Miners Hive Blockchain Technologies, Hut 8 Prep for Ethereum Merge

Hive exploring other coins to mine while Hut 8 ready to “pivot” ether-focused machines to offer AI and other services

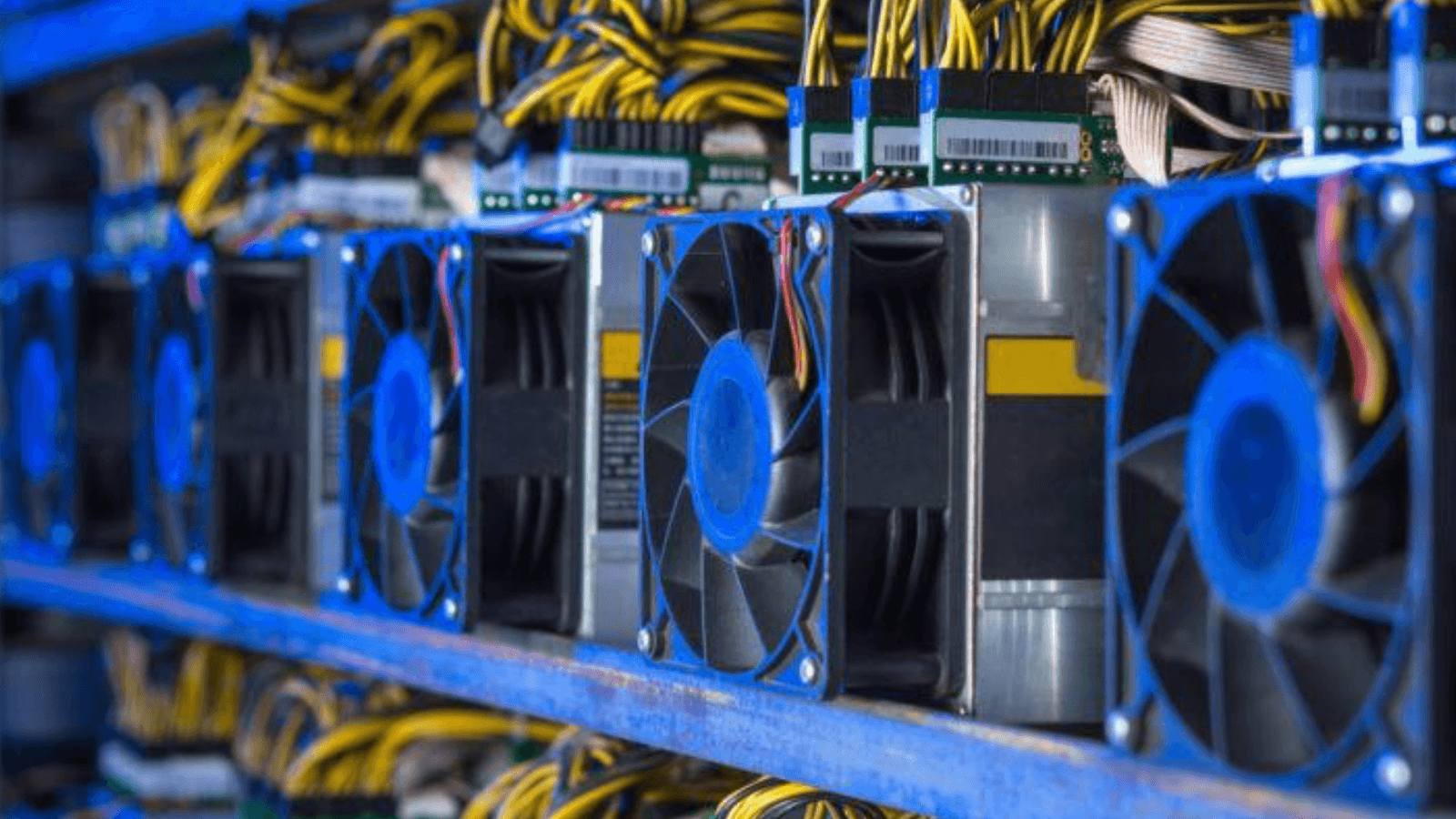

Bitcoin mining farm | Source: Shutterstock

- New coins miners such as Hive are likely considering mining ETC and ETHPoW, according to Valkyrie Investments’ head of research

- Hut 8 Mining ready to pivot 180 GPUs mining ether to focus on artificial intelligence, machine learning and visual effects rendering

Hive Blockchain Technologies is plotting out ways to optimize its Ethereum mining capabilities as the blockchain’s transition from proof-of-work to proof-of-stake quickly approaches.

The Vancouver-based company is seeking to optimize its 6.5 terahashes of Ethereum mining capacity as the transition gets set to unfold, it revealed Tuesday. Hive has started analyzing mining other coins with its fleet of graphics processing units (GPUs) and is implementing beta testing this week.

The company did not immediately return a request for comment.

Josh Olszewicz, head of research at crypto fund manager Valkyrie Investments, told Blockworks that miners are likely considering shifting to Ethereum Classic (ETC), ETHPoW, or other proof-of-work chains.

“EtHash [application-specific integrated circuits] (ASIC) miners have begun shifting to ETC because making less profits is better than making none at all,” he said. “GPU miners, not being able to advantageously compete head-to-head with ASIC miners, will likely move to the ETHPoW fork, when that occurs.”

GPU miners have increased flexibility on what they can mine, however, compared to ASIC miners, Olszewicz said.

Hive’s roughly 38,000 Nvidia GPU cards — including the A4000, A5000, A6000 and A40 models — account for about 2.8 terahashes of the company’s Ethereum hashrate.

“These cards can be used for cloud computing and AI applications, and rendering for engineering applications, in addition to scientific modeling of fluid dynamics,” the company said in a statement.

A portion of the A40 GPU cards are being applied to cloud computing as part of a pilot program at one of its data centers, the crypto miner added.

Hive Blockchain Technologies mined 821 bitcoin and 7,675 ether during the year’s second quarter, the company reported last month. Its overall production of digital currencies increased by 7% quarter over quarter, as it produced 4% more bitcoin and 20% more ether.

The company said that it has sold ether to fund the expansion of its bitcoin mining program with new generation ASICs. Its ETH position sank from 25,000 ETH to 5,100 ETH, as of Aug. 31. The company held 3,258 BTC on that date.

Meanwhile Hut 8 Mining said in a company statement Tuesday that it installed 180 Nvidia GPUs in its data center in British Columbia last month.

Currently mining ether, the machines will be designed to pivot to offer artificial intelligence, machine learning or visual effects rendering services to customers.

“We are watching the lead-up to the Ethereum Merge very closely, and remain laser-focused on growing our bitcoin stack while building high-performance computing infrastructure to support the future of the digital asset ecosystem,” a Hut 8 spokesperson told Blockworks in an email.

Hut 8 generated 375 bitcoins in August and held 8,111 BTC on Aug. 31.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.