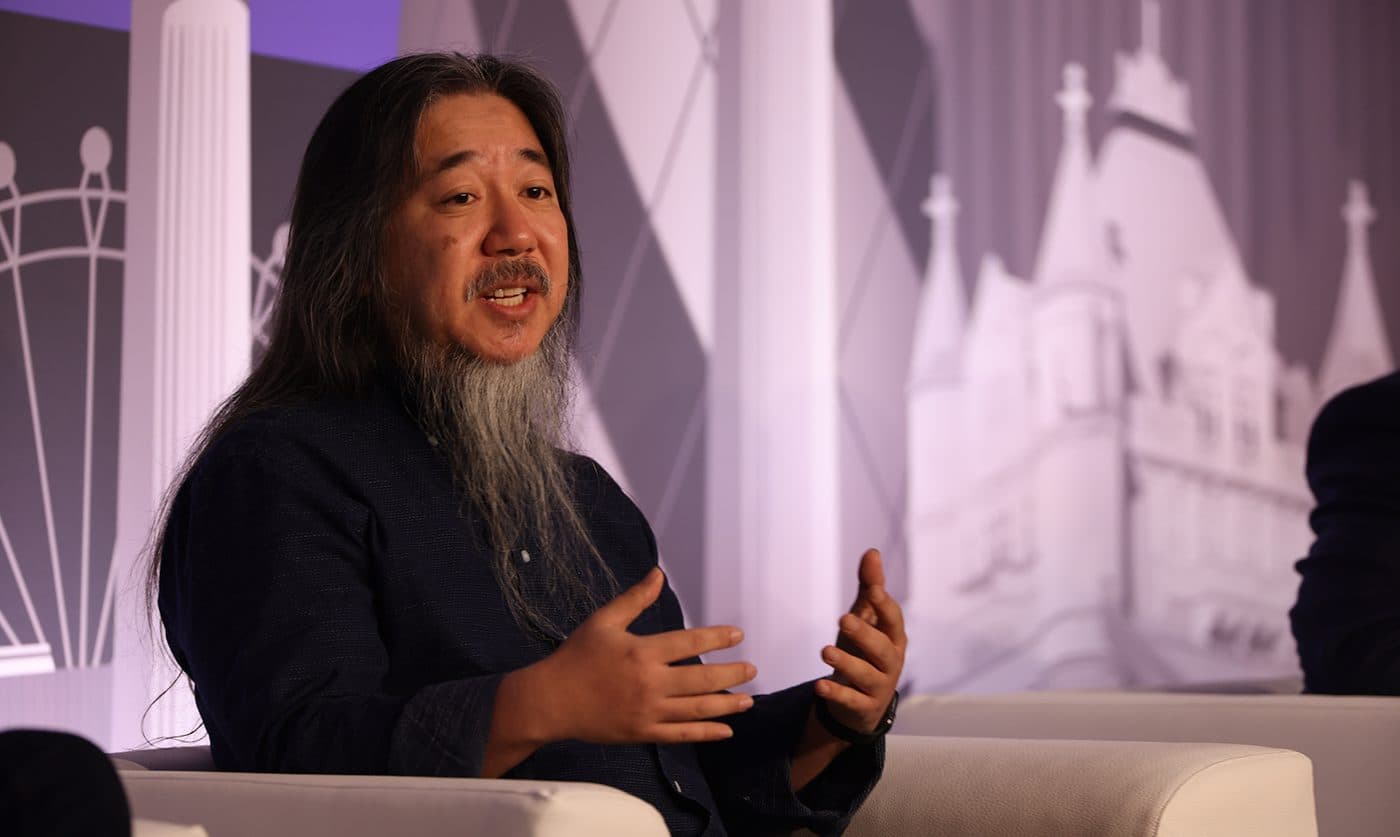

Thomas Uhm, Jane Street; Source: Ian Walton for Blockworks

- ETFs provide a bridge between the digital asset space and traditional finance

- For institutions, cash-settled derivatives, “are safer from an asset security standpoint because the underlying can’t be hacked”, says Jane Street’s Thomas Uhm

Digital Asset Summit 2021, London — At Jane Street, Thomas Uhm is excited about the digital asset industry’s potential for growth, and the recently launched bitcoin futures exchange-traded funds (ETF) in the United States are just the beginning.

These products mark the start of a very significant bridge between traditional finance and the digital asset space, Uhm, who is a member of Jane Street’s global crypto institutional sales and trading team, said Tuesday.

“ETFs are a very, very useful gateway between these two worlds,” Uhm said during a keynote discussion at Blockworks’ Digital Asset Summit in London.

Abhishek Jain, head of international ETF trading at DRW, agreed. From a regulatory perspective, especially, the approval of bitcoin futures ETFs in the US marks the beginning of an important era for crypto and traditional finance.

“From a regulatory point of view, I think that the ETF is quite impactful,” Jain said.

“The regulators have finally broken the seal [for digital assets], this is the first real step in that direction, it certainly cannot be the last step.”

The ProShares Bitcoin Strategy Fund and the Valkyrie Bitcoin Strategy ETF, both bitcoin futures-based, began trading in October, eight years after the first crypto ETF application was filed with the SEC in 2013. The products are not perfect, Jain and Uhm admitted, but they offer a way for a new wave of investors to enter the digital asset market.

There are members of both the crypto and the traditional financial world that are critical of the futures-based structure. The nature of the fund means that there is often a tracking error in the price, and rolling futures contracts comes with additional costs for investors, Uhm acknowledged.

“But, I think it is maybe useful to take a step back and think about why certain investors, especially institutions, might care about or find comfort in the fact that these products are back by regulated futures,” Uhm said. “Because these are cash-settled derivatives, they are safer from an asset security standpoint because the underlying can’t be hacked.”

Why bitcoin futures?

It’s not surprising that the US Securities and Exchange commission approved a futures-based fund before a spot product, both speakers agreed.

“Regulators would like an additional layer of oversight,” Jain said. “In the case of a futures-backed ETF, they have CFTC and the CME SROs who provide that additional layer of oversight, which they don’t have yet for the physical bitcoin ETF space.”

Abhishek Jain, DRW; Source: Ian Walton for Blockworks

Abhishek Jain, DRW; Source: Ian Walton for BlockworksInstitutional players will continue to interact with the space, and continuing to have these conversations on a public stage is what is going to advance both industries, Uhm said.

“ETFs help institutions overcome the philosophical barrier of holding these assets,” Uhm said. “By the way, at Jane Street, we have these conversations with traditional players more or less constantly. Our hope is that we can add a little bit of value into the overall discussion if we’re a little bit more public about our interactions with the crypto space.”

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.