Are Nimble DEXs a Threat to Coinbase?

While raw numbers suggested that DEXs like Uniswap could challenge or even overtake established centralized exchanges, it remains to be seen if nimble upstarts will really challenge Coinbase whose valuation rivals some of the world’s largest stock exchanges.

Blockworks Exclusive Art by Axel Rangel

- Surging demand for DeFi has DEXs competing with Coinbase in volume and revenue

- Continued bull market might bring more revenue for Uniswap, but not at expense of Coinbase’s valuation

As the decentralized finance (DeFi) revolution hit full swing in the fall, for a few months Coinbase saw its trading volumes and revenue overtaken by Uniswap — one of the many new decentralized exchanges (DEXs) on the market.

For Coinbase, a blue-chip digital assets exchange preparing an initial public offering, this was bad news. A team of less than 12 people had built a product that was able to challenge what took tens of millions of venture capital and a staff of hundreds almost a decade to build.

While raw numbers suggested that DEXs like Uniswap could challenge or even overtake established centralized exchanges, it remains to be seen if nimble upstarts will really challenge Coinbase whose valuation rivals some of the world’s largest stock exchanges.

What is a DEX?

A decentralized exchange, or DEX, is a peer-to-peer exchange for digital assets where users can transact without an intermediary. Exchange rules are governed by smart contracts, and the transactions occur automatically with parties agreeing to send a small percentage of the value of the exchange to a liquidity pool which facilitates the trade.

With a DEX, there is no centralized custody or engine driving order placement. While there are developers that provide updates and quality assurance to the underlying code, there’s minimal corporate and regulatory structure or capital intensive operations. Instead, DEXs are governed by users who have a democratic influence thanks to governance tokens which let them decide the direction the platform takes.

Breaking out the numbers

To compare the two companies, in a recent valuation model, digital asset research firm Messari estimates that Coinbase will post revenue of just over $3 billion by the close of 2021. Using a blended trading fee model (Coinbase’s fees range on trading size and revenue), approximately $2.13 billion will be from trading with the rest being derived from Coinbase’s other income streams such as custody, staking and crypto-fiat ramps.

Messari’s model, however, might run on the conservative side and does not take into account the velocity of the bull market. Analysis done by The Block’s research director, Larry Cermak, puts Coinbase generating $2.44 billion per quarter in revenue, or roughly $6 billion to $8 billion for the year.

Uniswap, on the other hand, using publicly available data will post approximately $1.13 billion in revenue on trading revenue from its estimated $376 billion in trading volume before gas fees, which tend to vary wildly and are more often borne by the trader and not the exchange.

A growing threat … or not

Coinbase is aware of the potential threat to its business and the negative effect on its valuation.

“We compete against a growing number of decentralized and noncustodial platforms and our business may be adversely affected if we fail to compete effectively against them,” the exchange wrote in its S-1. “Such platforms have low startup and entry costs as market entrants often remain unregulated and have minimal operating and regulatory costs.”

After all, as Messari notes in a research report, Coinbase doesn’t have a monopoly in trading digital assets unlike its legacy financial world analogues — traditional stock exchanges.

Messari’s Mira Christanto says that while both are platforms where users can exchange digital assets, the similarities end there. As she wrote in the firm’s report that a comparison between the two companies using similar metrics, namely comparing profit to sales, earnings, and book value, would be “poor” as it would only place Coinbase at a valuation of $6 billion to $16 billion.

