$750M Longs Liquidated in Thursday Sell-off Alongside US Equities

Bitcoin has fallen 12% in the last 24 hours after an intraday high of about $43,500

Blockworks Exclusive Art by axel rangel

- The S&P 500 ended the day -1% lower after initially trading up 1.5%, which has only occurred 8 times since the 2009 GFC, according to Bianco Research

- Bitcoin is now at its lowest point since Aug. 5, when it traded as low as $37,316 intraday

All major digital assets are trading lower, following a sharp decline Thursday into Friday, and BTC is currently testing the lows at $38,150, echoing weakness in US equity markets futures. Around $750 million in long crypto derivatives positions were liquidated, according to data from Coinglass.

The Nasdaq 100 ended Thursday down about -2.2%, and has fallen nearly 11% over the past 15 trading days, now approaching its early-October lows of around 14400.

The S&P 500 also closed down roughly -1%, after initially rising 1.5%. According to Jim Bianco of Bianco Research, that has occurred “only 8 times since the Global Financial Crisis in 2009.”

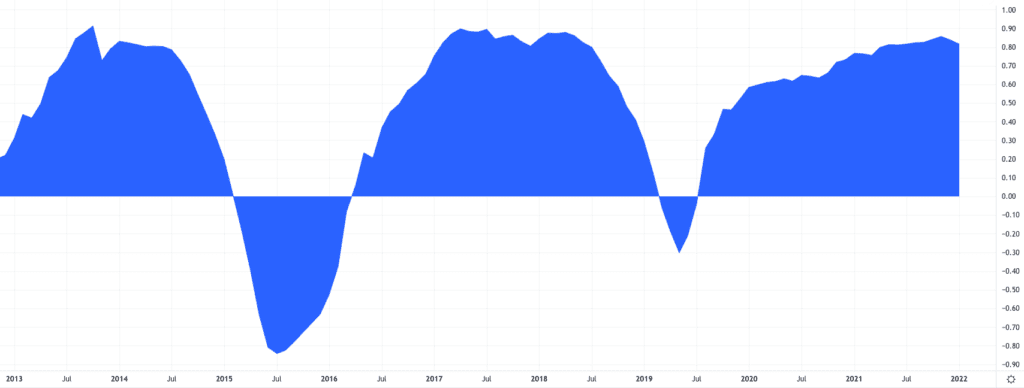

Bitcoin’s correlation with the tech-sector has been on an uptrend since the middle of 2019 and is near its all-time peak, on a monthly timescale, of about 0.8, as measured by the correlation coefficient (a 1.0 reading would be perfectly correlated, while -1.0 would be inversely correlated).

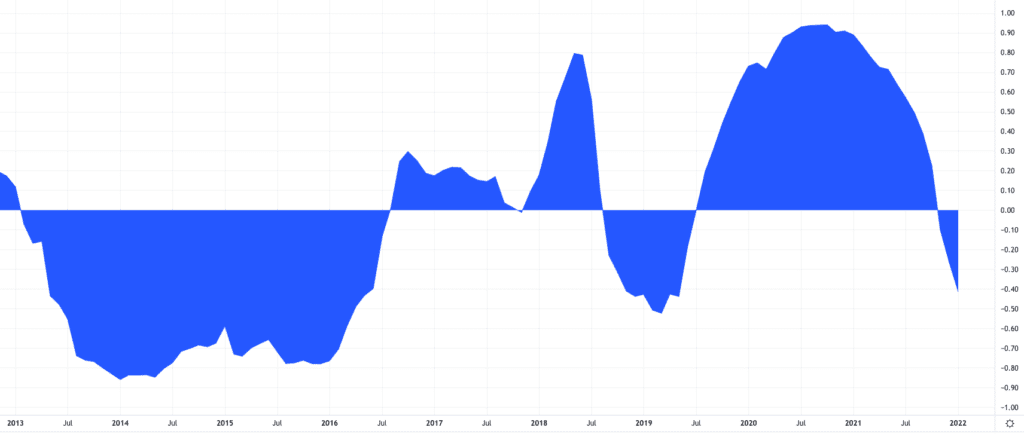

Positive correlation with the Nasdaq 100 has been the predominant condition for bitcoin throughout its history, particularly since 2017, a counterpoint to the narrative of BTC as a risk-off asset more akin to gold. Gold, meanwhile, has been significantly less correlated with the Nasdaq, although most assets moved in tandem throughout the stimulus-fueled uptrend in equities after the March 2020 crash.

