Will the ‘Coinbase Effect’ Survive the Company’s Direct Listing?

Coinbase suffered one of its outages Friday as the price of bitcoin shot up above $38,000. Industry observers speculate the price rally came as a result of an endorsement of bitcoin by Tesla CEO Elon Musk, who had changed his Twitter […]

Coinbase suffered one of its outages Friday as the price of bitcoin shot up above $38,000.

Industry observers speculate the price rally came as a result of an endorsement of bitcoin by Tesla CEO Elon Musk, who had changed his Twitter bio to simply: “Bitcoin.”

Other cryptocurrency exchanges like Binance and online brokerages suffered outages yesterday, overwhelmed by a surge in trading volume amid the GameStop short squeeze saga that led online brokerage Robinhood to block investors from buying certain stocks.

But unlike the institutional investors that have been driving the current bitcoin bull run so far, these retail investors aren’t coming for the inflation hedge, they’re looking to triple (or more) their money quickly.

“If there’s more money coming to Coinbase from Robinhood from users who are used to trading Tesla options and GameStop – they’re gonna come to Coinbase and see all these other tokens and digital assets available to trade that they weren’t fully aware of that like [DeFi tokens] UNI, AAVE, and SNX that look more interesting than bitcoin now,” said Adam Blumberg, cofounder at Interaxis, a digital assets education and training company for financial advisors and investors.

Coinbase has $90 billion in assets on its platform and more than 35 million verified users. Historically, when it adds a new asset to its exchange, its price tends to go up on the first day it’s available to trade (kind of like an IPO pop).

Coinbase declined to comment for this story.

The ‘Coinbase Effect’

The Coinbase Effect is a well known phenomenon. The price rallies of bitcoin and other digital assets have mostly been driven by retail investors. When an asset that doesn’t have a market on other large exchanges becomes available to trade on the world’s perhaps most accessible exchange, it creates hype. An asset can go from thousands to millions of prospective investors overnight.

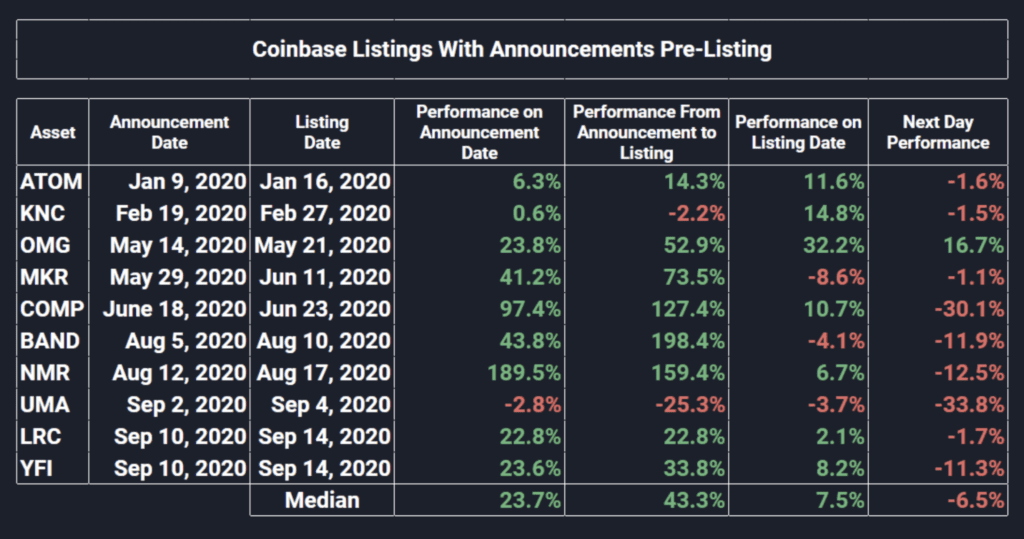

Coinbase listings in 2020 saw a median return of more than 24 percent on the day Coinbase announced they would be listed, according to eToro’s Q4 report on digital asset trends. Nine out of 10 performed positively on the day of their announcements (seven days in advance), most continued to grow in asset price from the announcement to the listing day, fell on the listing day and fell further the day after.