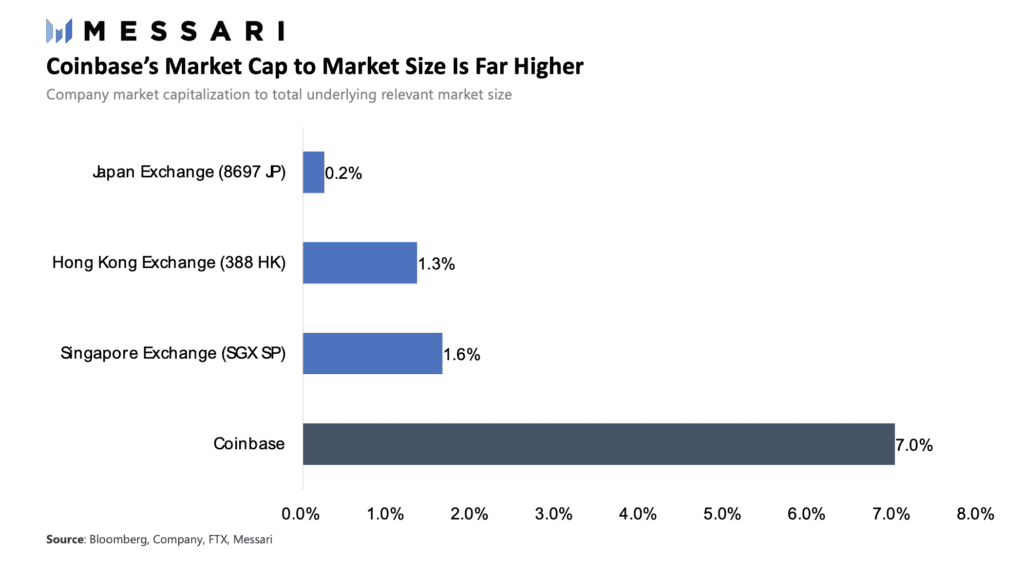

In addition, Coinbase’s valuation cannot really be compared to a traditional bourse given that its ratio of valuation to market caps of listed assets is significantly higher than exchanges in Japan, Singapore or Hong Kong.

Source: Messari

Source: Messari

“The Coinbase valuations will actually prop up DeFi exchange valuations as investors compare the two,” Christanto told Blockworks. “Uniswap’s UNI token is a governance token and the fee switch which will enable fees to flow to token holders has not been switched on. Uniswap has given control of this switch to the community so the founding team doesn’t have control. This is also because Uniswap doesn’t want to circumvent securities regulations as it has US-based venture capital funding.”

“The market is heavily pricing in Coinbase’s continued growth. As we see in the above valuations comparables, valuations are nearest to the price to sales growth valuations of $127 billion,” Christanto wrote in the report.

Efficiency is key

Although it’s yet to be seen if Coinbase can maintain this growth to back into the prescribed valuation, analysts do note that the company has been so far quite efficient at getting users on its platform.

“Coinbase is relatively efficient in growing its user base,” Sagar Joshi, a partner at investment advisory firm Drawing Capital LLC, told Blockworks. “Coinbase only spent about $56.78 million in sales and marketing costs in 2020 to generate $1.277 billion in revenue in 2020 which speaks to the virality of cryptocurrency investing interest, and Coinbase’s brand in the industry.”

Doug Schwenk, Chairman of Digital Asset Research, a consultancy, points to growth as the reason why Coinbase can sustain this valuation.

“If Coinbase can continue to grow revenues at this pace and the crypto markets continue to rise, investors will pay up for the potential. It will also represent one of the few opportunities for many investors to bet on the future of finance with a profitable, proven brand, as most crypto companies are private or less broadly known,” he told Blockworks.

Schwenk argued that Uniswap, despite its growth, isn’t really the threat to Coinbase that might be perceived.

“Exposure to the Uniswap token is much more difficult for many types of investors or funds, and the DEXs are not yet operating at the same scale and may be seen as untested on a number of fronts,” he said. “[A public listing] will make Coinbase available without the same constraints to fund managers, self-directed retirement accounts, and a host of others, providing lift to price and a premium so long as DEX volumes don’t significantly overtake.”

The regulatory moat

One of the main moats, Schwenk said, is regulatory burden. While Coinbase hasn’t necessarily cleared this entirely, a public listing would make it significantly more regulatory compatible than a DEX which is much more nebulous. For that, Coinbase is a “natural market leader.”

Because Coinbase makes a fair amount of money converting fiat to digital assets and vice versa, the company has value that it can unlock, but Uniswap cannot.

“I think that there will be two successful exchanges: those that are licensed and those that are completely decentralized,” Messari’s Christanto explains. “Coinbase’s success is based in fiat onboarding and offboarding and not going to cannibalize Uniswap, which is focused on wrapped Ethereum, wrapped Bitcoin and stablecoins for use in DeFi.”

So even though the optics of Uniswap hot on Coinbase’s heels might raise eyebrows on the eve of an IPO, after a closer look, this light-footed upstart may not be the threat it seems.