Bipartisan Stablecoin Regulation Has a Slim Chance of Passing This Year

The bill was originally slated to be introduced last week, but Republicans and Democrats are still going back and forth on key issues

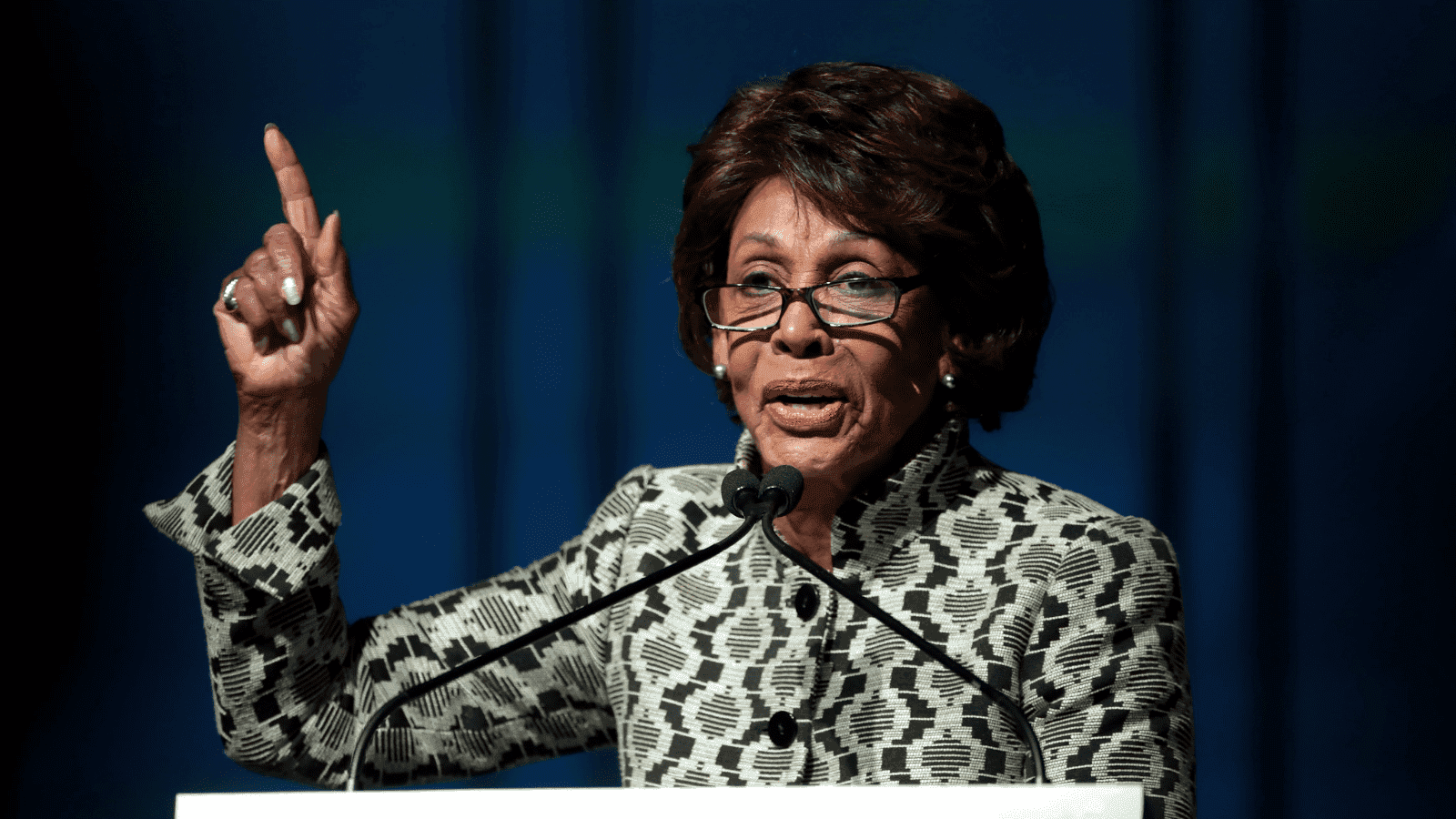

US Rep. Maxine Waters | Source: Gage Skidmore/"Maxine Waters" (CC license)

- The bipartisan stablecoin bill was supposed to be introduced last week, but lawmakers are struggling to agree on the text

- The odds of getting a law passed before 2023 are slim, sources familiar with the matter said

An eagerly awaited US bill that would regulate stablecoins has been delayed, giving the proposed legislation steep odds to become law this year, according to a source familiar with the matter.

The contents of the bill, which would be co-sponsored by House Financial Services Committee Chair Rep. Maxine Waters, D-Calif., and Rep. Patrick McHenry, R-N.C., have largely been kept confidential. But emerging details suggest a number of fundamental sticking points.

Washington insiders say there’s strong momentum to regulate stablecoins this year, following the collapse of Terra’s UST. US officials, including Treasury Secretary Janet Yellen, have urged financial regulators to treat stablecoin issuers akin to FDIC-insured banks, pointing to the potential for further fallout if no action is taken soon.

The outcome of Waters and McHenry’s bill, one source said, looks to be somewhere in the middle: There’s a general consensus that non-bank entities should be able to issue stablecoins, perhaps under the guidance of the Federal Reserve or a watchdog created for that purpose.

The bill’s timeline has faced repeated delays. The measure was originally slated to be introduced in the last week of July, but inter-partisan squabbling evidently scuttled its rollout.

Best case, the bill would be unveiled in August, with the “markup” stage — where politicians on the introducing committee weigh in, before sending the legislation to the floor — following in September. In any event, getting it through both houses of Congress before year-end is not likely.

Sources were granted anonymity to discuss non-public matters.

With the House out of session this week and uncertainty swirling around the November elections, it would be an uphill battle to get the bill finalized, the source said.

US regulators have been discussing reigning in the growing stablecoin industry for months. In the first of many expected digital asset reports following President Biden’s executive order, a group of regulators urged the government to work with other nations on crypto policy, specifically with regard to the cryptocurrencies designed to follow fiat currencies.

Stablecoins, such as Terra’s UST, are typically designed to trade on a one-to-one cadence with a fiat currency, such as the dollar or euro.

Industry participants largely agree that current market conditions do highlight a need for stronger regulatory guidelines — especially transparency of their underlying assets and auditing systems.

“If you just look at the events in April and May, basically the question everybody asked was ‘What are these stablecoins? Are they really stable? What is backing it?’” said Wolfgang Bardorf, senior vice president of Checkout.com. “If you look at a lot of the guidance that has come out, it has very much been going in that direction.”

Stablecoins have likewise been top of mind for regulators around the world.

The International Organization of Securities Commissions (IOSCO) and the Bank for International Settlements’ Committee on Payments and Market Infrastructures (CPMI) issued final guidance on stablecoin practices last month.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.