The median return on assets with pre-listing announcements was 7.5 percent, but during the six days between the announcement and the listing, the median return was 43 percent.

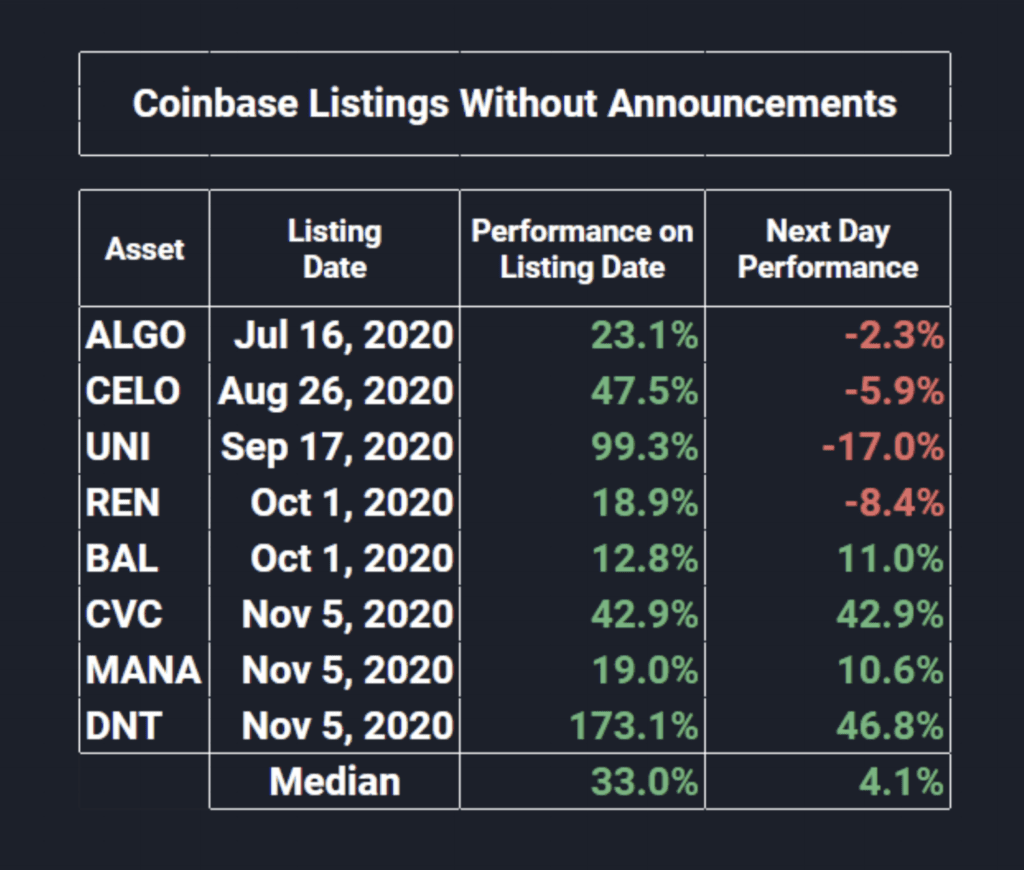

Eight assets were listed on Coinbase last year without an announcement in advance; they all had double-digit increases on the listing date and half maintained that momentum the following day. The median return was 33 percent.

