Have the Crypto Markets Bottomed? Markets Wrap

Open interest, increasing inflation, long positions, and exchange outflows all point to an increasing bullish sentiment for the crypto market

Blockworks exclusive art by Axel Rangel

- The price of bitcoin, a leading indicator of the overall crypto market, dropped to as low as $39,650 from its high of over $69,000

- New data, from the drastic increase of inflation to crypto exchange activity, may suggest a turn-around for the markets

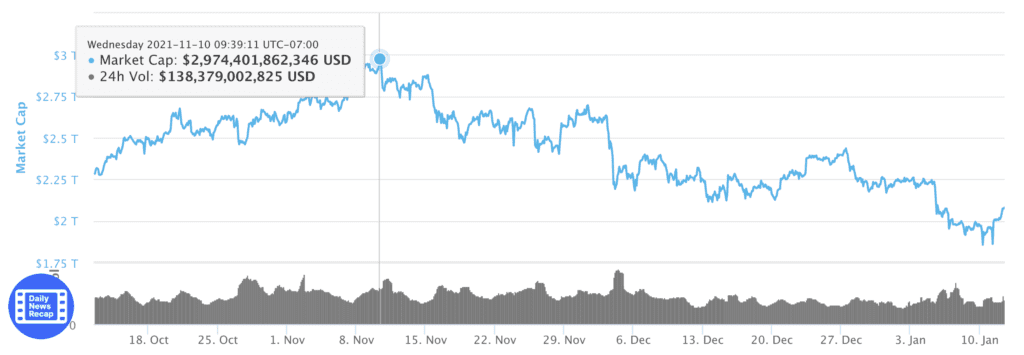

Crypto markets have consistently tumbled since the market’s all-time high market capitalization of nearly $3 trillion in November.

The ever-increasing slump can be attributed to a number of things, including the Fed’s announcement of reduced asset purchases and increased rates and a significant liquidation event earlier this month.

More recent data on exchange inflows and outflows, futures open interest, inflation and long positions all point to more positive market sentiment with the potential to reverse the downward trend.

Latest in Macro:

- S&P 500: 4,713, +0.92%

- NASDAQ: 15,153, +1.41%

- Gold: $1,822, +1.19%

- WTI Crude Oil: $81.49, +4.17%

- 10-Year Treasury: 1.746%, -0.034%

Latest in Crypto:

- BTC: $42,815, +2.20%

- ETH: $3,238, +4.70%

- ETH/BTC: 0.0756, +2.61%

- BTC.D: 40.47%, -1.09%

Recent slump

Bitcoin and the cryptocurrency markets are known to be volatile, but the crypto markets have dropped from a nearly $3 trillion market capitalization in mid-November to as low as $1.85 trillion. The market has since recovered to nearly $2.1 trillion, but uncertainty still remains.

https://coinmarketcap.com/charts/

https://coinmarketcap.com/charts/

Reasons for this volatility vary, but likely culprits include December’s weak jobs report, the Federal Reserve’s decision to quickly reduce the rate of asset purchases as well as increase interest rates, and a mass liquidation event early this month.

Bitcoin is typically described as a hedge against inflation so the Fed’s decision to slow down the rate of inflation with decreased asset purchases and increased interest rates seems to have had a negative effect on bitcoin’s price action. While many consider bitcoin a hedge to inflation and a hedge to even traditional markets, overall market psychology still takes a hold of bitcoin.

News of weak jobs report in December was not kind to all markets, including cryptocurrency. Perhaps the largest reason for the speedy drop in crypto assets was the massive liquidations across crypto exchanges as bitcoin’s price decreased.

Liquidations cause a cascading of price resulting in more liquidations and triggered stop-loss orders making bitcoin’s price fall even faster. As nearly all crypto assets are correlated to bitcoin, aside from stablecoins, liquidation events drop the entire market simultaneously. On January 5th liquidations across exchanges resulted in $800 million wiped off the market.

https://www.coinglass.com/LiquidationData

https://www.coinglass.com/LiquidationData

Market comeback

Consumer Price Index (CPI)

As mentioned, one of BTC’s largest value propositions is that it has a set quantity and is, therefore, a good tool to hedge against the inflation of the dollar. At 8:30 am EST, the most recent Consumer Price Index (CPI) numbers were released, showing that inflation had increased to 7.0% year-over-year.