Above: BTC correlation with the Nasdaq from 2013-present; Source: TradingView

Above: BTC correlation with the Nasdaq from 2013-present; Source: TradingViewBelow: Gold correlation with the Nasdaq 2013-present; Source: TradingView

“[The] market is catching a risk-off momentum due to [a] spike in supply side inflation fear as well as geopolitical concern over Russia/Ukraine situation,” William Fong, Treasurer at Australian trading firm Zerocap told Blockworks.

“Safe haven portfolio flow has shifted from stocks, credit and cryptocurrency markets into treasury bonds today in search of risk protection.”

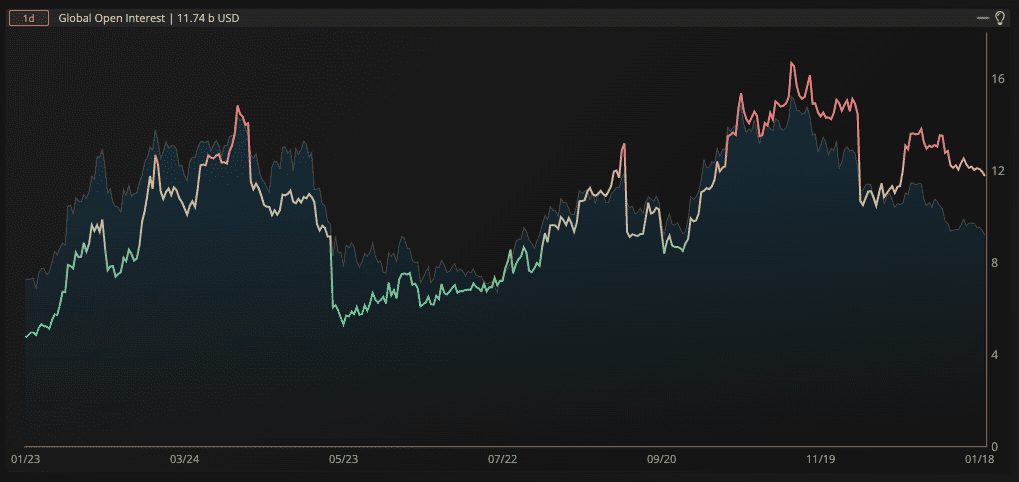

Fong also pointed to the unwinding of bullish leveraged positions in the market for crypto derivatives. The global open interest for bitcoin — a measurement of derivatives activity — has indeed fallen to about $11.4 billion in the wake of the sell-off, down from a peak of around $13.6 billion in late December.

Global Open Interest, the total number of outstanding contracts across all exchanges; Source: KrownTrading.net

Global Open Interest, the total number of outstanding contracts across all exchanges; Source: KrownTrading.net

However, there is hope for bitcoin bulls. By some metrics, such as the daily stochastic RSI, both equities and bitcoin are in oversold territory. And both remain in a primary uptrend on the monthly timeframe, with higher lowers and higher highs. For bitcoin, that remains the case so long as BTC ends the month above about $35,000.

Some bitcoin-specific indicators such as the Net Unrealized Profit/Loss (NUPL) — comparing BTC sales at a profit with those at a loss — show similarities with the summer 2021 sell-off, which found a bottom around $32,000, after intra-week moves as low as the $29,000 area.

European equity markets are trading lower, with the EURO STOX 600 index down -0.68%. The S&P futures market points to a similar down open for US equities, and the Nasdaq 100 futures are down about -1%.

Sebastian Sinclair contributed reporting.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.