The 3 Js

“The federal government has made explicit and implicit promises to millions of people, but has put no money aside in order to keep those promises. Some of you may wonder where Bernie Madoff got the idea for his Ponzi scheme. Clearly […]

“The federal government has made explicit and implicit promises to millions of people, but has put no money aside in order to keep those promises. Some of you may wonder where Bernie Madoff got the idea for his Ponzi scheme. Clearly he was studying federal entitlement policy.” – John C. Goodman

Everything is a Ponzi Scheme

By nature, big returns only exist the further you go out on the spectrum of liquidity. One of the most fascinating signs of cognitive dissonance is that long/short equity portfolio managers all think that they’re super original thinkers, but they surround themselves in the most commoditized game on the planet.

The monthly performance incentives also force them to play this proverbial game of investment chess and then start from scratch every 30 days. So someone please remind me why everyone thinks they are so smart? They’ve put themselves in an incentive sandbox where it’s almost impossible to massively outperform.

What I will never disagree with is that they are incredible risk-managers. They play not-to-lose better than anyone and charge rich baby boomers an arm and a leg in fees to do so. But does that create much growth? To me, that business model has led to some stagnation as capital never ends up making it to the real innovators and entrepreneurs.

To be fair, not everyone should start investing in private markets and crypto assets. A lot of bull markets bring out the best fraudsters looking for a ride on the free capital train. But at a 20,000 foot level, if we don’t invest in the future what will be left for our kids?

I think that transition of culture and capital from playing not-to-lose vs. playing-to-win is now happening because the Fed and Congress have pulled out every trick to avoid a credit crisis.

Historically, investors who got too levered had to pay the price when the cycle reversed, but it’s clear that the baby boomers like the 3 J’s (Jerome-age 67, Janet-age 73, Joe-age 78) won’t let their generation take any pain on their portfolios, as they want a very cushy retirement.

Instead, they are just gonna tax their children with a hefty amount of inflation.

So the question becomes…How do you stay one step ahead of the housing and asset inflation?

Going Out the Liquidity Curve

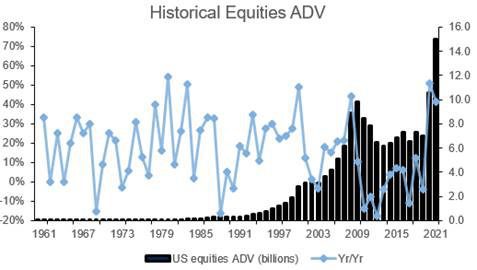

One of the things that scares me about the public equity markets is that average daily trading volume is making an all time high, potentially signaling a blowoff top. Trading volume spikes happen at secular peaks and valleys when sentiment is either euphoric or there is blood in the streets.

There are so many perverse incentives creating this phenomenon that we will cover in future newsletters (Robinhood etc). So, when I see the crowd jumping on Cathie Wood inflows and retail call options, I want to take my chips to another table.

The existential battle that I consistently have with myself is whether this is a blowoff top in risk-assets or have the 3 J’s tipped us into Weimar United States territory.

Right now, I’m leaning towards the Weimar U.S. and you aren’t going to be able to stay ahead of future inflation investing in Vanguard funds.

You need to move out into less liquid asset classes for opportunities until the REAL inflation gets so bad that the input costs of the business start really hurting the outputs.

If the 3 J’s change their tune, that’s when we need to worry. Until then, you gotta play the ponzi scheme!

This take comes from our Daily Newsletter. Get premium market insights every evening at 7 PM EST. Sign up now.