Turkish Bitcoin Interest Spikes After Lira Devaluation, Capital Controls

Interest in bitcoin in Turkey is off the charts as citizens fear the country could be heading for another currency crisis.

- Interest in bitcoin in Turkey is off the charts as citizens fear the country could be heading for another currency crisis.

- Turkey’s central banker Naci Agbal had repeatedly raised interest rates to stave off inflation and stabilize lira

Interest in bitcoin in Turkey is off the charts as citizens fear the country could be heading for another currency crisis.

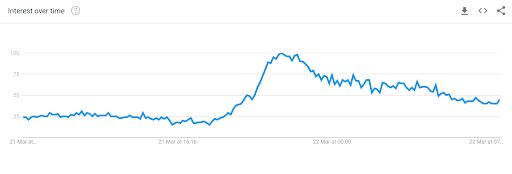

According to data from Google Trends, searches for “bitcoin” jumped by 566% as the lira plunged after Turkish president Recep Tayyip Erdogan unexpectedly fired Naci Agbal, the nation’s central banker —the third central bank chief in two years.

Source: Google Trends

Source: Google Trends

Agbal had repeatedly raised interest rates to stave off inflation and stabilize the lira. He is credited with pulling the lira back from all-time lows in 2018 that were caused by a currency war stemming from a diplomatic crisis between Washington D.C. and Ankara.

The country’s new central banker, Sahap Kavcioglu, tried to reassure investors and international fund managers that he had the same objectives as Abgal, however many are concerned that currency depreciation might be on the agenda as a means to stimulate growth.

Local media reports from the country suggest that capital controls could also be on the agenda as authorities look for a “range of strategies” to support the economy and stabilize the currency.

Turkey has $435.1 billion in foreign debt, according to a government release, which accounts for 59.1% of Turkey’s gross domestic product (GDP). Of this $435.1 billion, $189 billion, or 43.4%, will come due over the next 12 months which concerns analysts and economists.

“Investors need confidence that Ankara has a stable economic plan that goes beyond monetary tightening through rate hikes,” wrote Mustafa Sonmez, a Turkish economist in Al-Monitor.

Sonmez highlighted that real estate purchases accounted for 95% of the $4.6 billion foreign direct investment in Turkey last year with little foreign investor interest in its industrial or services sector.

Interest in digital assets is also picking up in India, as devaluation of the rupee means that many Indians are turning to bitcoin as a way to preserve their wealth. However, unclear regulations on the status of cryptocurrency in the country has created a barrier for many and confusion.

Volume on BTCTurkPro is up almost 70% in the last 24 hours, according to CoinMarketCap.

Learn more about today’s news: sign up for our daily newsletter by Tyler Neville and understand the crypto market in 5 minutes