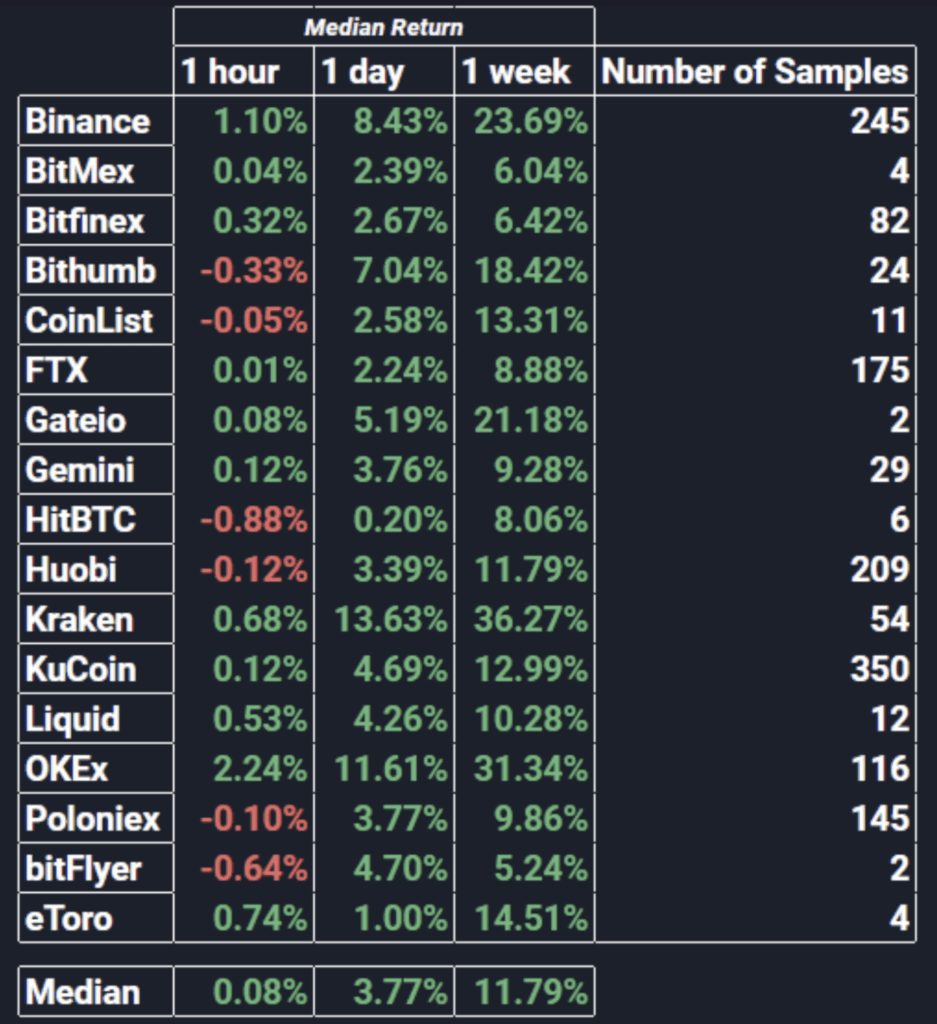

The report shows that while Coinbase listings have the most impact, peak returns are significant across all exchanges after a day and after a week.

Coinbase currently supports more than 40 assets and Coinbase Custody supports more than 90. Earlier this month Coinbase launched the Coinbase Asset Hub, a portal where issuers can apply to list their digital assets. It’s designed to streamline the process of getting “every compliant asset possible” listed, the company said in a blog post.

“We will continue to maintain a standard evaluation framework to ensure every asset we support meets our standards for legal, compliance, and technical security review,” it said. “Issuers may be subject to regulatory approval in some jurisdictions and we therefore cannot guarantee whether or when any asset will be approved.”

Being public may bring additional regulatory scrutiny

The listing process is likely to be thorough and rigorous since Coinbase is also preparing to go public this year through a direct listing.

In December the SEC filed a suit against Ripple Labs alleging a $1.3 billion unregistered securities offering of XRP, naming CEO Brad Larsen and co-founder Brad Garlinghouse as defendants.

At the time the suit was filed, XRP was the third most valuable crypto asset with a market cap of $23 billion. In the immediate aftermath of the SEC’s announcement, crypto exchanges began to delist the popular crypto to avoid regulatory exposure if XRP was deemed a security.

Coinbase, which has supported trading in XRP since February of 2019, is being sued by a St. Louis customer in the state of California that argues the company should have known that the crypto was a security.

The additional regulatory scrutiny of being a public company may mean that Coinbase will have to be more selective about which assets they support on their platform.

As the largest and arguably most well known company in crypto, it is possible that the listing decisions the company makes will be seen as a litmus test for individual assets.

In an industry notoriously lacking in regulatory clarity, this could prove problematic for portions of the industry that are operating in gray areas.

Blumberg added that with a new wave of retail investors – and newcomers to digital assets – different metrics for digital assets could emerge.

“We’ll have to start monitoring other forums of communication and chatter for crypto,” he said. “Hopefully it won’t go back to the pump-and-dump era of 2017.”