New Jobs Picked Up, Still Missed Mark

The Fed has indicated that employment data will be key in their decision on whether or not to start tapering or bond buying.

Source: Shutterstock

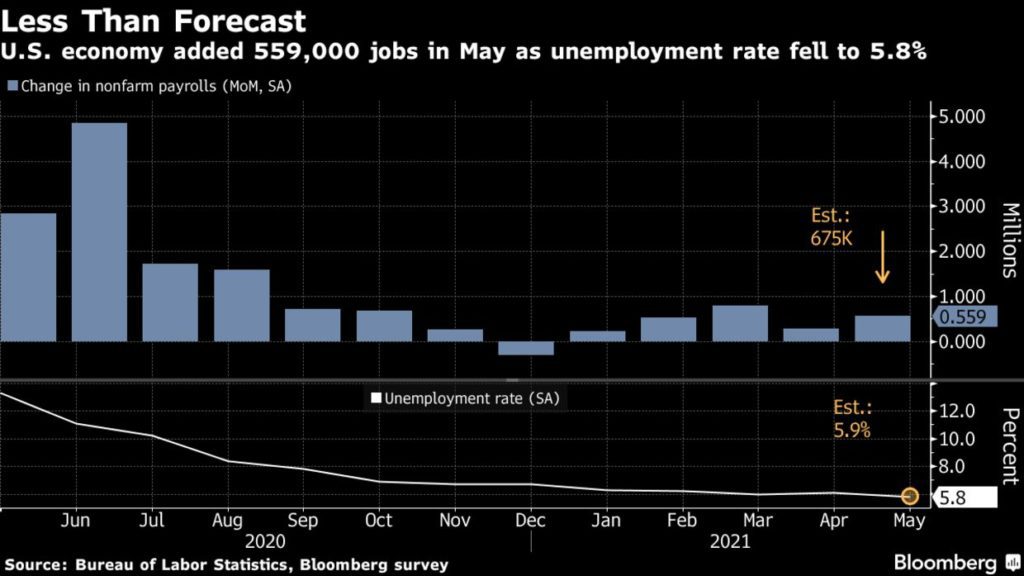

- The US added 559,000 jobs in May, slightly below the expected 675,000

- Hourly pay also increased 15 cents in May, down from a 21-cent gain in April

The United States added 559,000 jobs in May, which was slightly below expectations, but shows that recovery is inching forward. All eyes are now on the Federal Reserve, which is scheduled to meet later this month, and whether or not there will be a change in interest rates or bond buying.

Economists surveyed by Bloomberg expected 675,000 new jobs for May. April showed a massive and unexpected slowdown in hiring, which many attributed to higher unemployment benefits and pandemic-related concerns.

“As we were reminded last month, the state of the US labor market remains more uncertain and volatile than usual as it emerges from the unprecedented disruption of the COVID pandemic,” Matt Weller, Forex.com’s head of market research, told Blockworks. “A weaker-than-anticipated jobs report could present a buy opportunity in GBP/USD, which has spent the last three weeks consolidating in a tight range below multi-year highs in the 1.4200 region. A fundamentally-driven breakout in the pair would confirm the longer-term uptrend and could be the catalyst for bulls to set their sights on the five-year highs in the mid-1.4300s.”

The Fed has indicated that employment data will be key in their decision on whether or not to start tapering or bond buying. The central bank has maintained buying at $120 billion in assets per month since the start of the pandemic.

Hourly pay also increased 15 cents in May, down from a 21-cent gain in April, the Labor Department revealed Friday. Economists are keeping a close eye on pay as it is a strong indicator of how difficult it is for employers to find and retain workers.

Non-supervisors in leisure and hospitality rose again in May, but by less than half as much as in April. These positions were ones significantly impacted by the pandemic and areas where employers had difficulty filling roles after unemployment benefits started to kick in.

Workers in these industries have seen significant pay gains in recent months. Average earnings were $15.90/hour in May, up from $14.80 in April, showing that employers are starting to compete with attractive unemployment payments. Leisure and hospitality workers also showed decreased hours worked in May, showing that employers are having an easier time finding laborers.

Thursday’s data also painted a promising picture. Weekly Initial jobless claims fell to 385,000 for the week ended May 29, according to data released Thursday by the Labor Department.

ADP, a payroll processing firm, also reported better-than-expected numbers on Thursday. In the biggest gain since June 2020, 978,000 people were hired in May. This exceeded economists’ expectations of around 680,000.