3,600 Flock to Barcelona for Flashy Parties and No Price Talk

Ava Labs’ Avalanche Summit brought together bankers and crypto natives

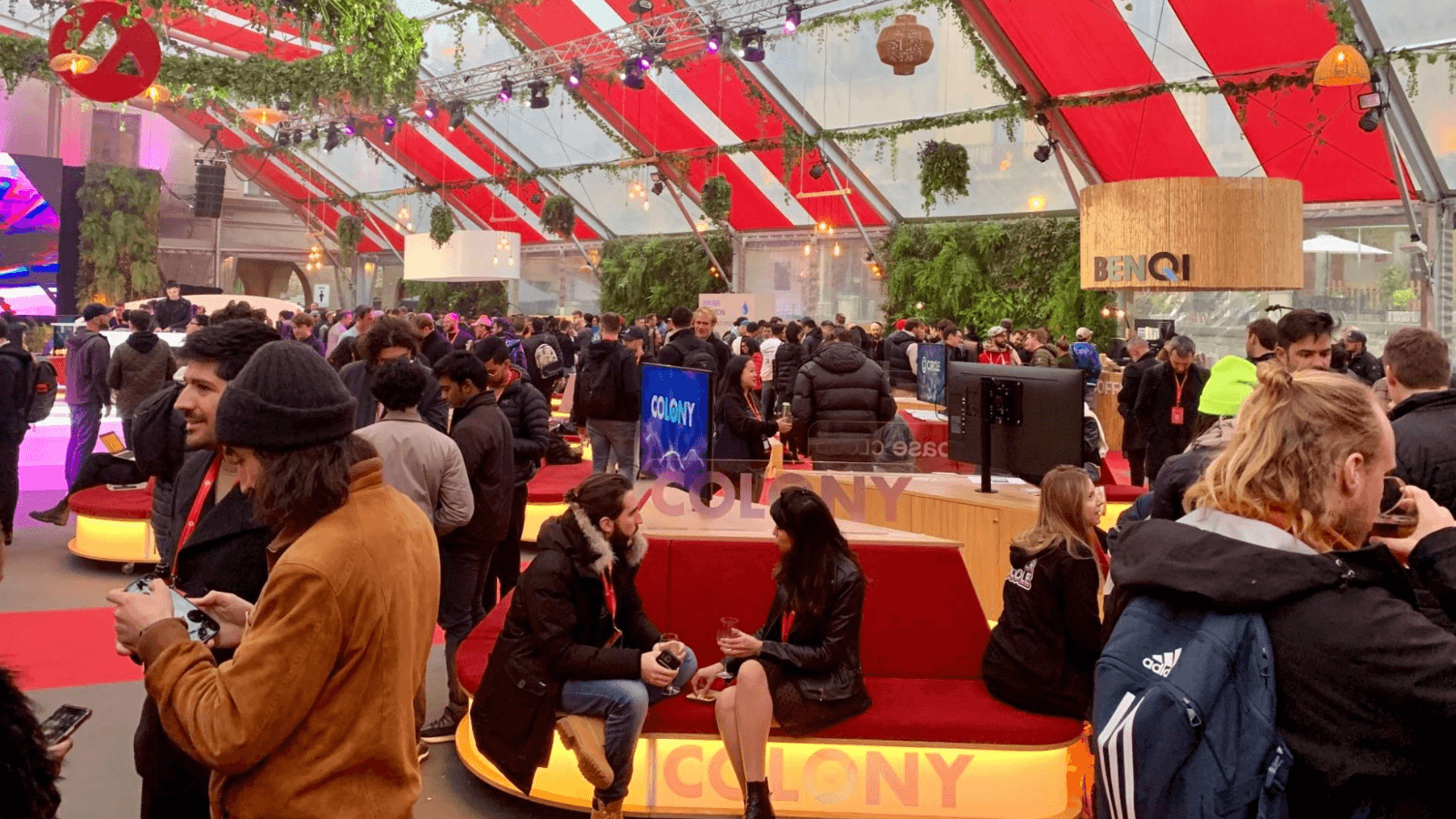

Inside the eco dome at Avalanche Summit in Barcelona | Source: Casey Wagner

key takeaways

- Avalanche conference brought 3,600 developers, investors and industry leaders to Spain for four days of content

- Institutional players made an appearance, many for the first time at a crypto event

This year’s Avalanche Summit, hosted by Ava Labs, the team behind the layer-1 blockchain, brought more than 3,600 developers, investors and crypto-curious to Barcelona.

