Bitcoin Suffers Chaotic Weekend as Price Plummets

Digital asset fund manager David D. Tawil, President at ProChain Capital, doesn’t believe all of this will have a material impact on the market long term.

Source: Shutterstock

- COIN and FinCEN FUD and Xinjiang Coal Calamity push prices lower

- The biggest digital asset by market cap dropped from roughly $60,000 to $52,148 during the Sunday trading day

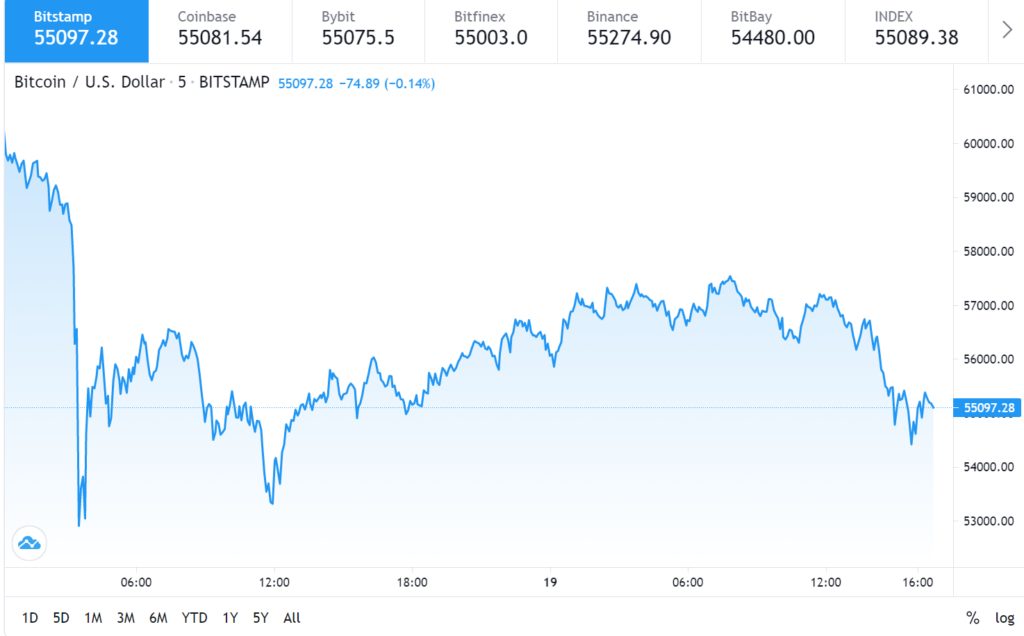

It was a really rough weekend for the price of bitcoin. The biggest digital asset by market cap dropped from roughly $60,000 to $52,148 during the Sunday trading day as a flurry of bad news gave rise to market panic and uncertainty.

Turkey’s crypto ban started the price drop. Then people on Twitter pushing dubious narratives about Coinbase executives dumping stock and allegations about US Treasury operatives looking to ban bitcoin pulled it down further. Troubles in China’s Xinjiang, a mining hotspot, finished things off pulling bitcoin down to three-week lows.

Source: Tradingview

Source: Tradingview

Fact check: Coinbase executives aren’t engaged in a ‘pump and dump’

On Saturday, after news of Turkey’s central bank moving to ban bitcoin began to weigh heavily on investors, charts began to circulate which appeared to show Coinbase CEO Brian Armstrong and his executives dumping a considerable amount of Coinbase stock.

Although Armstrong and his executives did sell what might seem like a considerable amount of equity in the company — Armstrong sold nearly $300 million on opening day — lost in the Tweets was the fact that these were merely the exercised stock options that vested.

Between himself and his trust, SEC filings show that Armstrong holds just over $14 billion in stock at current prices. While CFO Alesia Haas also sold 255,500 shares, it only represents 25% of her total holdings.

Coinbase PR was busy through the weekend putting out statements that executives maintain a “strong level of ownership” and the screenshots of the reporting services being cited were not accurate.

Needless to say, bitcoin’s price was on its way down, closing at $58,000 from just over $60,000 as the North American Friday session ended.

Fact check: US Treasury department claim not corroborated

Later on Saturday a semi-anonymous Twitter account operating under the nom-de-bird “FX Hedge” tweeted that the US Treasury department is planning to charge several financial institutions for money laundering using cryptocurrencies.

While a surface level examination of the tweet might deem the contents to be reasonably accurate, as after all the Financial Crimes Enforcement Network (FinCEN), under the purview of Treasury, has penalized miscreants in the digital asset space before such as bitcoin mixers, it can only issue civil penalties. The organization, primarily, collects intelligence that is passed on to law enforcement agencies or the Department of Justice to be used as evidence in prosecution. Which is why this story could not be corroborated by any other sources.

Bitcoin’s price is now hovering just over $53,000 as the market digested the news.

Fact check: Xinjiang’s coal troubles

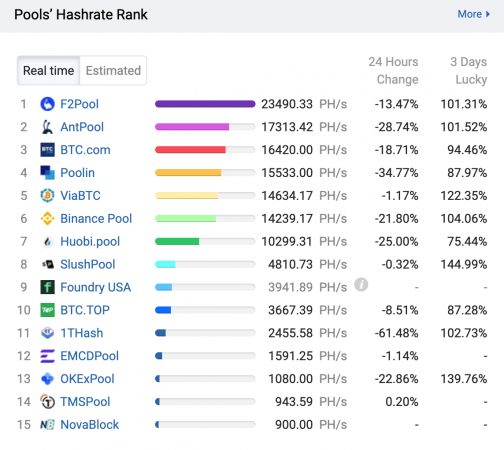

Bitcoin’s series of unfortunate events continued on into Sunday, and while the price was pushing back into the range of $55,000, the market began to digest that some of China’s biggest mining pools had to temporarily reduce their hashing power because of a power shortage in Xinjiang.

According to local media reports, a series of high-profile accidents at coal mines has caused them to cut down capacity thus forcing power plants to tell some of their biggest customers — data centers — to turn off the lights. CCTV, China’s state broadcaster, reports that there are 12 dead and 21 people trapped from a series of accidents that occurred earlier in the week. Power plants won’t get the green light to resume full operations until they have satisfied authorities in Beijing that they have improved their safety protocols.

Although most of the country’s mining capacity is located in mountainous Sichuan due to its abundance of hydropower, during the dry season, which spans from October to May, many miners migrate to Xinjiang for its cheap hydropower.

In addition, a lingering trade dispute with coal-exporting Australia means that the country has an energy crunch. At another time such a shutdown might not have been as material, but with a lack of Australian coal fueling power plants this has created a challenge for the grid.

A healthy pullback

Digital asset fund manager David D. Tawil, President at ProChain Capital, doesn’t believe all of this will have a material impact on the market long term.

“The Coinbase IPO was a lot of news for the sector in terms of being a very big event from a news perspective,” he told Blockworks. “I don’t think it did a lot from an increasing value perspective as it was just a question of transferring value from the early and private investors to the public’s hands.”

Tawil doesn’t think the large pullback over the weekend was a good thing, but still calls it “healthy”.

“I would say it’s a healthy thing, because what we want the asset class to become something over time that’s less and less speculative and more permanent and growth oriented as opposed to speculative,” he said. “A healthy pullback is good because it tells all the speculators ‘you’re on notice, because this is not a speculative asset class.’”

But ultimately, as an investor, Tawil says he’s waiting for a divergence in the asset class where everything doesn’t move in parallel. Only then is crypto a fully mature asset class, he believes.

“Go speculate on DOGE Coin if you want.”