The price action of bitcoin immediately followed with a jump of around 3.0% on the day. Increased inflation metrics have almost always resulted in a jump in bitcoin’s price with the entire crypto following behind. Should bitcoin’s use as a hedge against inflation remain intact, increased inflation will always be a positive for its price.

https://www.tradingview.com/symbols/BTCUSD/

https://www.tradingview.com/symbols/BTCUSD/Open interest

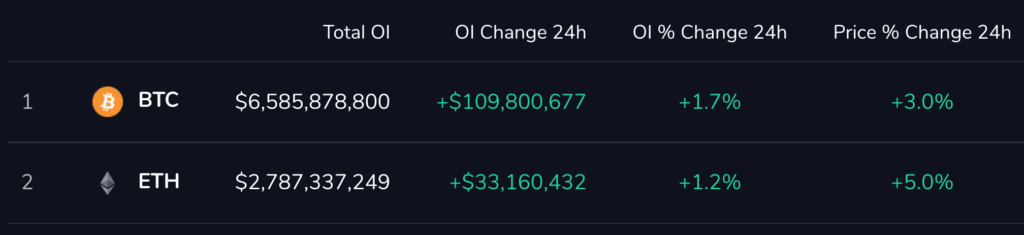

Another metric that can provide insight into market sentiment is the open interest in crypto futures. While a rapid increase in open interest can signal greed, moderate and slow growth of open interest can signal a return to bullish sentiment.

According to the exchange data site, Viewbase, open interest on bitcoin has increased 1.7% while interest in ether has increased 1.2% in the last 24 hours. After the recent liquidations, this moderate increase shows some level of strength and confidence returning to the market.

https://www.viewbase.com/futures

https://www.viewbase.com/futures

Inflows and outflows

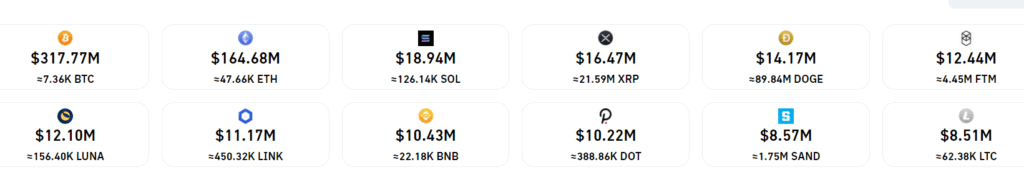

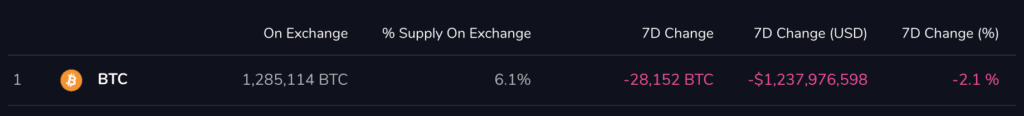

Other metrics that show positive sentiment in the market returning are exchange inflows and outflows as well as long vs. short positions. Cryptocurrency leaving an exchange is likely the result of a purchase followed by a transaction to a personal wallet while cryptocurrency sent to an exchange likely represents a sale.

In the last day, there has been an increase of 0.1% of BTC across exchanges, likely from traders taking money off today’s gains. In the last seven days, however, BTC on exchanges has dropped 2.1%, likely as a result of increased buying.

https://www.viewbase.com/exchange

https://www.viewbase.com/exchange

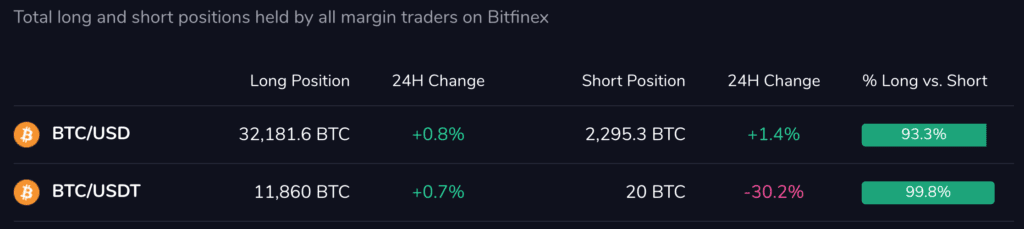

Long vs. short positions

As far as long vs. short positions go, one of the leading cryptocurrency exchanges by trading volume, Bitfinex, shows significantly larger long positions than short. Positions for the BTC/USD pair are 93.3% long and positions for the BTC/USDT pair are 99.8% long.

https://www.viewbase.com/bitfinex_long_short_position

https://www.viewbase.com/bitfinex_long_short_position

The sentiment for BTC, as well as the overall crypto markets, seems to have returned to a more balanced, if not bullish, state. Should this trend continue, the crypto markets could have already bottomed out.

What to expect tomorrow

Tomorrow and the coming days will represent a make-or-break moment for BTC and the crypto markets. The next test for BTC, and by extension the rest of the crypto market, will be at the $46,000 price point. Should BTC break this level it could continue higher and into a more bullish outlook.

Michaël van de Poppe, a market analyst and the founder of the cryptocurrency education platform, Eight Global, said that BTC is slowly flipping back out of its negative trend.

“Slowly flipping levels for #Bitcoin. The level to hold for me is the range around $42.8K. If that sustains, I’m expecting a test of $46K to happen. Just like I said a few days ago; I’d rather long than short,” said van den Poppe.

As noted, the $46,000 price point is the test for BTC. Failing to break this level could result in further sideways trading or, worse, a continuation of bearish movements.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.