CoinShares Reports Digital Asset Fund Flows Increase 36% in 2021

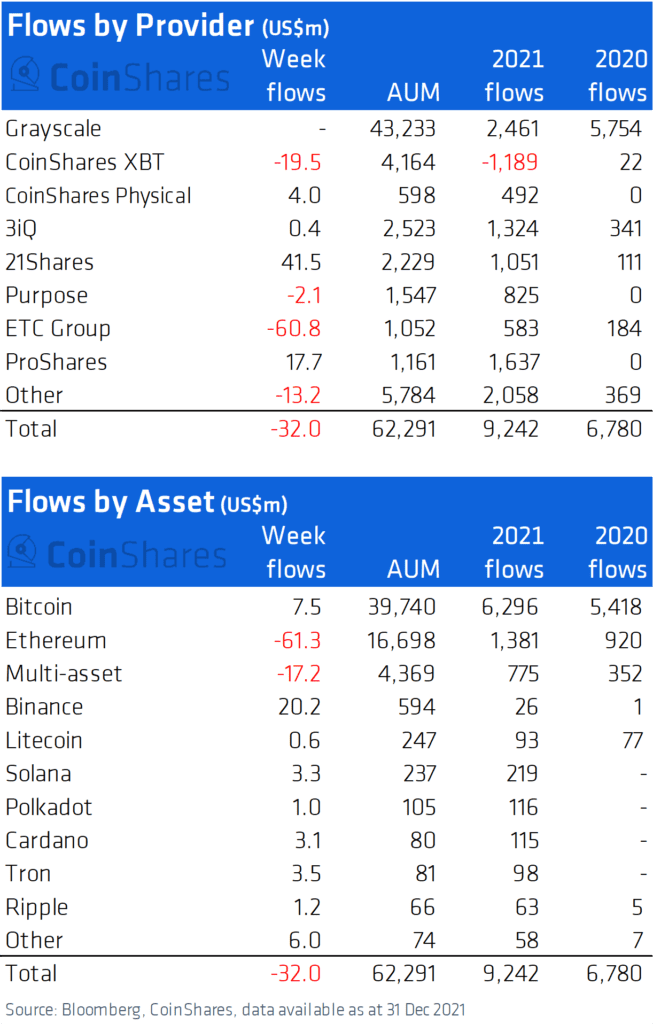

Inflows to digital asset investment products hit $9.3 billion in 2021 compared to $6.8 billion in 2020, CoinShares reports

Blockworks Exclusive art by Axel Rangel

key takeaways

- Rate of investments is down when compared to the 806% increase from 2019 to 2020

- Lower rate of increase could be attributed to a maturing market, CoinShares said in the summary

CoinShares’ annual survey of digital asset fund flows shows that total investment inflows into digital assets hit $9.3 billion in 2021. The amount is 36% higher than the 2020 figure, but the percentage increase lags significantly behind the staggering 806% increase seen from 2019 to 2020.

The digital asset investment and management company believes that the lower percentage represents a “maturing industry with total assets under management (AUM) ending the year at US$62.5 billion,” according to the survey.

The total number of coins in investment product form also expanded from nine to 15 in 2021, while 37 investment products were launched in 2021 versus 24 in 2020. Today there are 132, which is “indicative of the demand and popularity of digital assets,” said the summary.

Source: CoinShares

Source: CoinShares

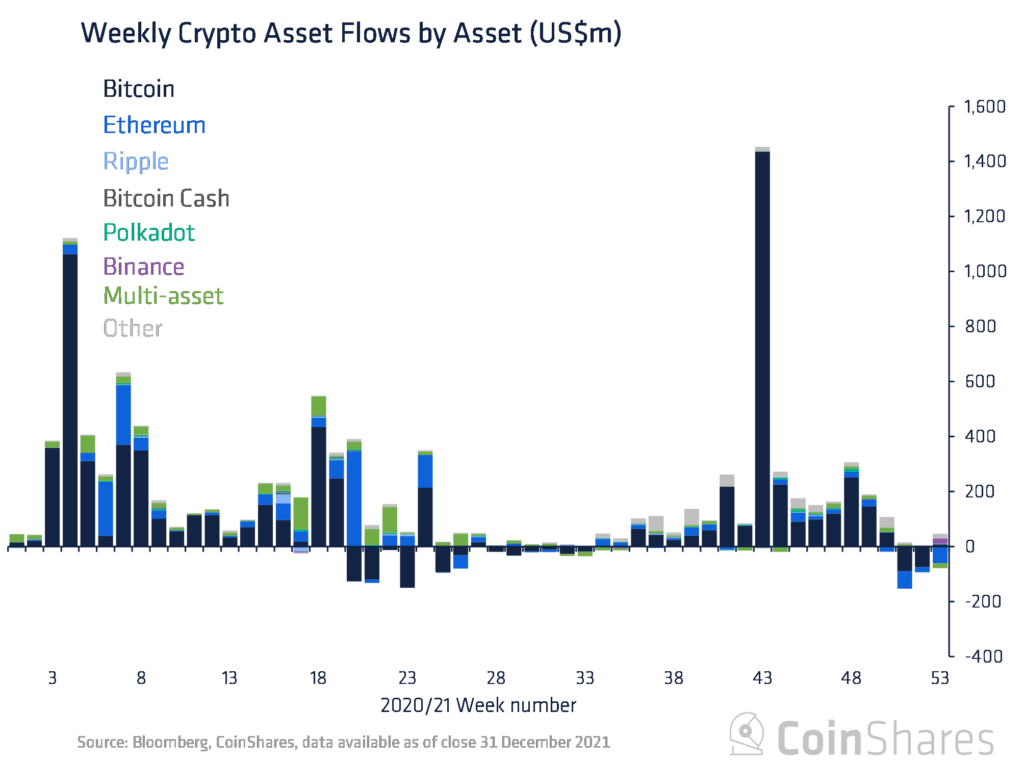

Specifically, bitcoin inflows for 2021 hit $6.3 billion, a year-on-year increase of 16% over 2020 which saw $5.4 billion, the lowest growth in inflows relative to other digital assets.

Meanwhile, ether inflows rose from $920 million in 2020 to $1.3 billion in 2021. However, the most recent round of negative sentiment has seen four weeks of outflows totaling $161 million, according to the report.

Source: CoinShares

Source: CoinShares

James Butterfill, investment strategist at CoinShares, told Blockworks via email that the firm had expected greater institutional adoption of bitcoin and greater inflows in 2021.

“Instead, investors are beginning to look ahead to other protocols such as Ethereum and Solana. Institutions are taking a while to warm up to the idea of Bitcoin and other digital assets, often due to regulatory or internal restrictions rather than there being no appetite for them,” he said.

Bitcoin faces some headwinds in 2022, such as rising interest rates, which CoinShares believes will initially hold back further price appreciation in the first quarter of the year. “But as the year progresses and it becomes evident that central bank monetary policy is ineffectual, and that regulatory pressures ease, it is likely we will see considerable institutional adoption.”

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.