Passes, which went for around $600 each, granted participants four days of conversation, most of which took place over cocktails and tapas, either inside or outside the conference venue. It was a sold out event, with many ticket-less hopefuls lingering around the entrance trying to catch a glimpse of the action or grab the attention of a speaker.

Talk of price, either of Avalanche’s native token AVAX, which is down about 26% year-to-date, or any other currency, was practically non-existent.

“I was surprised to see as many enterprise folks there, there were probably half a dozen people from Fortune 500 companies, recognizable big banks and other corporate funds, and this was their first crypto conference,” Snickerdoodle Labs’ CEO and co-founder Jonathan Padilla said, who traveled from California to speak on a panel at the event.

“I talked to the head of Bank of America’s digital asset and blockchain group…seeing them at this event, their first real crypto event, there’s a strong sentiment about how people are looking at the space.”

Even with a greater institutional presence, the event bore little resemblance to a typical financial conference, a strategic move from the Ava Labs team. The start time was late (noon), the dress code was casual (presumably it would have been even more relaxed if the weather had been nicer) and the alcohol was flowing. The main expo area, dubbed the “eco dome” had DJs performing almost non-stop.

“I’m working on a project that’s going to be huge,” one attendee said, shouting over electronic dance music at an afterparty event hosted by Trader Joe, an Avalanche decentralized exchange, at a club in downtown Barcelona. “It’s going to be bigger than Morgan Stanley.”

The official conference events, hosted at the Poble Espanyol, an open-air architectural museum and exhibition space sprawling 50,000 square meters, included three stages and more than 250 speakers who covered everything from the future of non-fungible tokens (NFTs) to building liquidity pools.

The venue was complete with a zen garden, a private area with massage tables, aerial yoga and green juice reserved for VIPs, speakers and hackers participating in the hackathon on the final conference day.

Devon Ferreira, senior vice president, global head of marketing at Ava Labs, was keen to note that almost half of the panel and keynote discussions included women.

“Still not enough, in our view — a great start, nonetheless,” he added.

Talk of Web3 infrastructure improvement seemed to dominate the conversation.

“In many discussions with node operators, liquid staking providers, application developers…it became clear that reliable, resilient and performant infrastructure is the next frontier for Web3,” said Renjie Butalid, vice president of business development at Metrika, a blockchain intelligence company.

“We’re still early. Network degradations and outages occur and will continue to happen until blockchain networks go through the maturity curve.”

Speakers at the event agreed, adding that many of the Web3 experiences users have today might not exist in the future as infrastructure continues to evolve.

“Fundamentally, one of the mistakes that I see a lot of projects and designers making is projecting Web3 technology on Web2 experiences,” said Calvin Chan, founder and CEO of Legitimate, an ecosystem that links physical products to digital identities, during a panel discussion.

There was a strong sense of community, which can be rare at events with a focus on a single blockchain, like Bitcoin Miami or Eth Denver. Many attendees attributed the jovial mood to a mix between joy of being back in person after two years of mostly virtual events and a growing optimism about the future of crypto and Web3.

“If the strength of a network is measured by the strength of its community, the Summit was a tour de force that suggests we are well-poised to lead the industry in 2022 and beyond, with a vibe that speaks to collaboration and inclusion,” Ferreira said. “[It’s] a welcome change from the tribalism typical of crypto.”

Attendees included Ethereum team lead Péter Szilágyi and well-known Bitcoin advocate, Udi Wertheimer, Ferreira pointed out, both of whom took to Twitter to share positive experiences from the event. Udi added the red triangle to his Twitter profile name — a marker for Avalanche community members — after the event.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- 0xResearch: Alpha directly in your inbox.

- Lightspeed: All things Solana.

- The Drop: Apps, games, memes and more.

- Supply Shock: Bitcoin, bitcoin, bitcoin.